Gaps in prices can be one of the strongest indicators of momentum and while many are using gaps as an opportunity to get out of a winning trades many times it is a great entry signal and beginning of a strong trend in the direction of the gap. Gaps work best in growth stocks especially after earnings are reported when they go into an accumulation phase but also at times in indexes as well as equities as an asset class go under accumulation. A gap signals momentum and that nobody is even willing to make a trade in the hole that is created in the chart.

- Gaps can be bought at the open for a possible quick gain and good entry but there is still a possibility that the gap could collapse and those are violent but the odds are that the right leading stock will continue in the direction of the gap. Better odds are to wait for the gap to hold for the first hour of trading then make an entry, you may get a better entry on a pull back and avoid being caught if the gap fails and price collapses. I like to buy gaps at the end of the day for the highest probability that it is a gap and go and not a gap and crap.

- Gaps in high volatility do not tend to hold and trend as well as a gap out of a clean price base.

- A gap off a key moving average or that opens over a key moving average has a better chance of success than a random gap.

- A gap into all time highs is especially powerful with all holders now in a profit and tend to just let the profits run.

- Shorts caught in gaps can add fuel to the fire of the trend as they are forced to buy to cover.

- A great place to set a stop is just under the low of the gap up day, price should not breach that level if it is going to trend. Using and end of day stop gives you better odds of not being shaken out if it just dips there temporarily.

- After the low of the day holds and a trend begins over multiple days then the trailing stop could be moved to the 10 day sma and then the 5 day ema to lock in profits but allow the trend to continue in your favor. On a very volatile stock some your the 21 day ema or 20 day sma as a trailing stock to not be shaken out of a winner for me personally that is too far away.

- Also be aware that a momentum growth stock that gaps up does not have long term resistance just pauses and higher highs, also overbought indicators are worthless in momentum growth stocks under heavy accumulation by money managers. RSI extremes can go farther than believed.

- When caught on the wrong side of a gap against you it is best to just get out in the first 30 minutes, if the gap holds and makes higher highs after the first thirty minutes of the trading day it almost always just gets worse as the day goes on.

- Gaps have a way of leaving so many retail traders on the sidelines because they think that was the move and they don’t want to chase. Some of my biggest winners were me buying into gap ups with the right position sizing and letting my winner run.

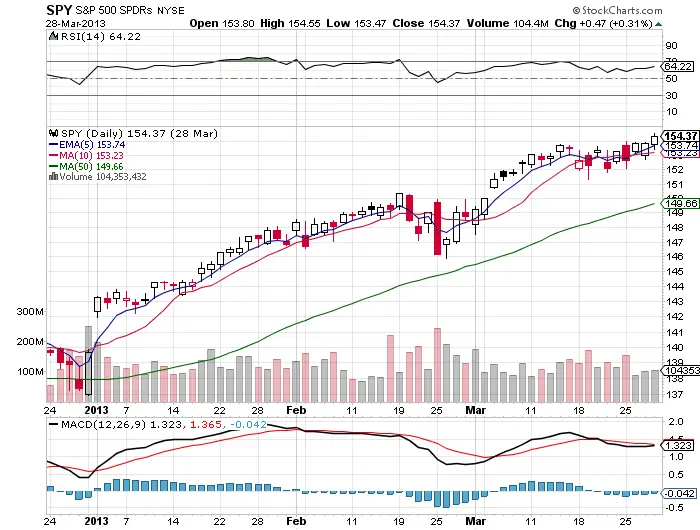

Here are four daily gap up charts I did trade successfully for profits some for big profits some for huge profits. I think it is a great exercise to look at the gap up day and see how it played out and how you would have played it for profits yourself.