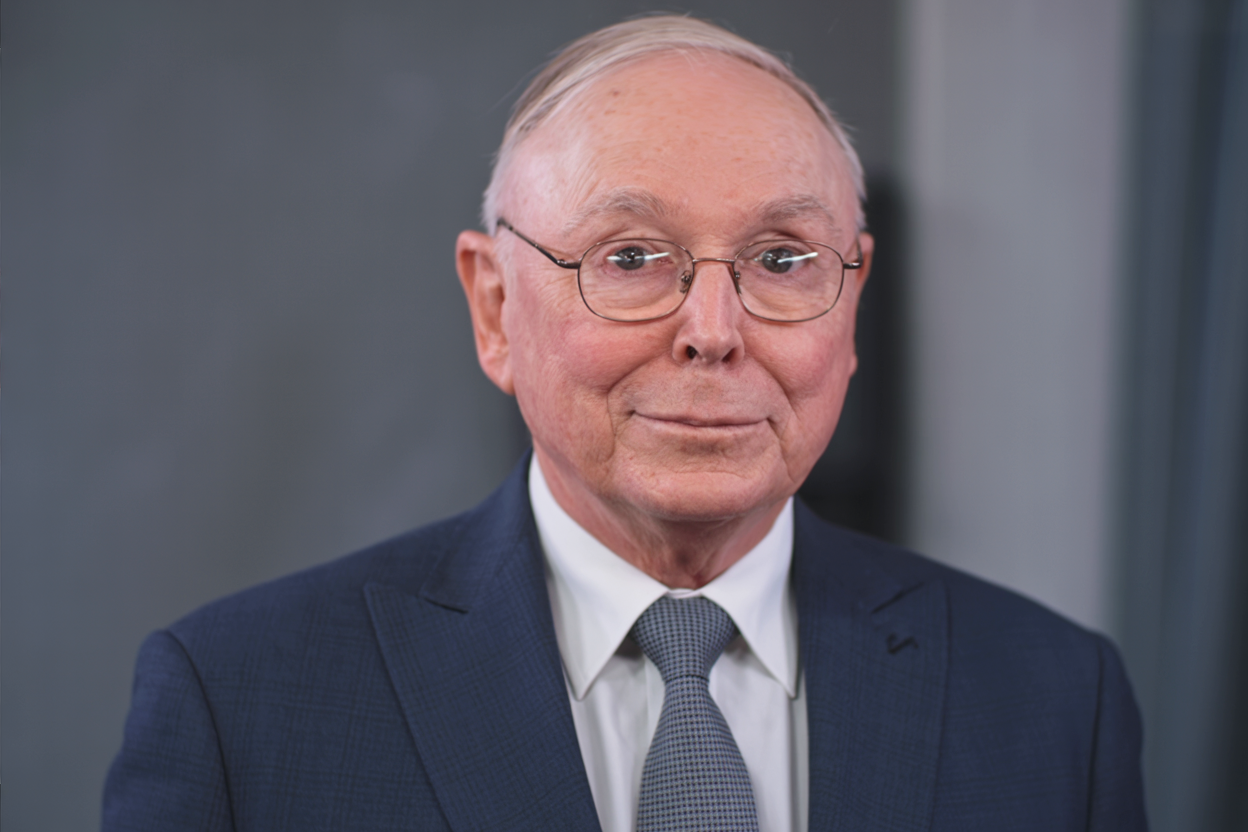

The late Charlie Munger, Warren Buffett’s legendary business partner, built a fortune worth billions yet lived with remarkable simplicity. His unconventional views on happiness focused not on luxury or status symbols, but on a handful of essential investments that compound in value over a lifetime. His wisdom offers a refreshing counterpoint to consumer culture and a roadmap for lasting contentment.

1. Books and Knowledge

“In my whole life, I have known no wise people who didn’t read all the time—none, zero.” – Charlie Munger.

For Munger, books represented the single best investment anyone could make. He spent hours daily reading across psychology, biology, history, physics, and economics—not for entertainment, but to build a “latticework of mental models” that improved decision-making in every area of life.

The beauty of investing in knowledge is its accessibility. Unlike many sources of happiness that require significant wealth, education through reading is remarkably affordable. A library card provides free access to humanity’s accumulated wisdom, and even purchased books offer extraordinary returns on investment.

Munger believed wisdom compounds like interest over time. Each book connects with others, creating a network of understanding that grows exponentially more valuable. This knowledge doesn’t depreciate like physical possessions—it becomes more useful as you accumulate more, helping you recognize patterns, avoid mistakes, and make better choices across all life domains.

The practical application: allocate time and money toward building a personal library and developing consistent reading habits. Focus on foundational works that have stood the test of time and read broadly across disciplines to master the multidisciplinary thinking Munger championed.

2. Quality Over Quantity in Everything

“I don’t want to own many things, and I don’t want to go many places. I’d rather stay right here and try to live a long and happy life with a few friends and relatives.” – Charlie Munger.

