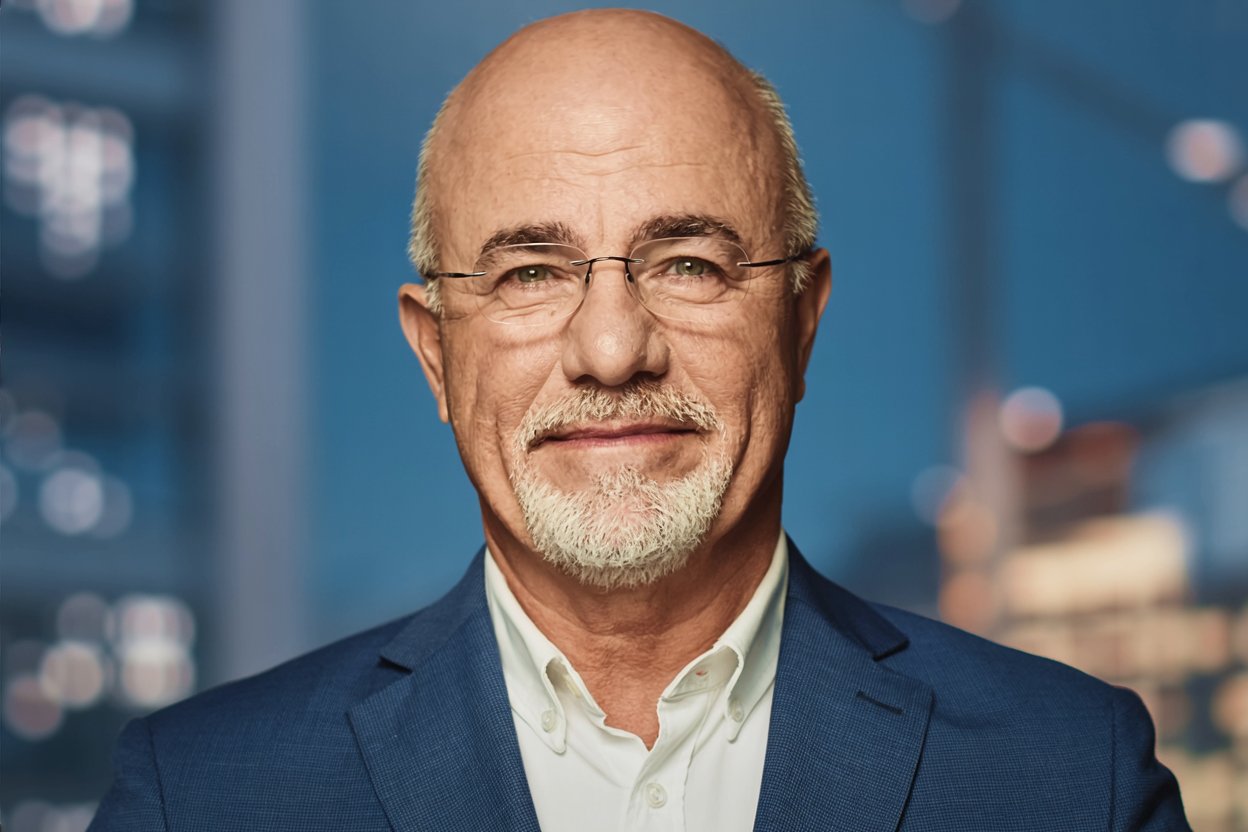

Dave Ramsey has spent decades teaching financial principles to millions of Americans, and his message consistently challenges the conventional wisdom of middle-class money management. While many people work hard and earn decent incomes, Ramsey notes that financial struggle remains a daily reality for many middle-class households.

His teachings identify specific behaviors and mindsets that keep people trapped in a cycle of living paycheck to paycheck, unable to build lasting wealth despite their efforts.

1. They Don’t Tell Their Money Where to Go

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey.

The foundation of Ramsey’s financial philosophy centers on the budget. People who don’t create a written budget before each month begins lose control of their money. Without a plan, income flows toward whatever demands attention loudest, whether that’s credit card bills, impulse purchases, or lifestyle expenses. The money disappears into daily spending without intentional direction toward wealth-building goals. Ramsey contrasts this with people who assign every dollar a specific job before the month starts.

2. They Give Their Income to Everyone Else

“You’re not broke because you don’t make enough. You’re broke because you give your income to everyone else.” – Dave Ramsey.

