This is a guest blog post from Rolf at Tradeciety:

The victim-trader – is trading really unfair and rigged?

High frequency trading, rigged markets, unexpected news and insider trading makes profitable trading impossible for the regular trader. But is that really true, and is trading becoming harder and harder these days?

Trading isn’t becoming harder – it’s becoming different

Since the beginning of the financial markets, trading has undergone constant changes. A few decades ago, it wasn’t even possible to get a real-time quote, and all you could do was trade using data that was a few minutes old. Placing a trade could take hours. At that time, the people who were able to get price information a little earlier had a major advantage.

Then, a few privileged people had access to a quote machine and some could even place trades via telephone. Imagine the advantage over the other traders who didn’t have the benefit of fast execution and real time data!

With the invention of the computer, everything changed again and traders were able to place a trade by clicking a mouse. It was suddenly possible to monitor dozens of financial markets on your computer screen and watch how markets interacted with each other. As you can imagine, the advantage over the typical trader was huge.

Globalization, the connected nature of the financial markets, and technological advancements represent the next era in trading. Trading doesn’t become harder, it undergoes a natural transformation that is inevitable. The trader who fails to adapt will be left behind.

Volatility, the way price action forms, how trends and ranges behave, and how macroeconomic events shape the markets may change, but it is the nature of financial markets and they will continue to change.

“The markets are the same now as they were five to ten years ago because they keep changing – just like they did then.”

– Ed Seykota

The victim trader – how to set yourself up for failure

Traders who look for excuses and outside circumstances to blame are adopting a dangerous mindset. If you believe that you are engaging in an activity where manipulation takes place and that other participants are taking advantage of you, making the right trading decisions becomes impossible.

If you are constantly expecting to be cheated or that the traders on the other site of your position will win anyways, you can’t perform at your highest level.

Just pick any trading forum and you will see that the most commonly discussed topic is “trading without a stop loss” because traders are scared of stop hunting. These traders neglect the importance of position sizing and risk management because they fear that their broker spies on their stops. This is just one examples of the blaming-mindset that will set you up for trading failure.

Take responsibility for your actions

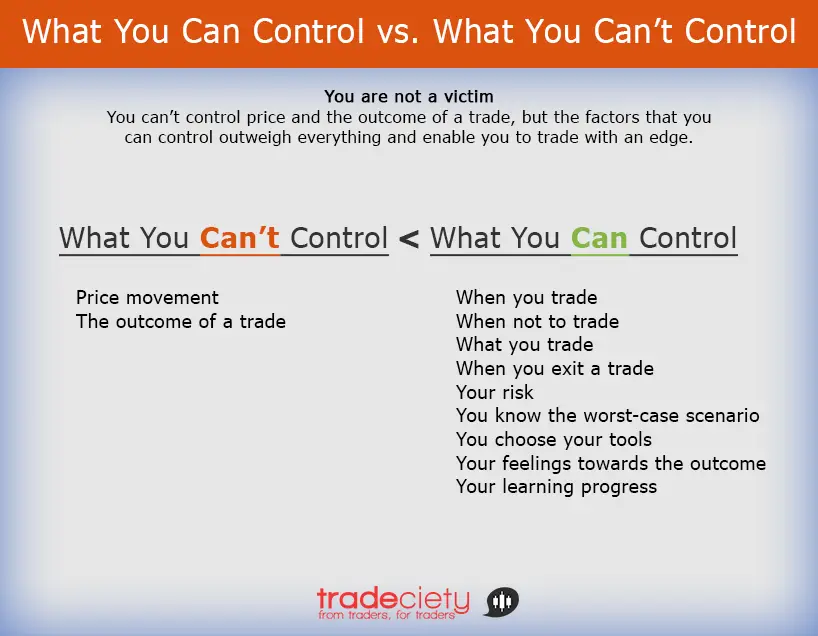

Only when you can accept responsibility for your actions and decisions, will you become a better and profitable trader. You always have complete control over your trading; you decide when to trade and when not to trade, you control your risk and the worst case scenario, you can exit unprofitable trades and limit losses, and you are the one responsible if you make an impulsive mistake. You are the only one who adds to losses, widens stops, or exits profitable trades too early.

If you operate with a victim-mindset, you are unable to take responsibility for your failures and you won’t see the necessity of looking for ways to improve. The victim trader just changes from one method to the next, hoping to get lucky and find something that works quickly. Only a responsible trader will look for patterns in their trading and find ways to turn failures into successes. A responsible trader doesn’t change systems, but looks for ways to make their current system work.

The following points describe the responsible trader:

- Focus on solutions and not on problems

- Stop blaming others and outside circumstances

- Focus on the things you can control

- Actively work on the things you can change

- Stop using excuses

- Understand that you can’t control the outcome

- Accept that your trading method will not work all the time

Read more of Rolf’s work at Tradeciety.com