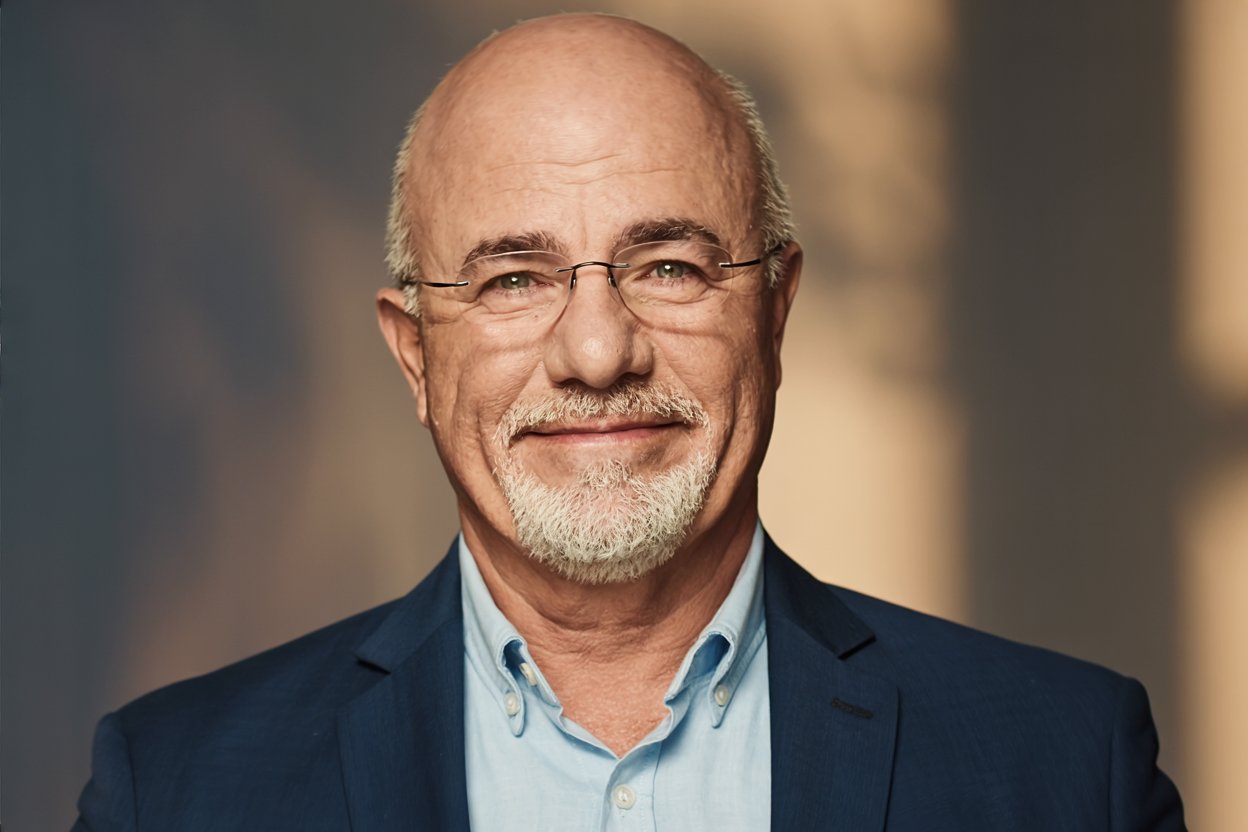

Financial regret is one of the heaviest burdens people carry as they age. The realization that simple principles, applied consistently over time, could have changed everything often arrives decades too late. Dave Ramsey, the personal finance expert who has helped millions escape debt and build wealth, teaches lessons that seem obvious in hindsight but remain invisible to most people during their crucial earning years.

These aren’t complex investment strategies or insider secrets. They’re fundamental truths about money that require nothing more than discipline and intentionality. Yet most people spend their twenties, thirties, and even forties ignoring them, only to face the consequences when time runs out. Understanding these lessons early can mean the difference between financial freedom and perpetual stress.

1. Debt Is Your Biggest Wealth-Building Enemy

The cultural message surrounding debt has normalized something that should alarm us. Car payments are considered inevitable. Student loans are viewed as necessary investments. Credit cards are treated as convenient tools rather than dangerous weapons. Ramsey challenges this entire paradigm with a simple message: debt is dumb.

Every dollar paid toward interest is a dollar that can’t work for your future. When you’re sending hundreds or thousands of dollars each month to banks and lenders, you’re funding their financial success while sabotaging your own. The math is straightforward, but the emotional weight of debt goes deeper than numbers. Debt creates stress, limits options, and keeps people trapped in jobs they hate because they can’t afford to leave.

