This is a Guest Post by Dr. Arnout ter Schure on Twitter @intell_invest.

What is the VIX/VXV ratio telling us about the state of the stock markets?

The VIX:VXV ratio has been dropping from almost 1.05 in June to today’s low reading of 0.83. What does this ratio mean and why should we care? To answer the first question. Everybody knows the VIX. It is the volatility index, which measures one-month implied volatility. The VXV ratio, however, is lesser known and measures the 3-month implied volatility. It therefore tends to be less volatile than the VIX. The ratio between the two tells us if expected near term volatility exceeds longer term expected volatility and vice versa. Hence a high ratio (>1.25) means a high current volatility, but expected lower volatility 3 months out, whereas a low ratio (<0.80) means traders and investors expect very little to worry about now but a lot more 3 months out. These extreme high and low readings often coincide with bottoms and tops, respectively (see Figures 1 and 2 below).

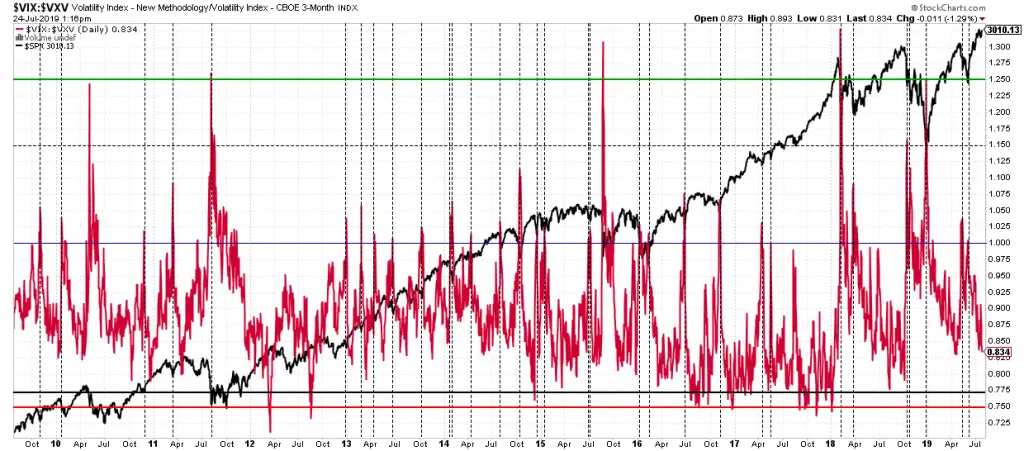

FIGURE 1: HIGH VIX:VXV ratio

High ratios identify bottoms more easily because bottoms are always a short-term affair: a bottom is put in on a day, followed by a spike higher over the next few trading sessions. So very high VIX/VXV ratios (>1.25) are easy additional information to confirm a meaningful bottom is being put into place.

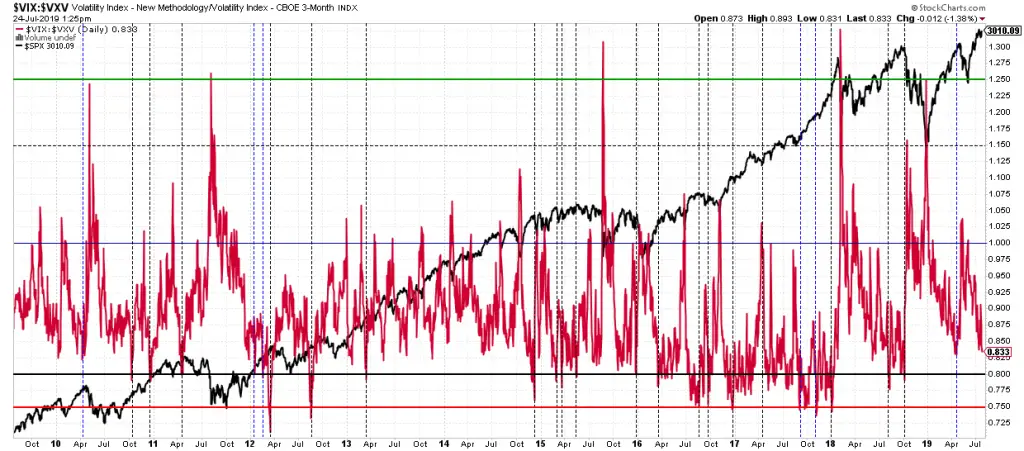

FIGURE 2: LOW VIX:VXV ratio

Tops on the other hand take time to develop and complacency can stay rampant much longer than you can stay rational or solvent. So low readings are not as reliable, but still very useful. Today’s low reading warrants further monitoring as it is getting close to the recent mid-April readings, and the market then topped within two weeks before dropping in May well-below the price it was printing back in April. Albeit price is now higher than in April, such corrections may warrant for many to either have protection in place, such as inverse ETFs (SPXU, SDS, SH), buy put options, etc. Or to simply move into a cash position.

Obviously, readings below 0.80 and especially VIX:VXV ratios below 0.75 are more indicative of a pending top than readings above these cut off levels. But, as the chart shows in 2016 through 2017 the ratio dipped below 0.80 and even below 0.75 frequently, while the markets simple kept rallying. Up until January 2018 that is. That was the last <0.75 reading and if you’d have ignored it the subsequent decline would likely have been very painful. Just like several others:

- March 2012: The market dropped within 4 days to below the price the VIX:VXV signal was given, then rallied to a marginal higher high the next few days, only to correct much more into the June 2012 low.

- August 2012: The market corrected the next 2 weeks to below the price at which the VIX:VXV signal was given, then rallied for new highs the following month, only to correct much more into the November 2012 low.

- August 2016: The market had topped and declined into its November low.

- December 2016: The market had topped, corrected into its late-December low and then rallied.

Hence, albeit a small “n” (but that’s simple because it’s a rare signal), all lead to corrections some of which much larger than most traders and investors can stomach and sit through as price eventually moves well-below levels from which the signal was given.

So as this ratio is approaching the 0.80 levels it is likely time to get a bit more cautious. But, as with everything else when analyzing the markets, please don’t use anything in isolation. Add this ratio to your toolbox, track it to see if the signals it is given align with other indicators, etc. In the end all your tools will help you assess what the next larger move in the markets most likely will be. It is rare all tools will align, so use a weight of the evidence approach.

Arnout ter Schure, Ph.D.

Founder and President Intelligent Investing, LLC