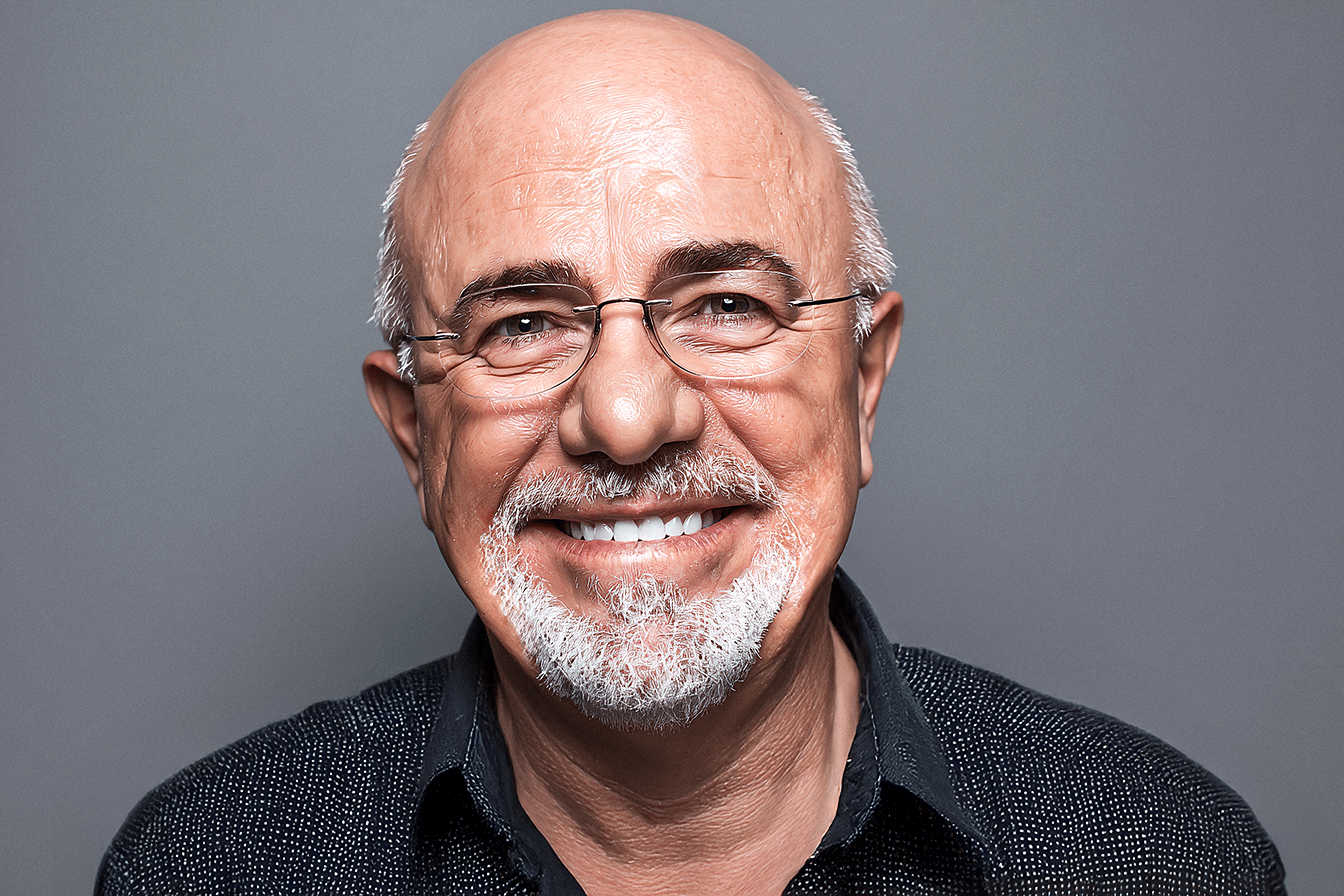

Few voices carry as much weight when it comes to building wealth in America as Dave Ramsey. His systematic approach to financial freedom has transformed millions of lives, proving that ordinary people can achieve extraordinary wealth through disciplined action and proven principles. Here is Dave Ramsey’s fastest way for middle-class people to become a millionaire:

1. The Baby Steps: A Proven Wealth-Building System

Dave Ramsey’s 7 Baby Steps represent more than just financial advice—they’re a complete wealth-building system tested by millions of Americans. With nearly 10 million people having completed Financial Peace University and over 8 million copies of “The Total Money Makeover” sold, this isn’t theoretical guidance.

It’s a proven roadmap that has created countless millionaires from everyday people. The Baby Steps provide a clear, sequential path from financial chaos to millionaire status, eliminating the guesswork and confusion that keep most people trapped in mediocrity.

2. Why Debt Is Your Biggest Obstacle to Wealth

Debt represents the single most significant barrier between you and wealth. When your income flows to creditors instead of investments, you can’t build wealth because you don’t have money to invest.

Ramsey illustrates this with a powerful example: imagine having $1,482 in monthly payments going to Toyota Motor Credit, MasterCard, Chase, and Sallie Mae. That same $1,482 invested consistently could create substantial wealth over time. The harsh reality is that you can’t be an investor when you’re broke, and debt keeps you broke by stealing your most powerful wealth-building tool.

