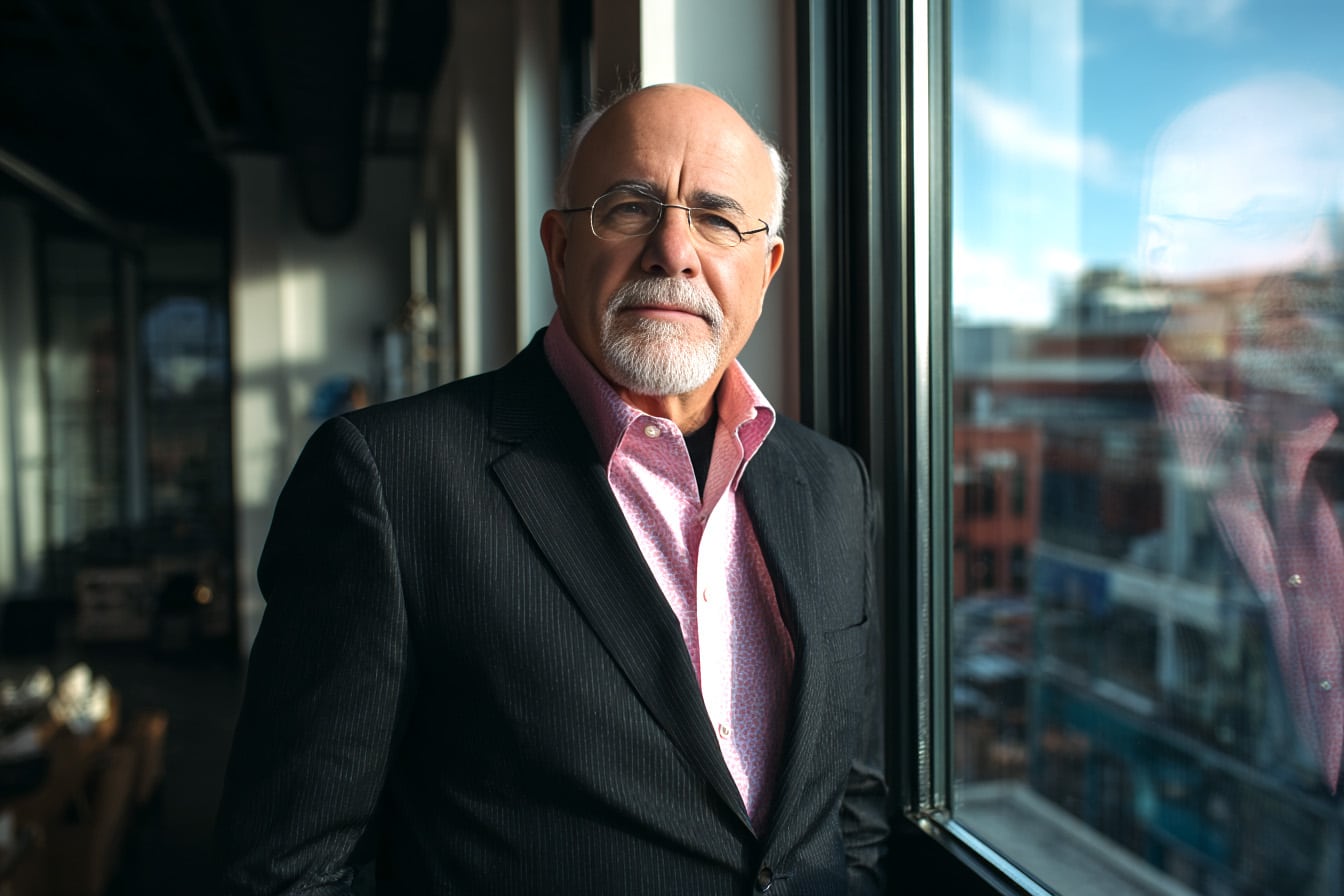

For over thirty years, Dave Ramsey has taught Americans how to build wealth through time-tested principles rooted in common sense and biblical wisdom. His approach isn’t theoretical—it’s proven. These five foundational steps have helped millions escape financial stress and build lasting wealth.

1. Have a Written Budget Plan

Jesus said, “Don’t build a tower without first counting the cost, lest you get halfway up and you’re unable to finish and all who see you begin to mock you.” This biblical principle forms the foundation of Ramsey’s wealth-building philosophy: you must have a written plan for your money.

A budget isn’t about restriction—it’s about intentionality. Ramsey advocates for zero-based budgeting, where every dollar is assigned a purpose before the month begins. This means your income minus all planned expenses equals zero. You’re telling your money where to go instead of wondering where it went.

The stark reality is that most Americans operate without any financial plan whatsoever. They live paycheck to paycheck, reacting rather than planning their finances. This approach guarantees mediocrity at best and economic disaster at worst.

Creating a written budget forces you to confront your spending habits honestly. It reveals where your money actually goes versus where you think it goes. This awareness alone often provides the motivation needed to make necessary changes. The budget becomes your roadmap to wealth, ensuring that saving and investing happen automatically rather than accidentally.

