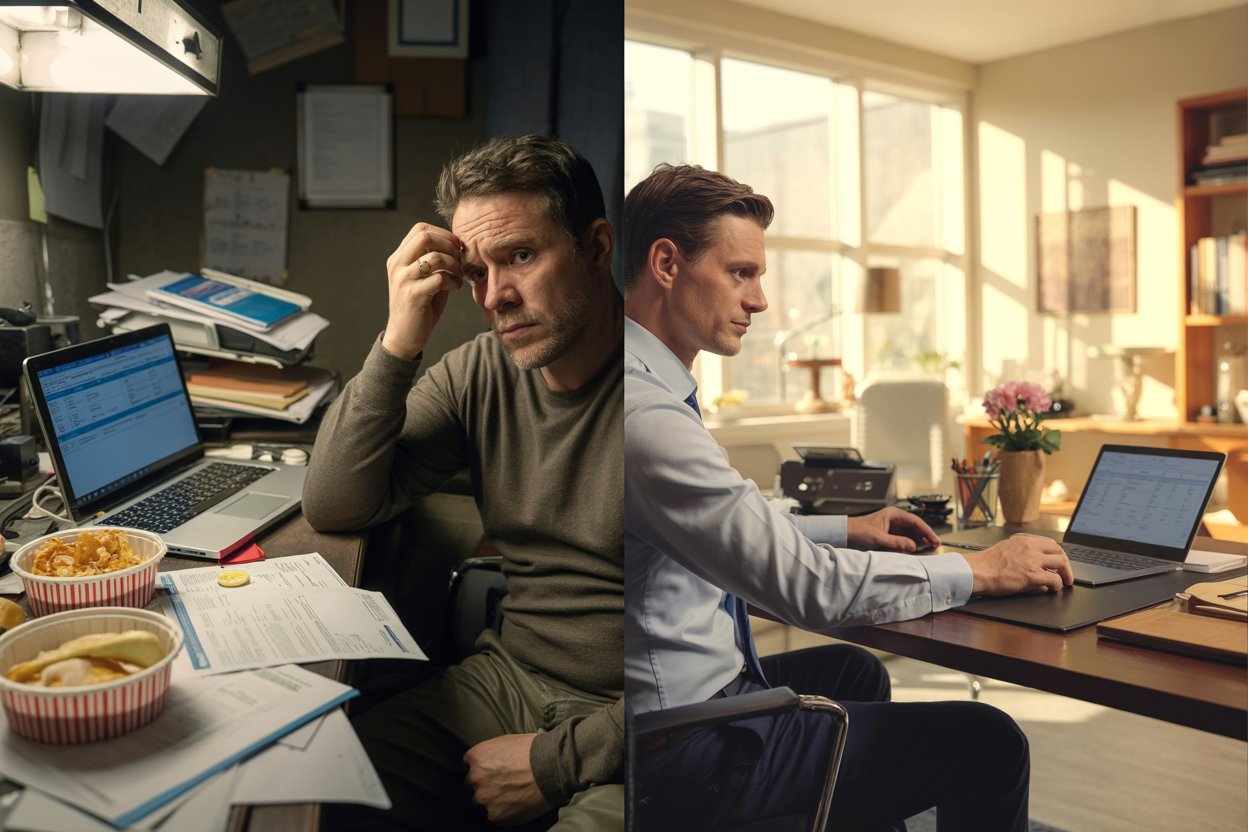

The difference between financial struggle and building wealth isn’t just about how much money you make. It’s about the daily decisions you make with that money. The behaviors keeping people broke are often invisible, passed down through generations, or reinforced by consumer culture.

Self-made wealthy individuals operate from a fundamentally different mindset. They’ve either learned or naturally developed habits that compound over time. These aren’t secrets locked away in exclusive clubs. They’re behavioral patterns you can study, understand, and implement starting today.

1. Living Paycheck to Paycheck vs. Building Cash Reserves

Broke individuals react to money as it comes in. When the paycheck hits, bills get paid, groceries get bought, and whatever remains gets spent. There’s no buffer, no breathing room, and no strategy.

Wealthy people prioritize building reserves first. They automate transfers to savings and investment accounts before money flows toward expenses. This creates a financial cushion that grows systematically.

Start with automatic transfers. Even a small percentage moved to savings immediately after each paycheck creates the foundation for financial stability. Track your spending for one month to discover leaks you didn’t know existed.

2. Spending More Than You Earn vs. Living Below Your Means

The broke mindset treats income as a ceiling to be reached through spending. Credit cards bridge the gap when expenses exceed earnings, creating a treadmill where you’re constantly running to keep up with obligations.

