In trading as in life there are both risks and rewards to consider before you start any journey. You have to ask yourself are the risks of loss worth the possibility of the gains from the rewards. In trading your risk is created on entry by a combination of your position sizing and stop loss if you are wrong. Your reward is your best case scenario if your profit target is met or when you let your profit run with a trailing stop and a trend goes parabolic. However the bigger picture is how much money, time, and mental energy you risk by devoting it to trading instead of other endeavors. If you do the work, create a trading system with an edge and trade it with proper position size with discipline over the long term you have the opportunity to change your financial life. If you enter into trading without understanding the realities of how difficult it is and that losses are inevitable you are setting yourself up for an education in the markets.

In the big picture here are some of the possible rewards:

- Making money

- Learning a new skill

- Becoming a better person

- Compounding returns

- Feeling more confident

- Learning about and overcoming your weaknesses

- Creating more free time with your profits

- Paying off debt

- Becoming financially independent

- Becoming wealthy

In the big picture here are some of the possible risks if you don’t respect the dangers:

- Losing money

- Trading before learning how to.

- Bringing out the worst in yourself due to stress.

- Compounding losses through trading too big with no edge.

- Becoming arrogant after a losing streak and losing all your profits.

- Learning you were not meant to be a trader.

- Wasting your time trading only to lose money.

- Going into debt by using credit cards to fund your account then losing it or margin calls by trading too big.

- Going bankrupt by putting on open ended risk or trying to trade full time and being under funded.

- Going broke by not respecting the risk of ruin.

Trading can both lose or make you money depending on how you approach it.

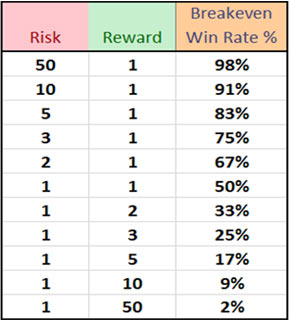

The first step to profitable trading is to manage for the risk of financial and mental ruin through proper management of position sizing and stop losses. Big draw downs don’t only destroy your financial capital and make it mathematically difficult to get back to even but can also cause a loss of nerve to keep going.

Trading is a professional endeavor like any other and requires an education in the fundamentals, the creativity to build your own system, and the discipline and perseverance to follow it over the long term to get to the reward.

Before you start any journey, first count the costs. The risk is the danger and the rewards are the positive possibilities.