Middle-class earners often structure their financial lives around payments to creditors before paying themselves. Car payments, credit card minimums, student loans, and subscriptions consume income that could otherwise be used to build wealth. When your paycheck goes to everyone else first, you’re working primarily to enrich banks and lenders rather than securing your own future. This creates a treadmill where increased income means larger payments rather than actual financial progress.

3. They Finance Their Lifestyle With Debt

“Don’t buy things you can’t afford, with money you don’t have.” – Dave Ramsey

The middle-class approach to major purchases typically involves financing rather than saving. Cars, furniture, vacations, and even everyday expenses get charged to credit cards or financed through payment plans. This is a fundamental wealth killer because debt payments drain cash flow that could compound through saving and investing. Borrowing for lifestyle expenses means paying premium interest rates while delaying wealth accumulation.

4. They Choose Payments Over Cash

“The rich avoid payments. The middle class makes payments.” – Dave Ramsey.

Ramsey draws a sharp distinction between how the middle class and the wealthy handle purchases. Middle-class consumers calculate what they can afford based on monthly payments rather than actual prices. This mindset shift transforms expensive items into seemingly affordable monthly obligations, but the total cost balloons through interest and fees. The preference for payments over cash ensures that income stays committed to past purchases rather than future wealth.

5. They Don’t Live Below Their Means

“Act your wage.” – Dave Ramsey

Middle-class earners typically spend right up to their income level, upgrading their lifestyle as their paychecks grow. This leaves no margin for saving or investing, regardless of one’s income level. Wealth building requires spending significantly less than you earn, creating a gap that allows money to accumulate and compound. Without this gap, even high earners remain broke because outgo matches or exceeds income.

6. They Chase Status Instead of Financial Peace

Ramsey frequently addresses what he calls “middle-class fancy,” the tendency to pursue status symbols that create the appearance of wealth while actually preventing its accumulation. Nicer cars, bigger houses in prestigious neighborhoods, and lifestyle upgrades designed to impress others all come with payments that drain resources.

The pursuit of looking successful replaces the disciplined behaviors that actually create financial security. This status-seeking keeps people broke while maintaining an illusion of prosperity.

7. They Stay in Debt Rather Than Eliminating It

“There are no shortcuts when it comes to getting out of debt.” – Dave Ramsey.

The decision to remain comfortable with debt represents a fundamental divergence from wealth-building behavior. Middle-class thinking often accepts debt as a regular and permanent part of life, while Ramsey teaches that debt elimination is essential for financial progress.

As long as debt payments consume income, wealth building can’t truly begin. The compounding effect that could work in your favor through investing instead works against you through interest payments.

8. They Fail to Save and Invest Consistently

“Someone who never invests money will never have any.” – Dave Ramsey.

Even when middle-class earners manage to save money, they often fail to invest it for growth. Saving alone won’t create wealth because inflation erodes purchasing power over time. Money must work through investments to compound and grow. Middle-class habits of keeping savings in low-interest accounts or avoiding investment altogether ensure that wealth never accumulates beyond what can be manually saved from income.

9. They Lack the Necessary Financial Discipline and Mindset

Beyond specific behaviors, Ramsey identifies fundamental mindset differences that separate the middle class from wealth builders. Middle-class thinking prioritizes security through stable paychecks and avoiding risk, while wealth-building requires disciplined behavior and delayed gratification.

The focus on immediate comfort rather than long-term financial freedom keeps people trapped in patterns that feel safe but prevent progress. This mindset issue explains why people with identical incomes can have vastly different economic outcomes.

10. They Let Fear or Complacency Stop Them From Taking Control

Perhaps the most significant barrier Ramsey identifies is psychological rather than mathematical. Many people remain broke not because they don’t understand what to do, but because fear or hopelessness prevents them from taking action.

The prospect of changing long-established habits, confronting debt, or living differently than peers creates enough anxiety to maintain the status quo. Complacency about gradually improving circumstances replaces the urgency needed to make fundamental changes now.

Conclusion

Dave Ramsey’s analysis of why middle-class people stay broke points to controllable behaviors rather than external circumstances. The path he prescribes involves creating and adhering to a budget, eliminating debt, living within your means, paying cash instead of financing purchases, and consistently saving and investing.

These aren’t complex strategies requiring advanced financial knowledge, but they do require discipline and willingness to live differently from the surrounding culture. His teachings suggest that financial peace comes from controlling your own spending and saving behaviors rather than waiting for circumstances to change.