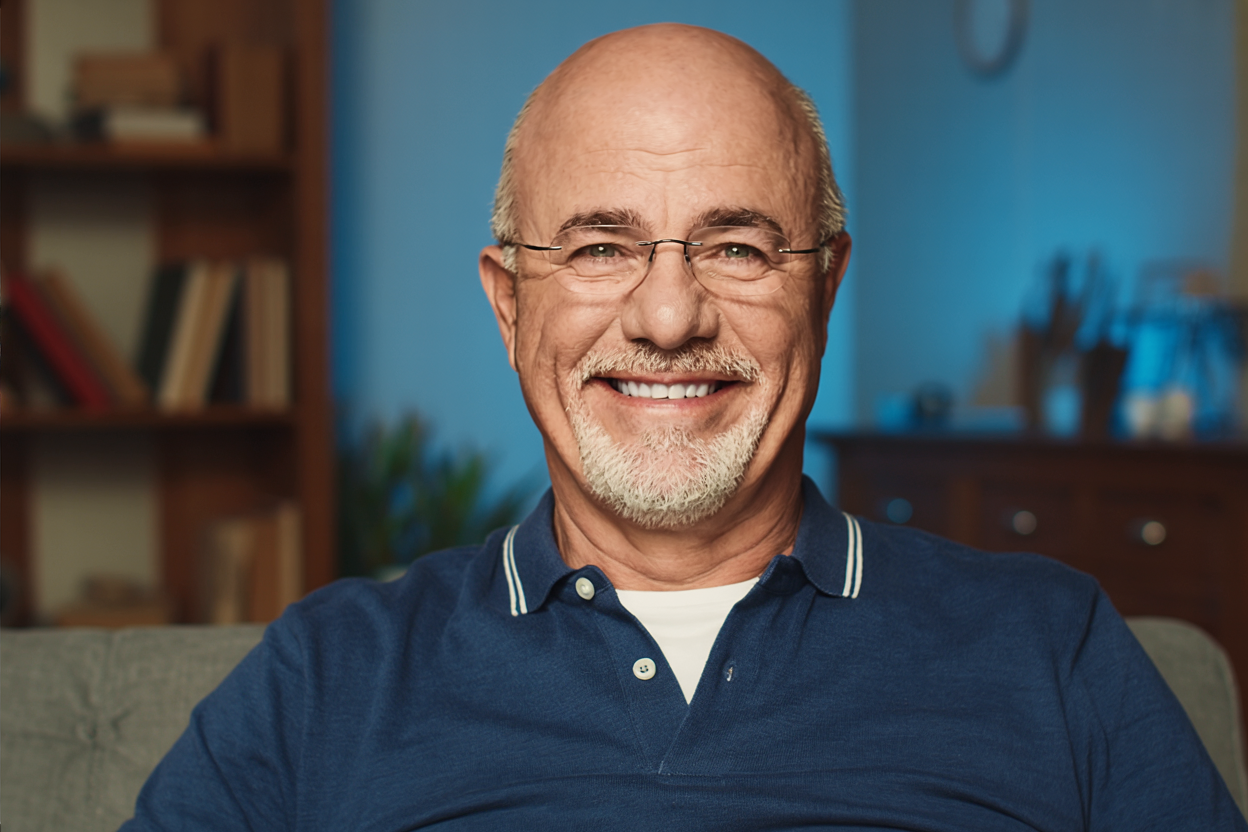

Dave Ramsey has spent over three decades teaching millions of people how to get out of debt, build wealth, and take control of their financial lives. Along the way, he has consistently pointed his audience toward books that shaped his own thinking and reinforced his core philosophy: personal finance is about behavior, not math.

What stands out about Ramsey’s recommendations is that they rarely focus on stock-picking strategies or advanced investment theory. Instead, they center on personal responsibility, discipline, and character. Here are the ten books he has recommended most frequently that he did not write himself.

1. The 7 Habits of Highly Effective People by Stephen R. Covey

This is one of the books Ramsey has referenced most often throughout his career. Covey’s framework for personal effectiveness is built around principles like being proactive, beginning with the end in mind, and putting first things first. These ideas align perfectly with Ramsey’s Baby Steps approach, which requires people to take ownership of their finances and follow a disciplined plan.

Ramsey often emphasizes that building wealth is less about knowing what to do and more about developing the habits actually to do it. Covey’s book provides the blueprint for that behavioral change.

