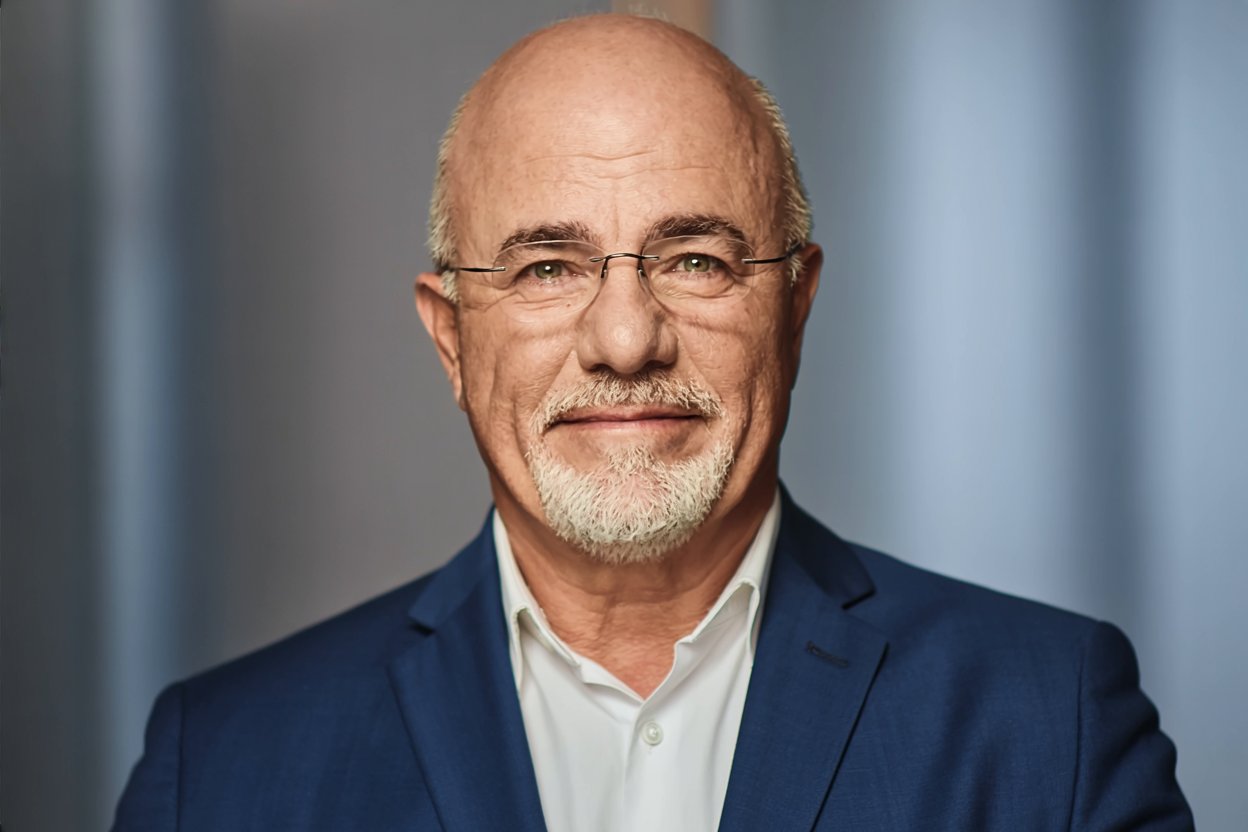

Dave Ramsey has spent decades teaching financial principles that extend far beyond balance sheets and budgets. His wisdom about money inevitably bleeds into broader life lessons about discipline, sacrifice, and the consequences of our daily choices.

While many men eventually grasp these truths, they often arrive at them after years of costly mistakes—when rectifying the damage requires significantly more effort than would have been needed for prevention.

This financial expert’s teachings reveal patterns that plague countless men who wake up in their 40s or 50s, wondering where their money, time, and opportunities disappeared. These aren’t complex economic theories requiring advanced degrees to understand. They’re straightforward principles that men consistently ignore in youth, only to pay the price in middle age and beyond.

1. Debt Destroys Freedom Before You Notice It’s Gone

“The decision to go into debt alters the course and condition of your life. You no longer own it. You are owned.” – Dave Ramsey.

When men sign loan documents in their 20s and 30s—whether for trucks, boats, or houses they can’t truly afford—they trade future freedom for present appearance. The monthly payments seem manageable initially, but they accumulate into a trap that restricts career moves, family choices, and life opportunities. By the time men recognize they’re trapped, they’ve spent years working primarily to service debt rather than build wealth.

