How can an option trader enter into a position, risk only $500 of their total trading capital but control $50,000 worth if stock? The numbers will vary greatly depending on the option pricing factors of intrinsic value and the Greeks but the point here is that it is possible to control a large dollar value of shares with a small outlay of cash. You are paying for the opportunity to implement leverage using other peoples money. The seller of the option is selling the right to the buyer for the opportunity to force the seller to deliver shares of stock if the option goes in the money and it is called from or put on the seller at expiration. The buyer of the option is paying for this opportunity. The maximum risk of the option seller is to buy to close the option before expiration at a higher price than they opened the option at or to deliver or buy shares at the option strike price at expiration.

An option seller who sales a naked option with no hedge theoretically has unlimited risk exposure. Unhedged short options have blown up many option sellers over the past 40 years. A way to cap the risk on the short side of options is to buy a farther out strike option hedge for their short options or sell options against a stock position that they have like a covered call or a covered put. Option sellers can have very long term winning streaks in particular markets like selling put options in a bull market or hot stock over and over again until they feel like they have found the Holy Grail of trading. Then events like Black Monday on 1987 or the financial panic of the fall of 2008 happen and selling naked put options suddenly leads quickly to ruin. I highly recommend only selling options with a hedge in place so your worse case scenario is a manageable loss not your account going to zero.

Their is an option play called a credit spread where you sell option premium and also buy an option farther out of the money as a hedge for your short option. So if a stock is trading at say $97, you could sell a $100 strike call option at $3 and then go out and farther in strike price on the same time frame and buy a $105 strike call option for $1. This drops your profit potential from $300 to $200 in the option play but it caps your loss to $300 if the stock moves all the way to $105 instead of unlimited losses if it rocketed much higher. For this bearish credit spread to be profitable price just has to close below $102 at expiration or the short side of the option play be bought back for a profit before expiration. If the stock closes below $100 on the day of expiration then the option expires worthless and the trade will net you $200 in profits. Over $102 and the trade is a loser and could cost you up to $300 if the stock runs all the way to $105 then your long option hedge kicks in to cover you. If the stock plunges much lower and drops the short option value enough then it could be worth closing early to lock in profits. A big lesson for new option traders here is that an option can be traded at any time before expiration to be profitable you do not have to make a trade until expiration to make money on it. This is the play I believe is the safest way to sell option premium if that is what you are interested in doing. It is at times hard to exit the long option hedge side of your trade at times if your short side is profitable because the liquidity will dry up on options so far out of the money. Sometimes the hedge will be a full loss if your short side is profitable.

One concern about selling stocks short is that there is unlimited risk on the short side. If you buy a stock at $5 it can only go to zero and you lose your initial $5 per share but if you short a $5 stock it could go to $100 and you lose $95 a share. While this is an extreme example and traders should exit way before this happens penny stocks and biotech stocks can at times be very dangerous on the short side if you can even find shares to borrow and sell short. Buying put options solve two problems for stock traders that want to short a stock: you don’t have to worry about finding shares to borrow for a short sell you just have to make sure the put options are liquid for your timeframe and your loss is limited to the put option contract. If a stock gaps up against your put option then your risk is already defined and capped at the price of you contract. If your put option contract is less than 1% of your total trading capital then the damage and drawdown will be minimal to your trading career. Your option trading account will live to fight another day. Your long put options can also go up in value if the volatility of the underlying stock increases as the Vega value will increase. However Vega cuts both ways and your long put options can drop in value sharply during rallies as the VIX drops and Vega the value decays quickly with fear decreasing. A rising VIX and an expanding price range will drive up put option values so they can be more expensive to buy later in a downtrend. They will be scooped up as hedges for insurance on longer term positions by investors and money mangers. I do believe that put options is the safest way to sell stocks short to cap your risk during unexpected rallies.

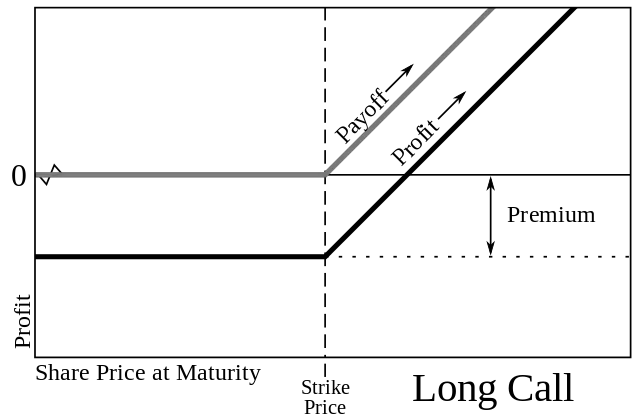

The power of owning options lie in their opportunity to both provide leverage to capital and also cap the risk exposure. For a relatively small amount of capital an option trader can control 100 shares of stock. By owning high Delta in-the-money options we can capture a large percentage of a price move but have a very limited risk exposure regardless of the size or speed of a move.

This is the power of asymmetric trading: unlimited upside with a limited downside. One key to managing risk in options is to not bet the majority of your capital on any one trade, trade options like stocks and only risk 1% of your total capital per trade. The biggest mistake that new option traders make is to trade way too big and their first loss or first string of losses take their account to zero. Many people are scared of options because they can be all or nothing trades, the key to managing that aspect of option trading is to trade with amounts that can be meaningful if you win but not be devastating if you lose. It is the big winning trades and winning streaks that can pay for many other small losses. The option seller has the risk in the underlying stock of the option but the buyer has the upside and the risk of the contract price. Options do not need stops because they have built in stops by their very nature. The power of leveraging other peoples money is powerful if used correctly.

Here are the quickest and easiest rules for managing your risk with option trading. This may save you a lot of pain and suffering if you are new to options.

Never lose more than 1% of your total trading capital on one option trade. If you have a $30,000 option trading account then you can only buy options at $300 or less per trade. This caps your worse case scenario loss at 1%, it would take 10 losing trades in a row for a 10% drawdown in total trading capital. It would be possible to buy a $600 option with a 50% stop loss but that is an arbitrary level to exit. The best stop losses for options would need to be based on key price levels on stock charts that invalidated your original entry. Like a stock losing its price support when you are long with a call option position. Trading longer out options can give you more leeway with stops because their Deltas are lower and you are trading primarily with slow moving Theta time decay.