2. Think and Grow Rich by Napoleon Hill

Napoleon Hill’s classic has been a fixture of Ramsey’s recommendations for years. The book focuses on the psychology of success and the belief systems that either propel people forward or hold them back. Hill argues that wealth begins in the mind long before it shows up in a bank account.

Ramsey frequently tells callers that broke is a temporary condition, but poor is a state of mind. Hill’s work reinforces that message by showing how desire, faith, and persistence are the fundamental foundations of financial success.

3. The Millionaire Next Door by Thomas J. Stanley and William Danko

This book gave Ramsey one of his most powerful teaching tools: proof that most millionaires are not flashy spenders but quiet, disciplined savers. Stanley and Danko’s research revealed that the typical American millionaire drives a used car, lives below their means, and invests consistently over time.

Ramsey frequently references these findings when confronting the myth that wealth requires a high income. The book supports his argument that anyone with a middle-class income can build significant wealth through patience and discipline.

4. The Richest Man in Babylon by George S. Clason

Written in the 1920s and set in ancient Babylon, this book delivers timeless money principles through parables. The lessons are simple: pay yourself first, avoid debt, and make your money work for you. Ramsey has long appreciated how it distills complex financial wisdom into stories anyone can understand.

The enduring appeal of Ramsey is that its advice hasn’t changed in nearly a century because it didn’t need to. The fundamentals of building wealth are the same whether you live in ancient Babylon or modern America.

5. The E-Myth Revisited by Michael E. Gerber

Ramsey recommends this book specifically for entrepreneurs and small-business owners. Gerber’s central argument is that most small businesses fail because their founders know how to do the work but don’t know how to build a business. The solution is learning to work on the business rather than just in it.

This resonates with Ramsey, who built his own company from the ground up after going broke. He understands firsthand that running a successful business requires systems, leadership, and strategic thinking.

6. Good to Great by Jim Collins

Jim Collins studied companies that leaped from average performance to sustained greatness. The book’s emphasis on disciplined people, thought, and action fits seamlessly with Ramsey’s worldview.

The idea that greatness comes from consistent execution over time rather than one dramatic breakthrough mirrors Ramsey’s approach to wealth building perfectly.

7. Boundaries by Henry Cloud and John Townsend

This book addresses something Ramsey constantly talks about: the connection between relationships and money. Cloud and Townsend explain how a lack of healthy boundaries leads to people-pleasing, enabling, and financial decisions driven by guilt rather than wisdom.

For Ramsey, money problems are almost always behavior problems, and behavior problems are often relational problems. This book gives people the tools to say no, set limits, and take responsibility for their own financial boundaries.

8. How to Win Friends and Influence People by Dale Carnegie

Ramsey has recommended Dale Carnegie’s classic for anyone looking to advance their career or improve their communication skills. The book teaches practical principles like listening, showing genuine interest, and making others feel valued.

Ramsey understands that earning more money is a critical part of wealth building, and your ability to connect with people directly impacts your earning potential. Carnegie’s principles give people an edge that pays real financial dividends.

9. QBQ! The Question Behind the Question by John G. Miller

This short but powerful book is about personal accountability. Miller’s premise is simple: instead of asking blame-shifting questions like “Why is this happening to me?”, you should ask ownership questions like “What can I do to improve this situation?”

This fits perfectly with Ramsey’s most fundamental belief. He consistently tells his audience that they are responsible for their own financial outcomes. Miller’s framework gives people a practical tool for shifting from a victim mindset to an ownership mindset.

10. Thou Shall Prosper by Rabbi Daniel Lapin

Rabbi Daniel Lapin’s book explores the moral and ethical dimensions of wealth creation from a faith-based perspective. Ramsey has cited it frequently because it addresses a question many of his listeners wrestle with: Is it morally acceptable to pursue wealth?

Lapin argues that creating wealth through honest enterprise is a moral good because it creates value for others. This aligns with Ramsey’s teaching that building wealth is not greedy when done with integrity and generosity.

Conclusion

The pattern across all ten of these books is unmistakable. Dave Ramsey does not point people toward technical finance manuals or market-timing strategies. Every book on this list deals with mindset, character, discipline, accountability, or relationships. That consistency over three decades tells you everything about what Ramsey believes actually builds wealth.

If you are looking to transform your financial life, these books provide the behavioral and psychological foundation for real change. The math of personal finance is not complicated. The hard part is becoming the kind of person who consistently makes wise financial decisions, and that is precisely what these ten books teach.