Nobody accidentally wins at anything, and you’re not the exception. Wealth building requires planning, starting with a written budget that accounts for every dollar you earn.

2. Get Out of Debt Completely

Your income is your most powerful wealth-building tool, but debt payments steal that power and hand it over to banks and lenders. Ramsey is adamant: you must eliminate all debt except your home mortgage to build real wealth.

The debt snowball method—paying off debts from smallest to largest regardless of interest rates—forms the cornerstone of Ramsey’s debt elimination strategy. This approach prioritizes psychological wins over mathematical optimization, recognizing that personal finance is more behavioral than mathematical.

You’re working for everyone except yourself when making car, credit card, and student loan payments. These monthly obligations consume income that could be building your wealth instead. The average American household carries significant consumer debt, creating a barrier to wealth accumulation that seems insurmountable.

Debt represents a fundamental transfer of wealth from you to someone else. Every month, your hard-earned money flows to creditors instead of growing in investments. This opportunity cost is staggering when calculated over decades.

The biblical principle that “the borrower is servant to the lender” reveals the true nature of debt. You can’t build lasting wealth while serving multiple financial masters. Debt elimination isn’t just about mathematics—it’s about freedom. When you don’t have any payments, you have money. That’s when real wealth building begins.

3. Live on Less Than You Make

The book of Proverbs teaches that “in the house of the wise are stores of choice food and oil, but a foolish man devours all that he has.” This ancient wisdom directly challenges modern Americans’ tendency to spend every penny earned.

Living below your means isn’t about deprivation but creating a margin of safety in your financial life. This margin becomes the foundation for all wealth-building activities. Without it, you’re trapped in an endless cycle of paycheck-to-paycheck living.

The concept requires a fundamental mindset shift. Instead of asking “Can I afford this?” the question becomes “Should I buy this?” This subtle change in thinking transforms you from a consumer driven by wants into an investor focused on building wealth.

Lifestyle inflation poses the greatest threat to living below your means. As income increases, expenses rise proportionally, leaving no additional money for wealth building. Breaking this cycle requires conscious effort and deliberate choices about spending priorities.

Creating financial margin isn’t about earning more money—it’s about controlling the controllables in your current situation. This might mean choosing a smaller house, driving older cars, or finding creative ways to reduce monthly expenses. These choices aren’t sacrifices when viewed through the lens of wealth building—they’re investments in your financial future.

The discipline to live below your means creates the capital needed for the next crucial step in building wealth.

4. Save and Invest Your Money

Ramsey’s approach to saving and investing follows his famous Baby Steps methodology. First, establish a starter emergency fund, then focus on debt elimination, followed by a full emergency fund of three to six months of expenses. Only after completing these foundational steps should you begin serious wealth building through investing.

The power of compounding makes time your greatest ally in wealth building. Starting early, even with modest amounts, creates exponential growth over decades. However, Ramsey emphasizes that consistency matters more than complexity. Simple, broad-based mutual funds consistently outperform complicated investment strategies for most people.

His investment philosophy centers on growth stock mutual funds with long track records. This approach avoids the speculation and complexity that derails many would-be investors. The goal isn’t to beat the market—it’s to participate in long-term market growth through disciplined, regular investing.

The biggest problem most people have with investing isn’t their rate of return or expense ratios—they don’t invest anything. You can’t build wealth without saving money, and you can’t grow wealth without investing that saved money wisely.

Ramsey recommends investing 15% of household income for retirement after eliminating debt and establishing an emergency fund. This percentage ensures serious wealth building without sacrificing current financial stability.

5. Be Outrageously Generous

According to Ramsey, the ultimate purpose of building wealth is developing the capacity for outrageous generosity. This final principle transforms wealth building from a selfish pursuit into a noble calling with eternal significance.

Generosity requires financial success, which is why it comes after establishing the other four principles. You can’t give what you don’t have, and broke people can’t help others effectively. Building wealth creates the platform for meaningful generosity that impacts lives and communities.

Biblical principles emphasize giving as both a privilege and a responsibility. Those blessed with financial resources bear the responsibility to bless others. This perspective transforms wealth from an end goal into a means for serving others.

Planned generosity differs dramatically from impulsive giving. When generosity is built into your budget and wealth-building plan, it becomes sustainable and impactful. This approach ensures that giving enhances rather than undermines your financial foundation.

The psychological and spiritual benefits of generosity often exceed the financial cost. Generous people report higher satisfaction and purpose, understanding that their wealth serves something greater than personal accumulation.

Rich people don’t become rich by spending money frivolously—they become rich by saving, investing, and giving strategically. True wealth provides options and opportunities that extend far beyond personal consumption.

Conclusion

These five principles work because they address money management’s mathematical and behavioral aspects. They’re not complex theories requiring advanced education—they’re common-sense practices that anyone can implement regardless of their current financial situation.

Success comes from consistent application over time, not from perfect execution. Building wealth remains accessible to anyone willing to embrace these proven principles and persist through the inevitable challenges.