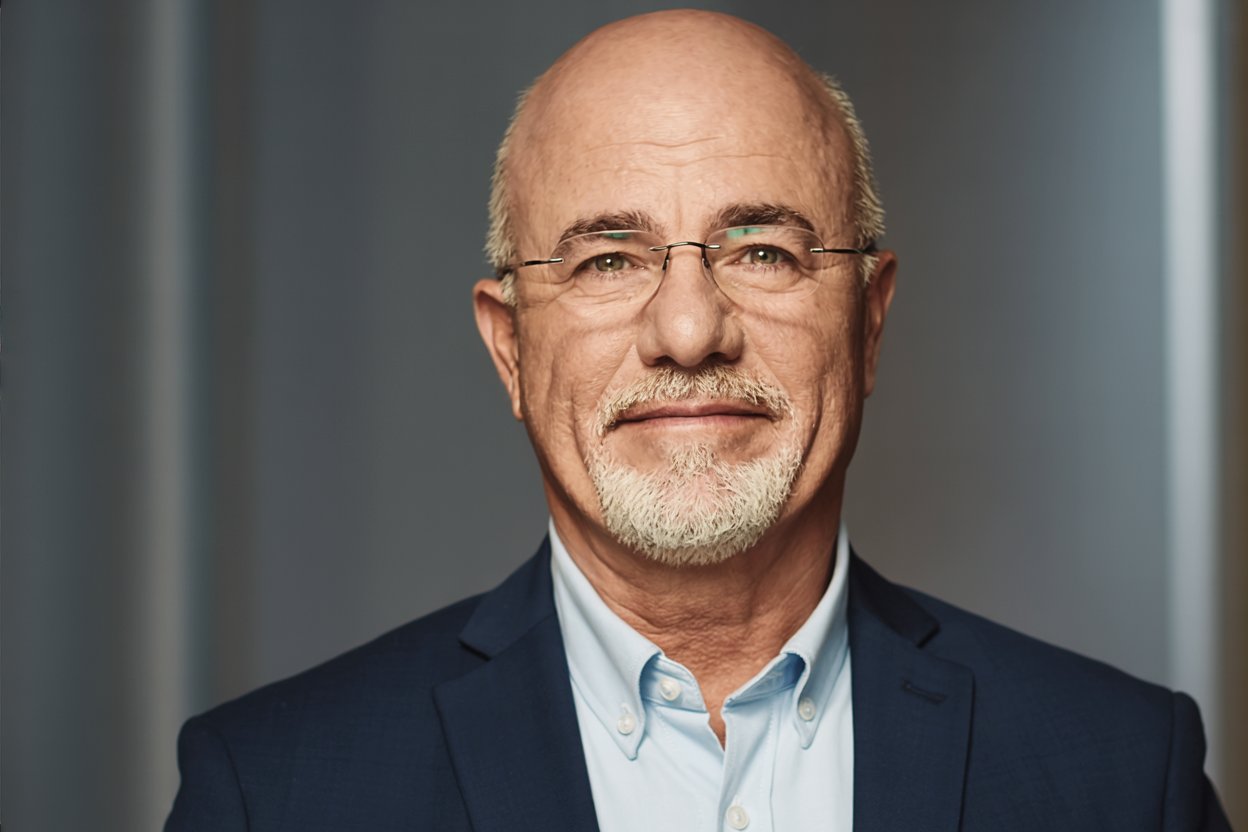

Dave Ramsey has spent decades teaching people how to escape the paycheck-to-paycheck trap. His message cuts through financial denial with surgical precision.

He identifies ten specific money drains that keep people broke, regardless of income. These aren’t minor inconveniences. They’re wealth destroyers that compound over time, turning temporary setbacks into permanent poverty.

Understanding these patterns isn’t about judgment. It’s about recognizing the gap between what struggling families spend on and what financially stable people avoid entirely.

1. Credit Card Interest

Ramsey built his entire philosophy around one core principle: debt steals your future income before you even earn it. When you’re living on tight earning versus spending margins, credit card interest functions as a tax on being poor.

The cycle works like this: emergency expenses are charged to credit, minimum payments consume income, and interest charges grow faster than principal reduction. What starts as a $500 balance becomes a multi-year sentence of paying banks instead of building stability.

His solution strips away complexity. Stop using credit cards entirely.

Switch to cash-only spending, attack existing debt with intensity, and redirect every dollar that would otherwise feed interest payments into an emergency fund instead.

2. Car Payments

Ramsey calls car payments the single most significant obstacle to wealth building in America. The average household spends hundreds of dollars each month on vehicle financing while claiming they can’t afford to save.

The math doesn’t lie. A $400 monthly car payment consumes $4,800 annually, money that could cover three months of rent, fund a significant emergency fund, or eliminate other debts.

Low-income families driving new cars aren’t displaying success. They’re displaying precisely why they remain poor.

Ramsey’s fix challenges this status quo: teaching followers to drive paid-for vehicles, even if they’re old and unglamorous. The goal isn’t appearance; it’s eliminating fixed costs that prevent financial breathing room.

