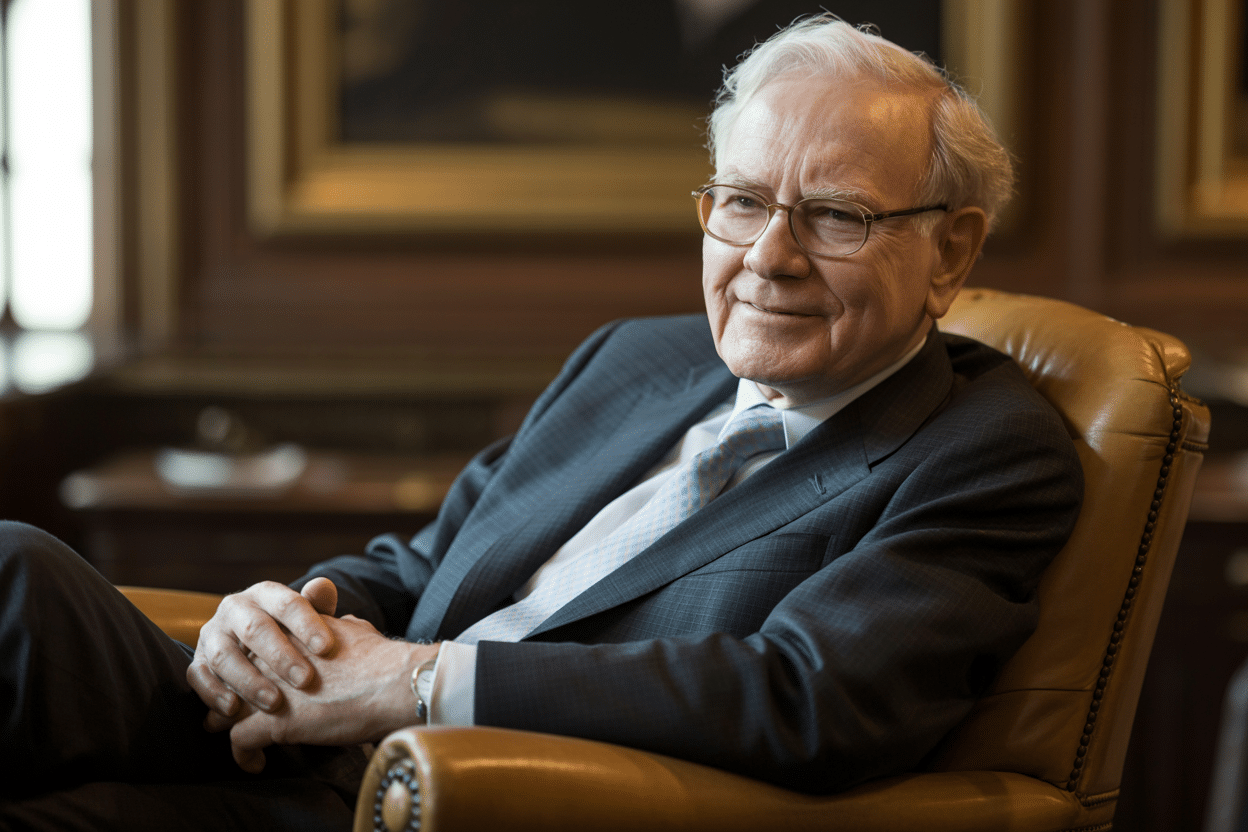

Warren Buffett, the legendary “Oracle of Omaha,” is one of history’s most successful investors. Born in 1930, this 95-year-old investing and business genius has demonstrated that consistent application of sound principles can create extraordinary wealth.

Buffett turned the struggling textile company Berkshire Hathaway into one of America’s most valuable corporations by repurposing it as an investment holding company. Today, Berkshire Hathaway’s market cap is over $1 trillion. His approach proves that patient, principle-driven investing can generate remarkable long-term returns. The following ten golden rules reveal the foundation of his investment philosophy and business success.

1. Find Your Passion and Purpose

“Take the job that you would take if you were independently wealthy,” Buffett advises. This principle forms the cornerstone of his philosophy on career satisfaction and success. He discovered his passion for investing early, starting when he was eleven and reading every investment book in the Omaha Public Library by age twelve.

His children exemplify this approach, pursuing their genuine interests rather than chasing money. When you work at something you genuinely love, you’ll naturally excel because the work doesn’t feel like work. This passion creates the energy and persistence necessary for long-term success in any field.

“I get to do what I like to do every single day of the year… I tap-dance to work, and when I get there I think I’m supposed to lie on my back and paint the ceiling. It’s tremendous fun”. – Warren Buffett

2. Hire for Character First

When evaluating people, Buffett looks for three essential qualities: integrity, intelligence, and energy, in that exact order. He warns that without integrity, the other two qualities become dangerous. “If they don’t have integrity, you want them dumb and lazy,” he explains, because smart, energetic people without moral grounding can cause tremendous damage.

This hiring philosophy extends beyond business into all relationships and partnerships. Character forms the foundation of trust, and trust enables effective collaboration. In today’s interconnected business world, reputation travels fast, making integrity more valuable than ever. Companies and individuals who consistently demonstrate strong ethical standards build lasting success.

