This year one of the most profitable systems with the smoothest rides has been simply to buy and hold an equity index. Even the big cap S&P 500’s $SPY ETF is up almost 27% at this point. I am sure there are many new traders that were rewarded for simply being biased to the long side. Buying the indexes when they were falling knives always worked out if they held on to the trade and didn’t cut their losses. They bought new highs and were rewarded with more new highs. They traded too big on the long side and just made more money for taking on the risk. I am sure their are some young equity buy and holders that have only been in the markets since 2009 that are wondering why everyone just doesn’t buy and hold mutual funds because they perceive that they always go up. This year buy and hold has been in favor and they have even beaten many good traders in their annual returns but let’s keep this in perspective. The bulls that received their profits this year because of luck need to learn how to trade because trading profits that come from luck return to their rightful owners very quickly when the luck runs out.

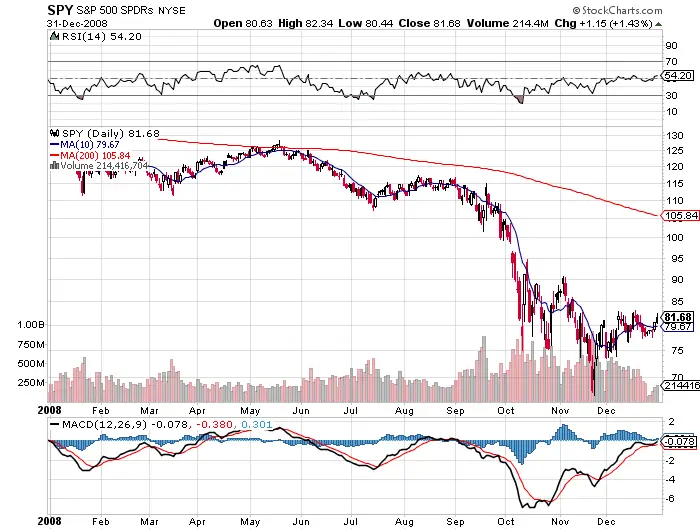

The dip buyers and perma-bulls of 2000-2002 and 2008 had a much different experience than the class of 2013.

The buy and holders that entered in 2000 and 2007 had much different experiences as well. The 2000 buy and holders had zero gains twelve years later in 2012. Buy and holders at the beginning of 2008 had to take a 50% draw down and stayed under water until 2012.