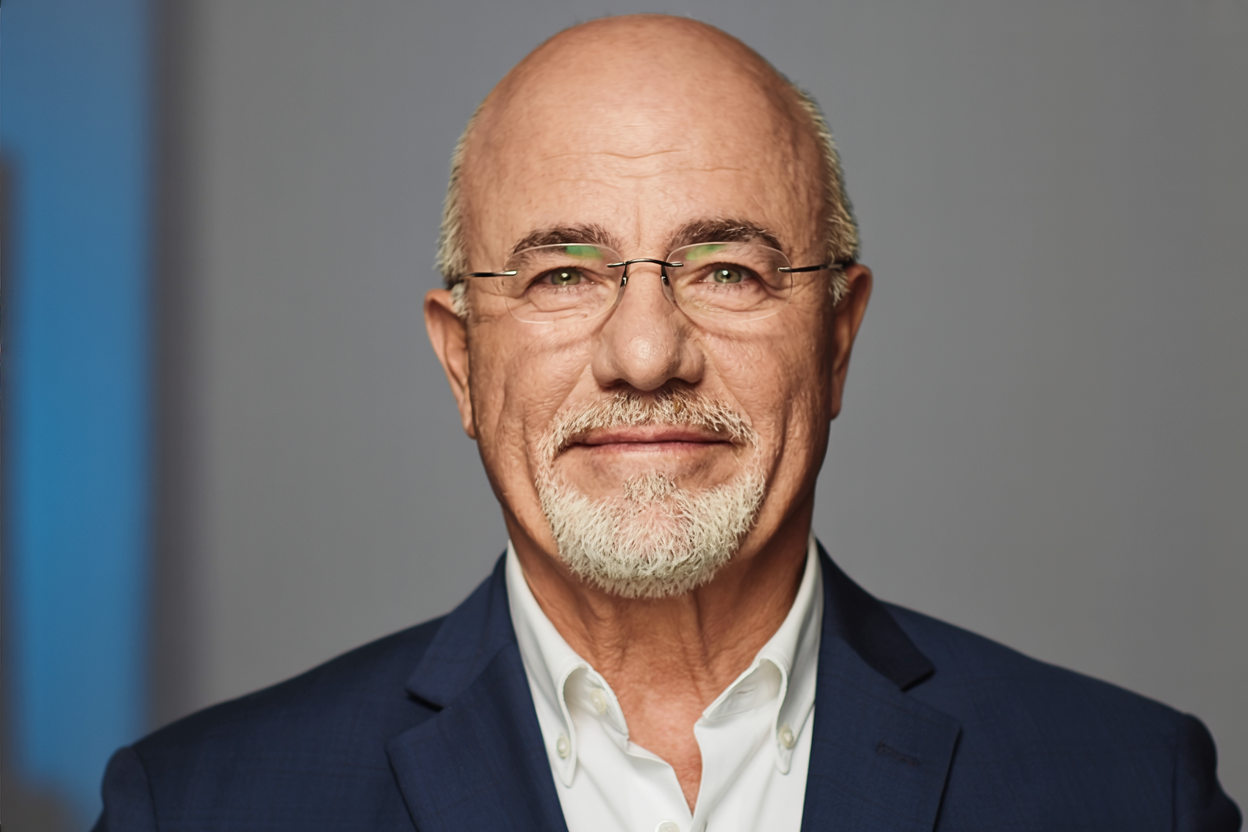

Dave Ramsey has built his reputation as one of America’s most trusted financial advisors by delivering straightforward advice that challenges conventional spending wisdom. His core philosophy centers on a simple but powerful principle: if you can’t afford to pay cash for something, you really can’t afford it.

Through his radio show, books, and financial coaching programs, Ramsey consistently identifies spending patterns that trap middle-class families in cycles of debt, preventing them from building real wealth.

His approach reveals that many purchases considered normal by middle-class standards actually destroy long-term financial success. By eliminating these five problematic spending categories, families can redirect a substantial portion of their monthly income toward savings, investments, and debt reduction.

1. New Cars Financed with Loans

Ramsey’s stance on new car purchases is unwavering and represents perhaps his most passionate financial advice. He considers financing new vehicles the most destructive financial decision middle-class families make. The core issue isn’t just the monthly payment itself, but the fact that new cars lose significant value immediately after leaving the dealership lot. When families finance these rapidly depreciating assets, they’re essentially paying interest on something that becomes worth less every single month.

Financial math paints a stark picture. Two monthly car payments can easily drain family budgets by over a thousand dollars when you factor in the principal and interest. This figure doesn’t even include the higher insurance premiums that come with new vehicles or the ongoing maintenance costs. Ramsey frequently points out that you can predict who will remain middle-class simply by looking at their driveway. When expensive cars with obviously large monthly payments sit in front of a modest home, it signals a fundamental misunderstanding of wealth building.

His alternative approach is straightforward: purchase reliable used vehicles with cash. Specifically, he recommends buying two to three-year-old cars that have already absorbed the initial depreciation hit while still offering modern features and reliability. This strategy eliminates monthly payments, reduces insurance costs, and frees up hundreds of dollars each month for genuine wealth-building activities, such as paying off debt, building emergency funds, or investing for retirement.

