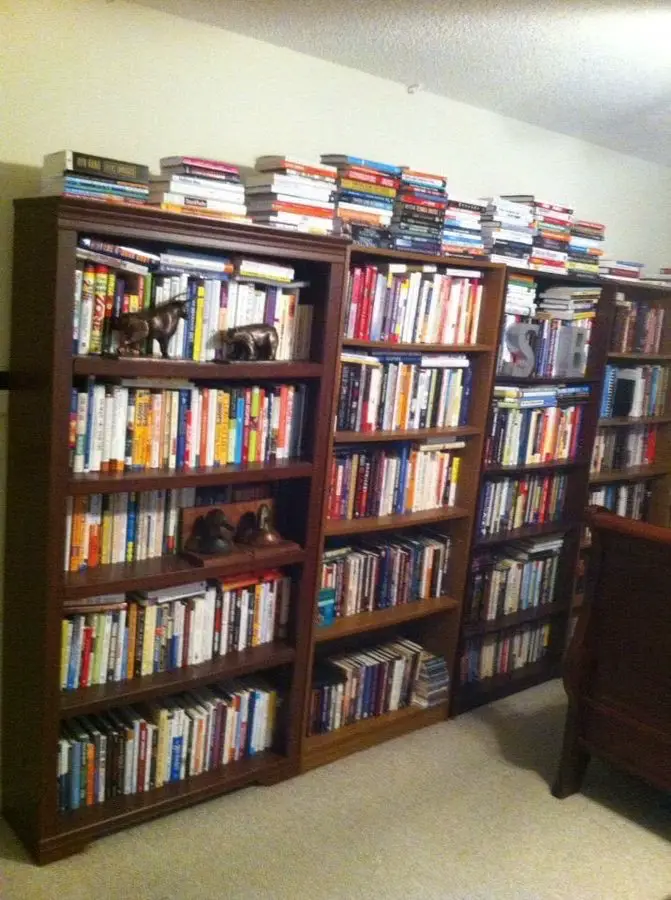

In the past 25+ years of being active in the financial markets I have been a big reader. As many people will sit and watch television, play video games or be on the internet for hours I have done the same thing with books. I love learning new things and gaining life changing information to put into effect in my life for self improvement. I have read over 1,000 nonfiction books with over 400 of those being about trading, investing, and personal finance. I have reviewed hundreds of these books on my Amazon Page since 2005.

What have I learned after spending over $5,000 on hundreds of trading books?

- In trading you must have the right mindset, the right risk managment, and a system with an edge to make money over the long term. If any one of these are missing you will not make it.

- It is possible to beat the market, the Trend Followers, the Market Wizards, and Warren Buffett have proven that beyond a doubt.

- Opinions, predictions, and beliefs are meaningless on the markets. You have to go in the path of least resistance and follow the trends.

- If you approach trading like a gambler you will never make long term profits, you have to trade from the perspective that you are a casino and you need to trade the probabilities and statistics and make money from the gamblers.

- To make money in the markets you need an edge, if you don’t know what an edge is or what yours is then you don’t have one.

- Position sizing determines the long term success of your trading system and is the primary metric that determines both the size of your returns and the risk of eventually blowing up your account.

- There are two types of trading books, one kind is written by content writers and are painfully boring and useless and the other is written by traders who have a passion for trading and studying the world’s best traders.

- 20% of trading is system development and 80% is being able to psychologically follow your own plan.

- If you find value in a trading book it will pay you back in mulitples of the cover price.

- Risk management can save you more money than any other lesson.

- The Amazon Kindle App is a great platform for storing all your trading books on your iPad. Much more efficient than having a physical library.

- If you have a trading author that helps you read all his books first before looking for another author you like.

- Focus on books that teach you exactly what you are trying to learn.

- Some of the best trading books are written by or about Market Wizards and Trend Followers.

- You don’t need to read hundreds of trading books to learn how to trade you only have to read the right ones. There are ten trading books that I see as the best and all you need and I also think the trading books I have published cut through all the noise for new traders and just tell you what I learned quickly with no fluff.

Here are the top ten trading books in my experience:

- Market Wizards: Interviews With Top Traders

- Trend Following: How to Make a Fortune in Bull, Bear, and Black Swan Markets

- The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade Management

- Trade Like a Casino: Find Your Edge, Manage Risk, and Win Like the House

- Trade Your Way to Financial Freedom

- How to Make Money in Stocks: A Winning System in Good Times and Bad

- The Universal Principles of Successful Trading: Essential Knowledge for All Traders in All Markets

- Reminiscences of a Stock Operator

- How I Made $2,000,000 in the Stock Market

- Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude

Here is a list of my books where I cut through all the fluff, stories, anecdotes, and just tell you what I learned on my own trading journey and from reading what everyone else has written:

- Investing Habits is the book to read if you just want to learn the basics of the stock market and investing to be able to participate in wealth creation through building up your own account through a taxable brokerage account or a 401K, 403B, or an IRA. I wrote this book for my friends and family who were interested in getting started in the stock market.

- So You Want To Be A Trader is a basic introduction of what being a trader is all about. It is a heads up on what to expect if you are thinking about actively our own account.

- New Trader 101 gives new traders a short cut to the principles needed for successful trading.

- Buy Signals, Sell Signals introduces the trader to reactive technical analysis using signals for trading in place of opinions, predictions, and emotions.

- Moving Averages 101 introduces the trader to using moving averages as signals for managing trades for discretionary trading.

- New Trader, Rich Trader explains the difference between new traders and rich traders in their trading principles in a narrative story.

- New Trader, Rich Trader 2 explains the difference between good trades and bad trades by explaining how to manage trades properly. This book explains the principles in a narrative sequel to the first book.

- Trading Habits explains 39 of the most powerful rules for trading the stock market.

- Calm Trader shows the reader how to trade the markets without losing their mind by managing their mind, emotions, ego and expectations.

- The Most Helpful Traders On Twitter gives the reader lessons from some of the best traders that share their methods and strategies online.

- 5 Moving Average Signals that Beat Buy and Hold shows examples of five moving average systems for trend trading the $SPY exchange traded fund that out performs just buy and hoping.

- Trading Tech Booms and Busts shows examples of seven moving average systems for trend trading the $QQQ exchange traded fund that out performs just buy and hoping.

- 50 Moving Average Signals That Beat Buy and Hold gives thorough quantified data for 50 moving average signals across diversified exchange traded funds over the past 17 plus years and multiple market environments that create profitable trading through multiple market environments.

- The Ultimate Trading Risk Managment Guide explains stop losses, proper postion sizing, and avoiding the risk of ruin along with diverisfication in signals and your watchlist.

- Options 101 is a short cut to learning the basics of trading option contracts to shorten the learning curve and lower the risk when beginning.