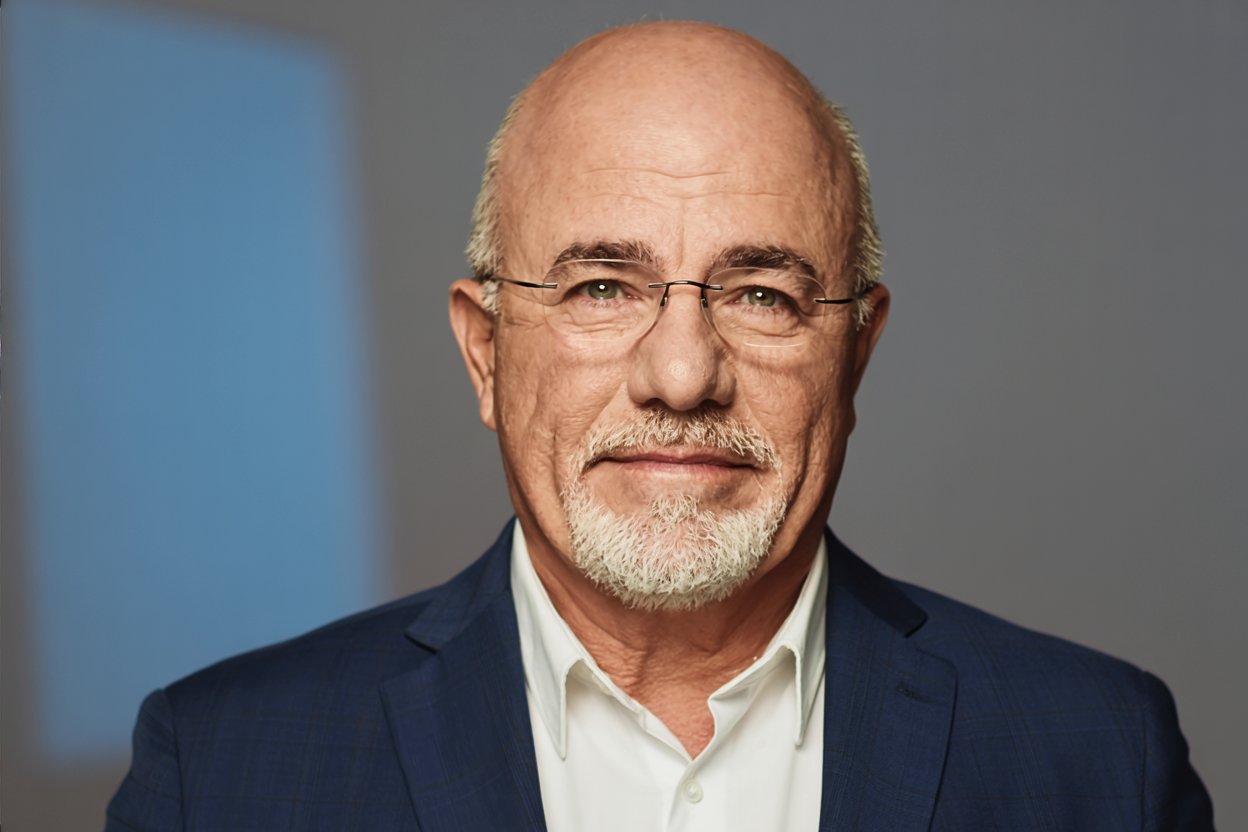

Dave Ramsey has spent decades teaching Americans how to build wealth, and his message is clear: the middle class stays middle class because they buy things that keep them broke. While most financial advice focuses on what to invest in, Ramsey’s teachings cut deeper by exposing what’s draining bank accounts in the first place.

These aren’t exotic purchases or rare mistakes. They’re everyday decisions that millions of Americans make without questioning whether they’re building wealth or destroying it. Here are five purchases Dave Ramsey consistently tells the middle class to stop making immediately.

1. New Cars (Especially With Loans)

“A new car loses 60% of its value in the first five years. You’re not getting a deal, you’re getting fleeced.” – Dave Ramsey.

Ramsey’s stance on new cars is absolute, and the reasoning is mathematical. The moment a new vehicle leaves the dealership, it begins depreciating at a rate that makes it one of the worst financial decisions the middle class makes repeatedly.

A $35,000 car financed over six years at typical interest rates means paying roughly $40,000 or more for an asset that will be worth $14,000 when the loan is paid off. The monthly payment alone, averaging $500 to $700 for many middle-class buyers, represents money that can’t be invested, saved, or used to eliminate other debts.

Ramsey teaches that this single decision keeps families locked into paycheck-to-paycheck living for years. His alternative is straightforward: buy reliable used cars with cash, drive them until they’re no longer reliable, and invest the difference.

A three-year-old vehicle offers most of the utility of a new one at half the price, with the steepest depreciation already absorbed by the first owner. The middle class treats car payments as inevitable, but Ramsey argues they’re optional expenses disguised as necessities.