3. Stay Within Your Circle of Competence

Buffett quotes Tom Watson’s wisdom: “I’m no genius, but I’m smart in spots and I stay around those spots.” This principle of staying within one’s circle of competence has protected Buffett from many costly mistakes. He openly admits there are numerous topics he doesn’t understand and stays away from those areas.

Rather than trying to be an expert in everything, he focuses on industries and businesses he can thoroughly analyze and understand. This focused approach allows for deeper and concentrated knowledge and better decision-making. The key is honestly assessing your knowledge boundaries and having the discipline to operate within them rather than venturing into unfamiliar territory.

4. Embrace Continuous Learning

Buffett reads five to six hours daily, consuming newspapers, magazines, annual reports, and biographies. “I just sit in my office and read all day,” he states. This voracious appetite for knowledge has continued throughout his career, though he acknowledges reading more slowly now than when younger.

He particularly enjoys biographies, learning how others navigated challenges and opportunities. Reading provides the raw material for better decision-making, offering insights from diverse sources and experiences. The compound effect of continuous learning creates an ever-expanding foundation of knowledge that improves judgment over time. Buffett has explained that knowledge builds upon itself, creating exponential rather than linear growth in understanding.

5. Apply a Margin of Safety

Buffett illustrates this concept with a bridge metaphor: “You don’t drive a truck that weighs 9,900 pounds across a bridge that says limit 10,000 pounds.” Instead, find a bridge rated for 20,000 pounds to ensure safety. This principle extends far beyond investing into all major decisions.

Building margins of safety protects against unforeseen circumstances and provides a cushion for errors in judgment. Whether in financial planning, business operations, or personal choices, leaving room for the unexpected prevents catastrophic outcomes.

The margin of safety principle acknowledges human fallibility and the unpredictable nature of complex systems, advocating for conservative approaches that can withstand adverse conditions.

6. Build Economic Moats

“Capitalism is all about somebody coming and trying to take the castle,” Buffett explains. Success attracts competition, making sustainable competitive advantages essential. He seeks businesses with “moats” that protect them from competitors through cost leadership, superior talent, strong brands, or network effects.

A low-cost producer enjoys one of the strongest moats, but talent-based advantages can be equally powerful. Steven Spielberg’s filmmaking ability creates enormous economic value because few can replicate his talent. These competitive advantages must be durable and difficult to replicate. Building moats requires identifying and reinforcing unique strengths while competitors struggle to catch up.

7. Maintain an Unstructured Schedule

“No meetings,” Buffett emphatically states about his daily routine. His days remain very unstructured, allowing time for reading, thinking, and phone conversations without the constraint of packed schedules. This approach enables a deep focus on capital allocation, which he considers his primary job.

The businesses within Berkshire Hathaway run themselves, freeing him to concentrate on strategic decisions. Despite different working styles, he and Bill Gates structure their time to maximize productivity according to their personalities and aptitudes. Unstructured time creates space for reflection and strategic thinking that busy schedules often eliminate. This approach counters the modern tendency to equate busyness with productivity.

8. Fight Complacency

“The biggest thing that kills great businesses is complacency,” Buffett warns. He advocates for restlessness and the feeling that competitors always pursue you, requiring constant forward movement. The danger for successful companies lies in resting on past achievements rather than maintaining competitive intensity.

He uses Coca-Cola as an example, noting they must compete with the same intensity whether serving ten customers or 1.8 billion servings daily. This restlessness must permeate entire organizations, creating cultures that view tomorrow as more exciting than today. Maintaining a competitive edge requires treating every day as if the business were still small and vulnerable.

9. Study Failure

Charlie Munger’s approach to learning resonates with Buffett: “All I want to know is where I’ll die so I’ll never go there.” They systematically study business failures to understand what causes companies to fail. This reverse engineering of failure provides valuable lessons for avoiding similar mistakes.

Learning from others’ errors costs less than making those mistakes personally. Failure analysis reveals patterns and warning signs that successful companies can recognize and avoid. This principle extends beyond business into personal development, where understanding failure modes helps build better strategies. Studying what doesn’t work often provides clearer insights than analyzing success alone.

10. Do What You Love With People You Respect

Buffett reflects on his good fortune: “We really get to do what we like to do the way we want to do it with people we choose to be around.” (paraphrasing) This principle guided his decades-long partnership with Charlie Munger and shaped his business relationship approach.

Working with people you respect and trust creates an environment where everyone can perform at their best. The freedom to choose collaborators and structure work according to personal preferences enhances satisfaction and productivity. This approach recognizes that sustainable success requires alignment between individual values, work methods, and the people involved. Creating these conditions becomes increasingly possible as success provides more choices and freedom.

Conclusion

These ten principles transformed Berkshire Hathaway from a failing textile company into one of America’s most valuable corporations. Buffett’s success demonstrates that consistent application of sound principles, compounded over decades, creates extraordinary results.

His approach emphasizes character over cleverness, focus over diversification, and patience over quick profits. These timeless rules remain as relevant today as when Buffett first applied them, offering a proven framework for building lasting success in any field. His trillion-dollar empire is a testament to the power of principled thinking and disciplined execution over many decades.