3. The Power of Your Income as a Wealth-Building Tool

Your income is your most powerful wealth-building instrument, but only when it’s not diverted to debt payments. Every dollar sent to creditors is a dollar that can’t work for your future. When you eliminate debt, you suddenly have access to hundreds or thousands of dollars monthly that can be redirected toward building wealth.

This isn’t about earning more money—it’s about keeping and investing the money you already make. The transformation happens when you stop giving your income away and start using it to secure your financial future.

4. Baby Steps 1-3: Sprint to a Financial Foundation

The first three Baby Steps create your financial foundation through “gazelle intensity” sprints. Step one establishes a $1,000 emergency fund for immediate protection. Step two eliminates all debt except the house using the debt snowball method.

Step three builds a full emergency fund of three to six months of expenses. These steps typically require 18 to 30 months of intense focus and sacrifice, but they’re designed as quick sprints rather than marathons. The goal is to reach step four—investing—as rapidly as possible while building habits that will serve you for life.

5. Baby Steps 4-6: The Marathon to Millionaire Status

Steps four through six represent the wealth-building phase and operate as “intentional long-haul marathons” done simultaneously. Step four involves investing 15% of income in retirement, step five funds children’s college education, and step six pays off the home early.

Unlike the sprint mentality of the first three steps, these require sustained effort over decades. The magic happens when you complete step six—you can invest an entire monthly house payment, dramatically accelerating your path to millionaire status.

6. The Math That Makes Millionaires

The mathematics of wealth building is surprisingly straightforward and powerfully compelling. Consider a household earning the average American income of $60,000 annually. Investing 15% of that income from age 30 to 65 in good growth stock mutual funds can result in $5 to $10 million in retirement accounts.

Ramsey notes that you’d still become a millionaire even if these projections are dramatically wrong. This isn’t wishful thinking—it’s mathematical certainty based on historical market performance and compound growth. The challenge isn’t the math; it’s following through with consistent investing over decades.

7. Mindset Matters: Believing You Can Do It

Perhaps the most critical factor in building wealth isn’t income or education—it’s belief. Ramsey’s research revealed that 97% of millionaires believe they control their destiny, compared to only 69% of the general public. This difference in mindset proves everything.

When you believe wealth building is possible, you’ll find ways to make it happen. You’ll find excuses for why it can’t work when you don’t think so. The negative voices in our culture constantly tell people they can’t succeed, stealing hope and creating self-fulfilling prophecies of financial failure.

8. Ordinary Professions, Extraordinary Wealth

The path to millionaire status doesn’t require a high-profile career or exceptional income. Ramsey’s extensive research reveals that everyday professions consistently produce millionaires. These aren’t lottery winners or inheritance recipients—they’re regular people who made smart decisions with their money over time.

The key insight is that wealth building depends more on what you do with your income than on how much you earn. High earners who spend everything remain broke, while modest earners who invest consistently become wealthy.

9. Why Teachers and Engineers Dominate the Millionaire List

Ramsey’s millionaire study produced surprising results about which middle-class professionals build wealth the most. Engineers ranked first, accountants second, and teachers third among millionaire professions.

Managers came fourth, with lawyers fifth. Notably, doctors and bankers didn’t even make the top five. These first professions share common characteristics: they’re process-driven and systematic. Since becoming a millionaire also requires consistency and discipline, people who are comfortable with systematic approaches naturally excel at wealth building.

10. Breaking Through the “I Can’t Do It” Mentality

The biggest obstacle to building wealth isn’t external—it’s the internal belief that success isn’t possible. Cultural “barking dogs” constantly reinforce messages that ordinary people can’t get ahead anymore.

These negative influences steal hope and create learned helplessness. The antidote is recognizing that people with your same background, age, race, and profession have successfully built wealth. If they can do it, so can you. The difference isn’t capability—it’s belief combined with action.

11. The Generosity Factor: What Millionaires Do Differently

Baby Step 7 focuses on building wealth and becoming outrageously generous. This isn’t just about having money—it’s about using wealth to positively impact others. Wealthy people often gravitate toward helping people who share their background.

A single mother who builds wealth naturally wants to help other single mothers. This generosity creates meaning beyond personal financial security and provides powerful motivation during the challenging years of wealth-building.

12. Your Inputs Determine Your Outcomes

The “garbage in, garbage out” principle applies powerfully to wealth building. Your closest relationships and information sources shape your beliefs about what’s possible. Surrounding yourself with negative people who constantly complain about money problems will reinforce limiting beliefs.

Instead, seek positive influences through books, podcasts, and relationships with people who believe in financial success. Read stories of ordinary people who built extraordinary wealth, and let their examples become your mental inputs.

13. Real Stories of Baby Steps Millionaires

Ramsey has met tens of thousands of millionaires following the Baby Steps system. These individuals represent every race, gender, national origin, geographic area, profession, and income level. They’re not theoretical examples—they’re real people who transformed their financial lives through systematic action. Their stories prove that the Baby Steps work for anyone willing to follow them consistently over time.

Conclusion

Building wealth doesn’t require exceptional intelligence, inheritance, or luck. It requires consistently following a proven system while believing in your ability to succeed. Dave Ramsey’s Baby Steps provide that system, moving you from financial chaos through debt elimination to systematic wealth building.

Math and systems work, and ordinary people become millionaires by following these principles. Your journey to seven figures begins with Baby Step 1 and believing you can achieve financial freedom regardless of your starting point.