2. Status Symbols and Luxury Items

Ramsey draws a sharp distinction between appearing wealthy and actually building wealth. He consistently criticizes the middle-class tendency to purchase designer clothing, luxury handbags, premium electronics, and high-end accessories in an effort to project an image of success. These purchases represent a fundamental misunderstanding of how wealth accumulation actually works.

His observations about real self-made millionaires reveal a fascinating contrast to typical middle-class spending habits. Self-made millionaires often shop at practical stores and avoid expensive brand names entirely. They prioritize value over status symbols because they understand that costly clothes don’t generate income or build wealth. Instead, these items drain resources that could be invested in appreciating assets.

The psychology behind status purchases is particularly damaging for middle-class families who have limited discretionary income. When they spend disproportionate amounts on items meant to impress others, they sacrifice opportunities to improve their actual financial position. Ramsey’s advice cuts through social pressure with brutal honesty: stop buying things you can’t afford with money you don’t have to impress people you don’t even like.

The opportunity cost of luxury spending is significant. Money spent on status symbols could be generating returns through investments instead. True wealth comes from accumulating assets, not accumulating expensive possessions. Ramsey emphasizes building wealth first, then purchasing luxury items with cash after achieving genuine financial security.

3. Timeshares

Ramsey’s position on timeshares is crystal clear and absolutely uncompromising. He describes them as one of the worst financial traps available to middle-class families. The timeshare industry creates an illusion of a vacation investment, but the reality involves high upfront costs, perpetual maintenance fees, and virtually no resale value.

The financial burden extends far beyond the initial purchase price. Annual maintenance fees typically increase every year, creating an ongoing expense that families can’t easily escape. Special assessments for property improvements add unexpected costs on top of regular payments. Unlike actual real estate ownership, where you build equity and property values may appreciate, a timeshare represents only the right to use a property for a specific time period each year.

The resale difficulty presents another major problem. Timeshares are notoriously difficult to sell because prospective buyers understand they’re not purchasing actual property but rather the option to use one. The existence of companies specifically designed to help people exit their timeshare contracts demonstrates just how trapped owners become.

Ramsey’s alternative approach emphasizes financial flexibility and control. He recommends saving money specifically for vacation expenses and paying cash for diverse travel experiences. This allows families to vacation where they want, when they want, without being locked into specific locations or carrying ongoing financial obligations for decades.

4. Frequent Restaurant Meals

The rising cost of dining out has transformed restaurant meals into a significant budget drain for middle-class families. Ramsey points out that regular restaurant visits can consume hundreds of dollars monthly, representing money that should be directed toward wealth-building activities instead. While he doesn’t advocate eliminating dining out entirely, he emphasizes the importance of making it an occasional planned entertainment expense rather than a regular convenience solution.

Home-cooked meals typically cost a fraction of the price of restaurant meals, making meal preparation one of the most effective ways to reduce monthly expenses. The challenge with frequent dining out involves both the direct costs and the tendency for restaurant spending to go untracked in family budgets. Many families underestimate how quickly individual restaurant meals accumulate into substantial monthly expenses.

When dining out becomes a default solution for busy schedules rather than a conscious choice for entertainment, it often indicates broader issues with meal planning and household organization. The cumulative impact of cutting back on restaurant spending usually surprises families who calculate their annual totals. Redirecting even a portion of restaurant spending toward debt reduction or investments can significantly accelerate financial progress.

5. Extended Warranties

Ramsey considers extended warranties to be overpriced insurance products that rarely provide value to consumers, while generating substantial profits for retailers and manufacturers. Whether offered on appliances, electronics, or vehicles, these warranties represent poor financial decisions for middle-class families trying to build wealth.

The fundamental issue is that companies selling extended warranties have carefully calculated the odds. They structure these products to maximize profitability while minimizing the likelihood that customers will actually use the coverage. Warranty periods are designed to end before most parts are likely to fail, and the coverage itself is often limited in ways that exclude common problems.

The costs can quickly add up if families routinely purchase extended warranties on multiple items. Instead of spending money on warranties that are likely to go unused, Ramsey advocates for building a robust emergency fund that can cover unexpected repair costs when they actually occur. This approach provides greater financial flexibility and ensures that money isn’t wasted on insurance products with limited actual value.

Conclusion

Dave Ramsey’s identification of these five problematic purchases reveals a fundamental truth about middle-class spending: many widely accepted financial behaviors actively prevent wealth building. The opportunity cost of car payments, status purchases, timeshares, frequent dining out, and extended warranties creates a cycle where families appear successful while remaining financially vulnerable.

His overarching principle of avoiding purchases that require financing challenges for families to reconsider their spending patterns completely. By redirecting money from these wealth-destroying categories toward savings, investments, and debt elimination, families often discover that they have far more money available for genuine wealth building than they initially thought.

The cumulative impact of these changes can transform financial trajectories, moving families from consumption-focused spending toward actual wealth creation and lasting financial security.