4 Truths About Stop-Losses That Nobody Tells You

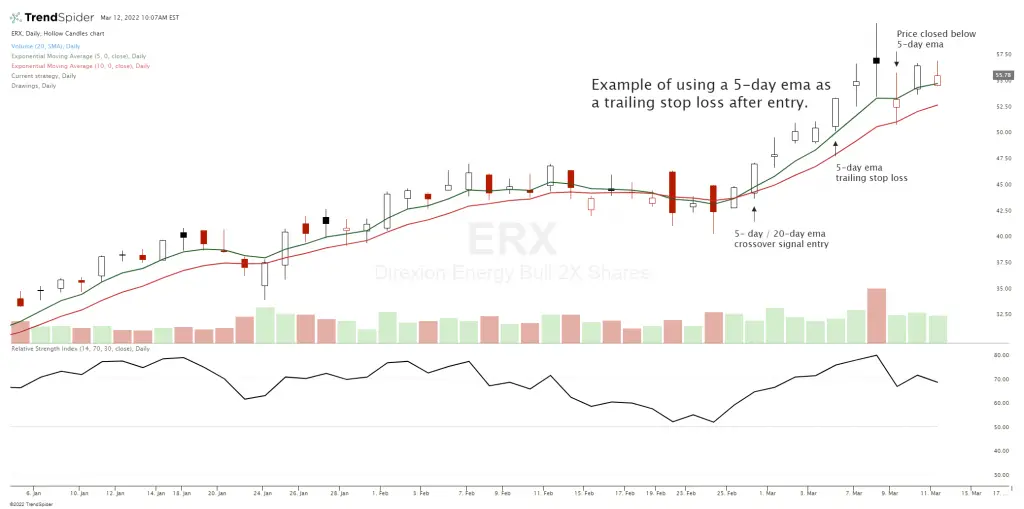

Trading professionals frequently employ stop-losses as a risk management method to reduce their losses on a given trade. The trade will automatically be exited when the market price hits the predetermined price threshold. A stop-loss prevents a minor loss from growing into a larger one and is universally acknowledged as a crucial component of any […]

4 Truths About Stop-Losses That Nobody Tells You Read More »