Despite having resources to buy virtually anything, Munger lived with remarkable restraint. He understood that accumulating possessions creates complexity, maintenance burdens, and distraction from what truly matters. His approach emphasized buying fewer things of exceptional quality than many mediocre items.

This philosophy extends beyond objects to experiences. While consumer culture promotes constant novelty, Munger found satisfaction in depth rather than breadth, preferring to enjoy familiar possessions like his home, rather than constantly seeking new stimulation.

When making purchases, choose items built to last, that serve their function exceptionally well, and that you’ll genuinely use for years or decades. Well-made furniture, a reliable vehicle, or quality tools provide more lasting satisfaction than closets full of fast fashion or garages filled with quickly forgotten gadgets.

This approach requires patience and willingness to save for better options rather than immediately gratifying impulses with cheaper alternatives. It demands honest self-reflection about what you need versus what advertising tells you to want. The result is a simpler life with less clutter, less decision fatigue, and more resources for things that genuinely matter.

3. Your Health and Fitness

“If you don’t care for your body, where will you live?” – Charlie Munger.

Munger recognized that health forms the foundation for everything else. Wealth becomes meaningless without physical and mental well-being, and other pursuits lose their joy. He viewed neglecting health as profoundly irrational—destroying the vessel needed to experience life’s pleasures.

Investing in health means allocating resources toward nutritious food, regular exercise, preventive medical care, and adequate rest. While these expenditures might seem normal, they represent some of the highest-return investments possible. The cost of prevention pales compared to the devastation of preventable illness.

This investment includes paying for environments supporting healthy habits: a gym membership you’ll actually use, a standing desk, quality running shoes, or a home in a walkable neighborhood with fresh food access. These aren’t luxuries but essential infrastructure for a good life.

Munger lived to be 99 with remarkable mental clarity, a testament to his commitment to this principle. No amount of wealth can buy back lost health, making prevention and maintenance the wisest possible allocation of resources. The earlier you prioritize health investments, the more dramatically they compound over a lifetime.

4. Time with People You Love

“The best thing a human being can do is to help another human being know more.” – Charlie Munger.

Munger’s quote reflects his strong belief in meaningful human connection. He emphasized that deep, trustworthy relationships with family and close friends matter far more than superficial connections or large social networks.

Investing in relationships means allocating time and money toward nurturing the people who matter most—traveling to visit family, hosting gatherings, or creating space for unhurried conversations. These experiences create memories and deepen bonds in ways material possessions never can.

The financial aspect isn’t about spending lavishly but removing barriers to connection: living closer to loved ones, even at a higher cost, having a home where people feel comfortable gathering, or being generous with shared meals and experiences. It might mean paying for help with other tasks so you have more energy for relationships.

Munger valued quality over quantity in friendships, just as he did with possessions. He preferred a small circle of deeply trusted, intellectually stimulating companions over a vast network of acquaintances. This approach requires investing significant time and emotional energy into fewer relationships, allowing them to develop genuine depth and trust.

5. Independence and Freedom

“I had a considerable passion for getting rich. Not because I wanted Ferraris—I wanted the independence. I desperately wanted it.” – Charlie Munger.

This quote captures Munger’s ultimate philosophy on wealth and happiness. For him, money’s greatest value wasn’t purchasing luxury goods but providing freedom and autonomy—the ability to make choices based on what you want rather than what is most needed to earn money, pursue interesting work rather than drudgery, and live according to his values.

Buying independence means making financial decisions, prioritizing optionality and autonomy over status and consumption. This might mean living below your means to build savings, choosing flexible career paths, or avoiding debt that forces unwanted decisions.

The path to independence requires patience and delayed gratification. It means resisting lifestyle inflation as income grows, investing systematically for the future, and building valuable skills. These choices compound over time, creating the financial foundation that makes true freedom possible.

True independence isn’t about retiring young or never working, but having the ability to work on what matters to you, with people you respect, in ways that align with your values. It means having enough resources that financial pressure doesn’t force character-eroding compromises. Munger believed this freedom was worth far more than any material possession.

Conclusion

Charlie Munger’s approach to happiness reflects a lifetime of rational thinking about what genuinely matters. His philosophy rejects consumerist assumptions, instead focusing on investments that compound value over time: knowledge that makes you wiser, quality that lasts, health that enables everything else, relationships that provide meaning, and independence that offers freedom.

What makes Munger’s advice particularly powerful is its accessibility. Most of these happiness investments don’t require vast resources. Books are cheap or free, quality often costs the same as constant consumption, health investments pay for themselves, relationships cost more time than money, and the path to independence begins with choices available to almost everyone.

The common thread is the importance of long-term thinking and compound effects. Just as he built wealth through patient, rational investing, Munger built happiness through consistent investments in things that grew more valuable over time.

His life demonstrates that lasting contentment isn’t found in shopping malls but in libraries, gyms, dinner tables with loved ones, and the financial discipline that creates true freedom.