The tragedy is that most people don’t see debt as an emergency. They accept it as usual, making minimum payments for years without recognizing the opportunity cost. By the time they understand how much of their income has been redirected to lenders instead of investments, decades have passed. Ramsey teaches that becoming debt-free isn’t just about math; it’s about reclaiming your income and your future.

2. You Need an Emergency Fund Before Anything Else

Life doesn’t wait for you to be financially prepared. The car breaks down. The air conditioner fails in July. Someone needs emergency medical care. These aren’t rare catastrophes; they’re predictable aspects of existence. Yet most people are utterly unprepared for them, which sends them straight back into debt every time something goes wrong.

Ramsey’s approach starts with a modest goal: save one thousand dollars before doing anything else. This starter emergency fund won’t cover everything, but it handles most of life’s more minor emergencies. Once debt is eliminated, the fund grows to cover three to six months of expenses. This larger cushion transforms financial life from reactive to proactive.

People who learn this lesson too late describe a cycle they couldn’t escape. Every time they made progress paying off debt, an emergency would arise, forcing them to add new debt. They spent years running in place, never understanding that the emergency fund was the missing piece. Without this buffer, you can’t maintain forward progress because life will constantly interrupt your plans.

3. Live on Less Than You Make

This principle sounds almost insulting in its simplicity, yet it’s where most people fail. The problem isn’t understanding the concept; it’s the execution. Without a plan, money disappears. Spending happens automatically, driven by impulse, convenience, and social pressure rather than intentional decisions.

Ramsey teaches that a budget isn’t restrictive; it’s liberating. When every dollar has an assignment before the month begins, you’re controlling your money instead of wondering where it went. This shift from passive to active money management changes everything. You start making conscious tradeoffs. You begin aligning your spending with your values instead of letting your lifestyle happen by default.

Those who learn this too late often describe decades of earning good incomes while somehow never getting ahead. They made money, but it flowed through their hands without purpose. They bought things that seemed reasonable at the moment but didn’t contribute to any larger goal. By the time they discovered intentional budgeting, years of potential savings had evaporated into forgotten purchases and lifestyle expenses that never delivered lasting satisfaction.

4. Start Investing Early Because Time Is Your Greatest Asset

Compound interest is often called the eighth wonder of the world, but most people don’t harness its power until it’s nearly too late. The difference between starting to invest in your twenties versus your forties isn’t just twenty years of contributions; it’s twenty years of growth on those contributions. Money invested early has decades to multiply, turning modest contributions into substantial wealth.

Ramsey recommends investing 15% of your income into retirement accounts once your debt is eliminated. This isn’t complicated investing; it’s consistent, long-term contributions to proven vehicles. The strategy is boring, which is precisely why it works. People who chase exciting investments often underperform those who contribute steadily to diversified funds over the long term.

The regret from learning this lesson late is particularly painful because the lost time can’t be recovered. Someone who starts investing at twenty-five can invest less overall and end up with more wealth than someone who starts at forty-five, even if the latter starter invests larger amounts. The earlier investor gave their money more time to work, and time is the one resource you can’t buy back.

5. Lifestyle Inflation Will Steal Your Future

Perhaps the most insidious wealth destroyer is the automatic upgrade. When income increases, expenses rise to match. The raise gets absorbed into a nicer apartment. The promotion justifies a luxury car. The bonus funds a bigger vacation. This pattern, known as lifestyle inflation, ensures that, regardless of how much people earn, they never seem to catch up.

Ramsey teaches that wealth building happens in the gap between earning and spending. If that gap stays constant regardless of income growth, you’ll never build substantial wealth. The secret is to keep expenses modest even as income rises, directing the difference toward investments rather than upgrades. This requires resisting cultural pressure that defines success through visible consumption.

People who learn this too late often have impressive incomes, but also remarkable debt to match. They upgraded everything as they climbed the career ladder, always feeling like they deserved it after working hard. But they wake up one day realizing that despite decades of high earnings, they have little to show for it. The lifestyle they built requires their full income to maintain, leaving them one job loss away from disaster.

Conclusion

These lessons from Dave Ramsey aren’t revolutionary. They’re simple, even obvious. Yet their simplicity is deceiving because simple doesn’t mean easy. Each principle requires swimming against cultural currents that encourage debt, discourage saving, and equate spending with success.

The people who learn these lessons early gain something beyond wealth: they gain freedom. Freedom from financial stress, freedom to make choices based on values rather than necessity, and freedom to build the life they actually want instead of the one their debt requires. The tragedy isn’t that these lessons are hard to learn; it’s that most people don’t know them until the time to apply them has largely passed.