2. Short-Term Sacrifice Creates Long-Term Wealth

“If you will live like no one else, later you can live like no one else.” – Dave Ramsey.y

Men who live modestly when peers are spending lavishly position themselves for entirely different futures. This means driving paid-off older vehicles, staying in starter homes longer than feels comfortable, and skipping trendy purchases that drain cash. Most men learn this lesson the hard way, spending freely in their youth and assuming there’s always time to save later. Then midlife arrives with increased responsibilities, and the compounding power of early savings becomes painfully apparent.

3. Impressing Others Costs More Than Just Money

“We buy things we don’t need with money we don’t have to impress people we don’t like.” – Dave Ramse.y

Consumer culture encourages men to signal their success through material possessions. Men typically realize too late that the approval they sought was empty. Neighbors impressed by material goods aren’t real friends. When financial trouble hits, those people vanish. What remains are the payments, the stress, and the recognition that genuine relationships weren’t built on what you owned.

4. Daily Discipline Compounds Into Life-Changing Results

“Work is doing it. Discipline is doing it every day. Diligence is doing it well every day.” – Dave Ramsey.

Working hard one day accomplishes little. Working with discipline daily—on budgets, health, relationships, and skills—creates compound effects that transform lives over the course of decades. Men often skip the unglamorous daily work in their youth. Then time reveals that small daily actions, repeated consistently, would have built the life they wanted.

5. Avoiding Change Until Crisis Forces It Wastes Years

“Change is painful. Few people dare to seek out change. Most people won’t change until the pain of where they are exceeds the pain of change.” – Dave Ramsey.

Men often delay uncomfortable changes until circumstances leave them with no alternative. They stay in soul-crushing jobs rather than risk transitions, tolerate unhealthy habits until medical scares force intervention, or remain in toxic situations because familiar misery feels safer than uncertain improvement. Years are consumed in situations that should have been escaped immediately.

6. Wealth Magnifies Character Rather Than Creating It

“More wealth doesn’t fix your life. More wealth makes you more of what you already are.” – Dave Ramsey.

Many men chase financial success, believing money will solve their problems or make them better people. Wealth amplifies existing character traits. The selfish person with money becomes more selfish. The generous person becomes more generous. This lesson hits men who achieve financial success only to discover it exposes character flaws they had ignored.

7. Your Life Reflects Your Choices, Not Your Circumstances

“Where you are today is the sum of every choice you’ve ever made. If you don’t like where you are, start making different choices!” – Dave Ramsey.

Taking personal responsibility for outcomes might be Ramsey’s most fundamental principle. Men commonly blame external factors for their situations. This blame-shifting prevents the ownership needed to change course. The lesson men learn too late is that small daily choices accumulate into their current reality. Different choices create different outcomes, but many men spend decades in a victim mentality before accepting they’re the authors of their own stories.

8. Money Should Serve Your Values, Not Define Them

“Money is a terrible master but an excellent servant.” – Dave Ramsey.

Men who prioritize wealth as their primary goal often achieve it at the expense of their relationships, health, and sense of meaning. They reach financial summits only to find the view empty and the climb not worth the sacrifice. This realization typically comes late when children are grown, marriages are damaged, and health is declining. Money should fund a life aligned with deeper values—such as family, faith, contribution, and growth—not become the value itself.

9. Following the Crowd Leads to Average Results

“The goal is not to be normal, because as my radio listeners know, normal is broke.” – Dave Ramsey.

Societal norms around money often lead to mediocrity. Car loans are standard. Credit card balances are normal. Living paycheck to paycheck is normal. Men who follow standard paths typically experience standard results, which often mean financial stress, limited options, and working into old age. Financial success requires doing what most people won’t: living below your means, rejecting debt, and building wealth slowly.

10. Starting Immediately Matters More Than Perfect Timing

“It’s never too late to turn things around. You are the only obstacle.” – Dave Ramsey.

Men often wait for ideal conditions before making changes. This waiting consumes years. Ramsey emphasizes that immediate imperfect action is usually preferable to delayed perfect action. The man who starts saving small amounts at 25 positions himself far better than the one who waits until 40 to save larger amounts.

Conclusion

Dave Ramsey’s lessons extend beyond financial mechanics to fundamental truths about how men build meaningful lives. The common thread is that short-term decisions create long-term realities.

Men who ignore these principles in youth pay compound interest on their mistakes for decades. The encouraging message is that it’s never too late to change course, although it is always better to do so earlier.

The men who grasp these truths early build lives of freedom and purpose. Those who learn them late spend their remaining years managing the damage done and wondering what could have been.