Wealthy individuals view their income as a boundary they never cross. They control expenses aggressively and track every dollar. This gap between earning and spending becomes the fuel for wealth building.

Create a zero-based budget where every dollar has a designated purpose. Review it weekly and cut expenses that don’t align with your long-term goals.

3. Accumulating Lifestyle Debt vs. Using Leverage Strategically

Broke people finance their lifestyle. They use credit cards for consumer goods, take out loans for depreciating vehicles, and borrow to maintain appearances. This debt creates monthly obligations that drain cash flow.

Wealthy individuals avoid consumer debt entirely or use leverage only for assets that appreciate or generate income. They understand the difference between debt that builds wealth and debt that destroys it.

Pay off high-interest consumer debt first. Stop using credit cards for purchases you can’t pay off immediately. If you must borrow, borrow only for assets that produce returns greater than the interest rate.

4. Seeking Immediate Gratification vs. Delaying Rewards

The broken behavior pattern prioritizes feeling good now over building something meaningful later. Small purchases add up. Impulsive decisions drain accounts with little consideration of future consequences.

Wealthy people delay gratification. They can see a desired purchase and choose to wait, redirecting that money toward investments that will generate returns. This doesn’t mean deprivation but strategic timing.

Before any non-essential purchase, implement a 48-hour waiting period. Write down your long-term financial goals and place them where you’ll see them daily.

5. Consuming Entertainment vs. Investing in Education

Broke individuals default to passive entertainment. Hours disappear into streaming services and scrolling on social media. This pattern keeps them in the same place financially and intellectually.

Wealthy people treat their minds as assets requiring continuous development. They read books that expand knowledge, take courses that build skills, and consume content that challenges their thinking.

Replace one hour of entertainment daily with learning. Read books about finance or skills relevant to your income potential. Take online courses that build marketable abilities.

6. Buying Status Symbols vs. Acquiring Income-Producing Assets

The broke mindset purchases items that signal status before establishing a financial foundation. Expensive cars, designer clothes, and luxury goods become priorities while investment accounts remain empty.

Wealthy individuals prioritize assets that generate income. They buy businesses, stocks, real estate, or develop skills that increase earning potential. Luxury items come later, purchased with returns from income-producing assets.

Delay luxury purchases until you’ve built a foundation of assets. Set specific financial milestones that must be reached before status purchases become options.

7. Blaming Circumstances vs. Taking Personal Responsibility

Broke people externalize their financial situation. The economy, their employer, their background, or their education becomes the reason they can’t get ahead. This mindset removes agency and prevents problem-solving.

Wealthy individuals focus on what they can control. They acknowledge external factors but don’t use them as excuses. They ask what actions they can take regardless of circumstances.

Reframe every problem as an actionable challenge. Instead of “I can’t save because my income is too low,” ask “What can I do to increase my income or reduce expenses?”

8. Avoiding Risk vs. Taking Calculated Chances

The broke mindset plays it safe. Fear of failure prevents experimentation. Opportunities pass by because the possibility of loss feels more significant than the potential for gain.

Wealthy people understand that calculated risk is essential for growth. They educate themselves, assess potential downsides, and take strategic bets.

Start with small calculated risks. Learn about potential opportunities before committing resources. Test ideas on a small scale before expanding.

9. Operating Without Goals vs. Setting Specific Targets

Broke individuals have vague aspirations but no concrete plans. They want “more money” or “financial freedom,” but don’t define what those terms mean or create a roadmap for achieving them.

Wealthy people set specific, measurable financial goals with deadlines. They break large objectives into quarterly milestones and track progress consistently.

Write your financial goals using specific numbers and deadlines. Create quarterly checkpoints. Review progress weekly and adjust strategies as needed.

10. Treating Time Casually vs. Valuing Every Hour

The broken behavior pattern treats time as abundant. Hours disappear into passive activities with no strategic purpose.

Wealthy individuals treat time as their scarcest asset. They track how they spend it, eliminate low-value activities, and focus energy on high-return tasks.

Track your time for one week. Identify activities producing no value toward your goals. Eliminate or reduce them. Redirect that time toward skills development or side income projects.

Conclusion

These behavioral differences aren’t about moral superiority. They’re about patterns that either build wealth or prevent it. The broken behaviors described here are often invisible to those practicing them, reinforced by culture and normalized by peers.

Change doesn’t require perfection. Pick three behaviors from this list that resonate most. Set one concrete action for each. Measure progress weekly. This focused approach creates momentum that spreads to other areas over time. The gap between broke and wealthy behavior is bridged one decision at a time.