2. Lottery Tickets

“The lottery is a tax on poor people and people who can’t do math.” – Dave Ramsey.

This habitual purchase represents hope marketed as entertainment, but the mathematics tell a different story. Americans spend billions annually on lottery tickets, with middle-class and lower-income households disproportionately contributing to these sales. Ramsey’s critique isn’t about the occasional $2 ticket; it’s about the systematic drain on resources that could be redirected toward building actual wealth.

The expected value of lottery tickets is profoundly damaging, meaning that every dollar spent is mathematically guaranteed to result in a loss over time. What makes this particularly destructive for the middle class is the opportunity cost. Money spent weekly on lottery tickets, if invested consistently over decades, compounds into substantial wealth.

Ramsey emphasizes that wealthy people don’t play the lottery because they understand probability and compound interest. The middle class plays because they’re sold a narrative about luck replacing strategy. His solution is direct: stop buying lottery tickets entirely and redirect even small amounts toward emergency funds, retirement accounts, or paying off debt. The path to wealth isn’t a matter of random chance; it’s the result of consistent behavior over time.

3. Too Much House

“Buying too much house can quickly turn your home into a liability instead of an asset.” – Dave Ramsey.

Ramsey’s guidance on housing challenges one of America’s most sacred financial assumptions: that bigger and more expensive houses represent success and wealth building. The reality is that oversized mortgages trap income in illiquid equity while raising every associated cost from property taxes to insurance to maintenance.

The middle class typically stretches to buy as much house as lenders will approve, often spending 30% to 40% of gross income on housing alone. This leaves minimal room for investing, building emergency funds, or handling unexpected expenses.

Ramsey’s specific prescription is a 15-year fixed-rate mortgage, where the payment represents no more than 25% of the borrower’s take-home pay. This approach ensures the house serves the family rather than enslaving them to decades of payments.

The cultural pressure to display success through housing keeps middle-class families financially fragile. A $400,000 house might feel like an achievement, but if it prevents saving $500 monthly for retirement or paying off $30,000 in student loans, it’s actually an anchor. Ramsey teaches that wealth isn’t displayed through square footage; it’s built through freed-up income that can compound over time.

4. Lifestyle Status Symbols

“We buy things we don’t need with money we don’t have to impress people we don’t like.” – Dave Ramsey.

This category encompasses designer clothing, luxury watches, high-end electronics upgraded annually, and any purchase driven more by image than utility. The middle class often mimics the consumption patterns of the wealthy without having the wealth to support it.

Ramsey’s teaching here cuts to behavioral psychology: these purchases provide temporary emotional satisfaction while delivering zero financial return. A $1,200 smartphone replaced every two years costs $7,200 over a decade, money that could compound to over $10,000 if invested instead. Designer handbags, luxury gym memberships, and premium cable packages all represent the same trap – trading long-term wealth for short-term status signaling.

Ramsey consistently argues that wealthy individuals build assets quietly, while the middle class displays its consumption loudly. His prescription is simple but culturally challenging: stop buying things to impress others and focus on building net worth instead of projecting success.

The middle class often justifies these purchases as “treating themselves” or “quality investments,” but Ramsey strips away these rationalizations by asking whether each purchase moves them closer to or further from financial independence.

5. Extended Warranties and “Peace-of-Mind” Products

“Extended warranties are extremely profitable for those selling them and a terrible deal for those buying them”. – Dave Ramsey.

Retailers push extended warranties on everything from appliances to electronics because they’re extraordinarily profitable, not because they benefit buyers. Ramsey teaches that these products prey on fear and mathematical ignorance. The companies selling warranties have calculated precisely how much they’ll pay out in claims versus how much they collect in premiums, and the spread is their profit margin.

For the middle class, these purchases represent a death by a thousand cuts – $50 here, $200 there, all adding up to thousands over a lifetime spent on products with a negative expected value. Ramsey’s alternative is building a proper emergency fund that serves as self-insurance.

Instead of paying warranty companies to cover potential future problems, middle-class families should save that money and cover repairs when they actually occur. The psychological shift from fear-based spending to self-reliance is a central tenet of Ramsey’s teachings.

Extended warranties seem responsible, but they’re actually expensive security blankets that companies sell because they know most won’t be used, and those that are will cost less than the premiums collected.

Conclusion

Dave Ramsey’s advice consistently reveals the same pattern: the middle class remains middle class by treating liabilities as everyday expenses and confusing consumption with wealth building. These five categories represent billions in annual spending that flows away from families and toward companies that profit from financial illiteracy.

The path forward isn’t complicated, but it requires rejecting cultural norms around cars, housing, status, and fear-based products. Ramsey teaches that wealth is built by buying appreciating assets, not depreciating liabilities dressed up as necessities. The middle class has the income to build substantial wealth, but only if they stop making purchases designed to keep them broke.