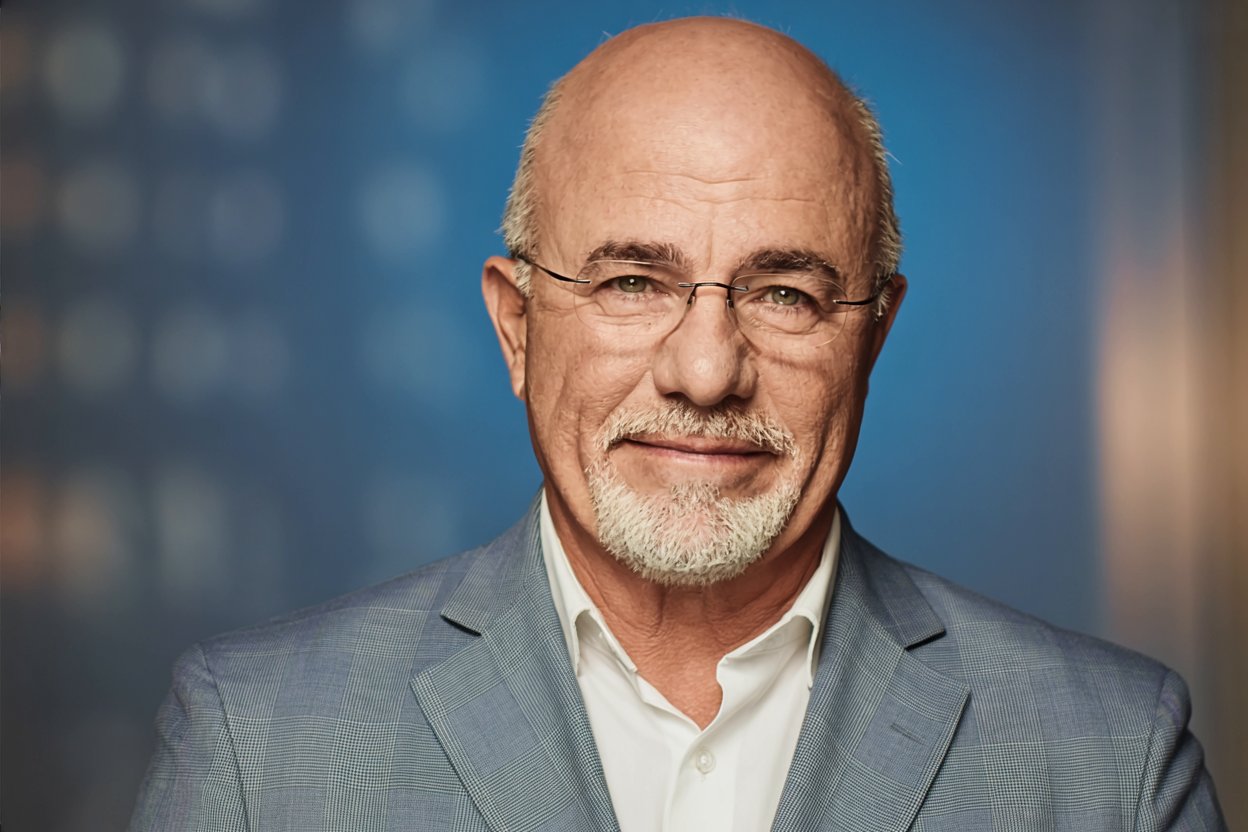

Dave Ramsey has built a financial empire teaching Americans how to escape debt and build wealth through disciplined spending. His core message remains simple yet powerful: wealthy people think differently about money. They don’t waste resources on depreciating assets, status symbols, or financial traps that keep the middle class stuck in perpetual debt cycles.

The self-made wealthy understand that building absolute financial independence requires saying no to purchases that drain cash flow and yes to investments that compound over time. Dave Ramsey’s teachings reveal a pattern among millionaires who refused to follow conventional consumer wisdom and instead chose patience, discipline, and intentionality with every dollar.

1. New Cars

“New cars are the biggest wealth killer in America.” – Dave Ramsey.

Self-made wealthy people refuse to absorb the massive depreciation hit that comes with driving a new vehicle off the lot. A new car loses up to 60% of its value in the first five years, making it one of the worst financial decisions an aspiring wealth builder can make. While neighbors finance brand new SUVs, self-made millionaires buy reliable used vehicles with cash.

The wealthy recognize that cars are a means of transportation, not status symbols. The thousands lost to depreciation in year one alone could have been invested in assets that appreciate.

2. Monthly Debt Payments

“If you can’t pay cash for it, you can’t afford it.” – Dave Ramsey.

Wealthy individuals don’t finance depreciating assets. Car payments represent one of the most normalized forms of middle-class financial traps, with the average monthly payment exceeding $700. That’s $8,400 in annual income that can’t be invested or saved. Financing a new car compounds the loss of money by adding interest to each payment on top of the depreciation.