3. Fast Food and Convenience Eating

This expense category reveals how small daily choices compound into massive monthly drains. A $12 lunch doesn’t feel significant. Five days weekly for a month equals $240, nearly $3,000 annually.

Ramsey identifies restaurant spending as one of the first budget leaks to address because it combines high frequency with complete discretion. Unlike rent or utilities, eating out is entirely under your control.

The alternative isn’t complicated. Meal planning, grocery shopping, and home cooking reduce food costs by 60-70% compared to restaurant spending.

This isn’t about deprivation. It’s about redirecting thousands of dollars from corporate restaurants into personal financial stability.

4. Lottery Tickets

Ramsey’s position on lottery tickets cuts to the psychological core of poverty spending: trading money for hope instead of investing it in actual progress—the lottery functions as a voluntary tax on people who can’t calculate probabilities.

Low-income families spending $50-$100 monthly on lottery tickets aren’t just wasting money. They’re revealing a belief that luck matters more than discipline, that sudden fortune beats incremental progress.

The fix requires confronting the uncomfortable truth. There is no magical rescue coming.

Every dollar spent on lottery tickets is a dollar not building real emergency savings, not reducing real debt, not creating real change in financial circumstances.

5. Gambling

Beyond lottery tickets, Ramsey identifies casino gambling and sports betting as wealth destroyers disguised as entertainment. The gambling industry profits specifically from people who can least afford to lose.

Casinos don’t build billion-dollar properties by letting customers win. They succeed by creating environments where poor judgment feels exciting, and losses feel recoverable with just one more bet.

The psychological trap is particularly vicious. Small wins create false confidence, losses trigger desperation betting, and the cycle continues until money runs out.

Ramsey’s approach eliminates the gray area: zero gambling, zero exceptions. Money flows only toward building stability, never toward feeding an industry designed to extract it.

6. Unaffordable Housing

Ramsey challenges the assumption that people deserve housing matching their aspirations rather than their income. When rent or mortgage payments consume 40%-50% of take-home pay, there’s no margin for emergencies, savings, or debt elimination.

The typical response claims cheaper housing doesn’t exist or isn’t safe. Ramsey pushes back: roommates, smaller houses, and less affluent neighborhoods exist.

The question isn’t comfort. It’s whether current housing costs make financial progress impossible.

His fix prioritizes function over form. Live below your means, even if it means temporarily sacrificing space, location, or privacy. High housing costs don’t just slow progress; they eliminate it.

7. Extended Warranties and Protection Plans

This category reveals how fear-based spending drains people who can’t afford actual insurance. Retailers profit from selling extended warranties because customers rarely use them enough to justify the cost.

Ramsey points to basic math: extended warranties exist because they’re profitable for sellers, which means they’re financial losers for buyers. The protection feels valuable, but it functions as an expensive piece of mind that rarely pays off.

The alternative requires different thinking. Build a small emergency fund instead of buying protection plans.

When repairs arise, cash covers them. When they don’t, you keep the money rather than forfeiting it to warranty companies designed to profit from your fear.

8. Impulse Purchases

Ramsey teaches that every purchase should be intentional, evaluated, and delayed. Impulse spending destroys struggling budgets by hijacking decision-making before rational thought engages.

The typical pattern: see item, want item, buy item, regret item. The purchase feels justified in the moment, but becomes unnecessary within days or weeks.

His solution introduces friction deliberately. Wait 24-48 hours before any non-essential purchase.

The delay allows emotional intensity to fade and rational evaluation to emerge. Most impulse purchases never happen once the waiting period interrupts the cycle.

9. Status Spending

Ramsey’s most quoted teaching addresses this directly: “People buy things they don’t need with money they don’t have to impress people they don’t like”. This pattern devastates low-income families more than any other because it prioritizes appearance over survival.

New phones, designer clothes, expensive sneakers: these purchases signal success while ensuring continued poverty. The irony is brutal: the very spending meant to project prosperity guarantees its absence.

The fix requires confronting social pressure completely. Ignore what neighbors drive, what coworkers wear, what social media celebrates.

Optimize every dollar for stability instead of status. The opinions of others can’t pay your bills or fund your emergencies.

10. Cigarettes and Alcohol

This final category combines health costs with financial drain. A pack-a-day smoking habit costs $2,500-3,000 annually. Regular alcohol consumption adds hundreds more.

Ramsey identifies these as discretionary expenses that people defend as necessities. The justification reveals the problem: addiction masquerading as choice, expense rationalized as relief.

The math can’t be argued. Money burned on cigarettes and alcohol is money not available for rent, food, debt, or savings.

The fix is elimination, not moderation. These expenses serve no financial purpose and actively harm both health and wealth simultaneously.

Conclusion

Ramsey’s frugal living principles work because they attack the real problem: behavioral patterns that convert income into waste before stability can develop. Each of these ten categories represents a choice, not a need.

The path from broke to stable doesn’t require a higher income. It requires stopping the leaks of current income on expenses that guarantee continued poverty. Cut these drains, redirect the money, and financial progress becomes inevitable rather than impossible.