Self-made millionaires understand that debt payments steal their most powerful wealth-building tool: income. They save cash and purchase vehicles outright, avoiding interest charges and maintaining complete control over their money.

3. Credit Card Interest

“The borrower is [servant] to the lender.” – Dave Ramsey

Self-made wealthy people don’t pay banks to use their own money. Credit card interest rates often exceed 20%, creating a cycle where minimum payments barely cover interest charges. The self-made wealthy recognize this trap and refuse to participate.

Millionaires understand that every dollar paid in interest is a dollar that can’t compound in investments. They prioritize eliminating consumer debt and building emergency funds to avoid the need for credit altogether. This discipline allows them to redirect hundreds or thousands of dollars each month toward wealth-building activities instead of enriching credit card companies.

4. Designer Brands & Status Symbols

“We buy things we don’t need with money we don’t have to impress people we don’t like.” – Dave Ramsey.

Wealthy people focus on net worth, not image. They wear affordable clothing, drive modest vehicles, and live in homes that don’t strain their budgets. Real millionaires often look nothing like the media portrays them.

Designer handbags, luxury watches, and premium brand clothing drain cash that could compound into absolute financial security. Self-made wealthy people couldn’t care less about impressing strangers with purchases that depreciate while legitimate investments appreciate quietly in the background.

5. Overpriced Homes

“A house is a blessing, not a burden.” – Dave Ramsey

Self-made millionaires refuse to become house poor. They don’t stretch their budgets to buy the maximum home banks will approve. Being house poor means having impressive square footage but no cash flow for investing, saving, or building wealth.

Smart home buyers purchase below their means, ensuring mortgage payments don’t exceed 25% of take-home pay. This leaves room for investing, enjoying life, and building emergency reserves. While neighbors leverage themselves into expensive properties, wealthy people live modestly and invest the difference.

6. Timeshares

“There’s no backing out, and there’s no way to sell the stupid thing because nobody wants to buy them.” – Dave Ramsey.

Wealthy people recognize timeshares as financial traps disguised as vacation solutions. These properties combine ongoing maintenance fees, zero resale value, and inflexible scheduling that locks buyers into decades of obligations.

The timeshare industry preys on emotional decisions made during high-pressure sales presentations. Wealthy individuals avoid these situations entirely, recognizing that vacation flexibility and financial freedom matter more than locking into property that can’t be sold and drains cash through endless fees.

7. Extended Warranties

“The only people who make money on warranties are the people who sell them.” – Dave Ramsey.

Self-made wealthy people self-insure with emergency funds rather than buying fear-based warranty products. Extended warranties rarely pay off for consumers but generate massive profits for retailers and manufacturers.

The wealthy allocate money toward fully funded emergency accounts that cover unexpected repairs without needing insurance company approval. They recognize that most products either work reliably or fail under the manufacturer’s warranty, making extended coverage unnecessary.

8. Eating Out Constantly

“You must tell your money where to go, or you’ll wonder where it went.” – Dave Ramsey.

Self-made wealthy people plan meals and track spending meticulously. Restaurant meals quietly destroy budgets through $15 lunches and $60 dinners that can easily add up to $500 a month or more. While eating out occasionally fits into the lives of aspiring millionaires, they don’t default to restaurants because planning feels inconvenient.

The difference between eating out constantly and meal planning can easily exceed $500 monthly. That’s $6,000 annually that middle-class earners send to restaurants, while people building wealth redirect it toward investments that compound into financial independence.

9. Lottery Tickets & Gambling

“Lottery is a tax on people who are bad at math.” – Dave Ramsey.

Wealthy people build fortunes through discipline, not luck. The lottery represents terrible odds disguised as affordable entertainment. Self-made millionaires understand that wealth results from consistent habits, intelligent investing, and patience, not from random chance or a virtual statistical impossibility.

The money spent on lottery tickets could compound into real wealth through basic investing. Wealthy individuals recognize that financial security comes from controlling what they can control: earning, saving, investing, and patience.

10. Latest Tech & Constant Upgrades

“Live like no one else, so later you can live like no one else.” – Dave Ramsey.

Self-made wealthy people delay gratification and avoid lifestyle inflation. They don’t upgrade phones annually or purchase the latest gadgets simply because new versions exist. Millionaires use technology until it stops working, not until something newer hits the market.

By resisting upgrade impulses, they maintain cash flow that compounds into financial independence while others chase the newest shiny objects.

Conclusion

Dave Ramsey’s wealth-building formula centers on behavior, not complex financial knowledge. Self-made millionaires live on less than they earn, avoid consumer debt, save aggressively, invest consistently, and exercise patience.

The wealthy don’t waste money on new cars, car payments, credit card interest, status symbols, overpriced homes, timeshares, extended warranties, constant restaurant meals, gambling, or endless tech upgrades.

They protect their cash flow and redirect it toward assets that appreciate. As Ramsey teaches, personal finance is 80% behavior and only 20% head knowledge. The self-made wealthy prove this truth through disciplined choices that prioritize long-term wealth over short-term gratification.