A trailing stop loss is a risk management tool for locking in profits on a winning trade.

While a trade may start out with a stop loss after the initial entry to exit if the trade does not go in the right direction but instead goes against the trader enough to show that a trade is likely not going to work out.

A stop loss is a way to manage a losing trade early on a trailing stop is way to manage a winning trade. The purpose of a stop loss is to keep a loss small while a trailing stop is a way to make a winning trade as big as possible.

An initial profit target on entry is one way to measure the risk/reward ratio on a trade when compared to the stop loss placement but a trailing stop can maximize a gain allowing a trend to run as far as it will go.

While a stop loss is set at the trade entry to cap a loss a trailing stop is moving to maximize a gain as a trade goes in your favor. A trailing stop is an exit strategy that triggers a stop when a price reverses back enough to signal the possibility that a trend is possibly coming to an end. The trailing stop is a moving target following a trade. Trailing stops ascend higher in uptrends and descend lower in downtrends following the trades movement.

A regular trailing stop is manually taken when price reverses under the price level or technical indicator used to signal the exit. A trailing stop limit order allows you to set a specific trigger price, this quantifies how much the price should move against the trade before an exit signal. A trailing stop limit order can set a specify percentage or a dollar amount to exit the trade. When your trailing stop limit order is triggered, the execution order for the trade will be a limit order. It will only execute if the price can be filled at the set price. A trailing stop limit can prevent bad fills on the exit and optimize for the best fill but it can also miss the exit altogether and cause bigger than expected losses by being stuck in a losing trade.

A trailing stop is a quantified strategy to keep a trader in a trend until the end when it starts to bend.

Here are some key strategies for trailing stops.

- A short term moving average can be used as a trailing stop in a swing trade. An exit is triggered when the price closes below the moving average used.

- A long term moving average could be used as a trailing stop in a trend trade. Exit when the price closes below the moving average used.

- Exit a winning trade when price closes below the previous day’s lowest price for short term trades.

- Exit a trade when price closes under a specific RSI reading like 30, 50, or 70 trailing up your stop as each level is overtaken on a chart.

- Exit a short term trade after a bearish candle forms like a bearish engulfing.

- Use a close below a previous price support level of a current trading range using a tiered box system.

- Use a lowest price in a set number of days as a trailing stop. For example enter on the highest price in 20 days and exit if it returns to the lowest price in 10 days.

- Exit if price retraces a percentage from its highest price point.

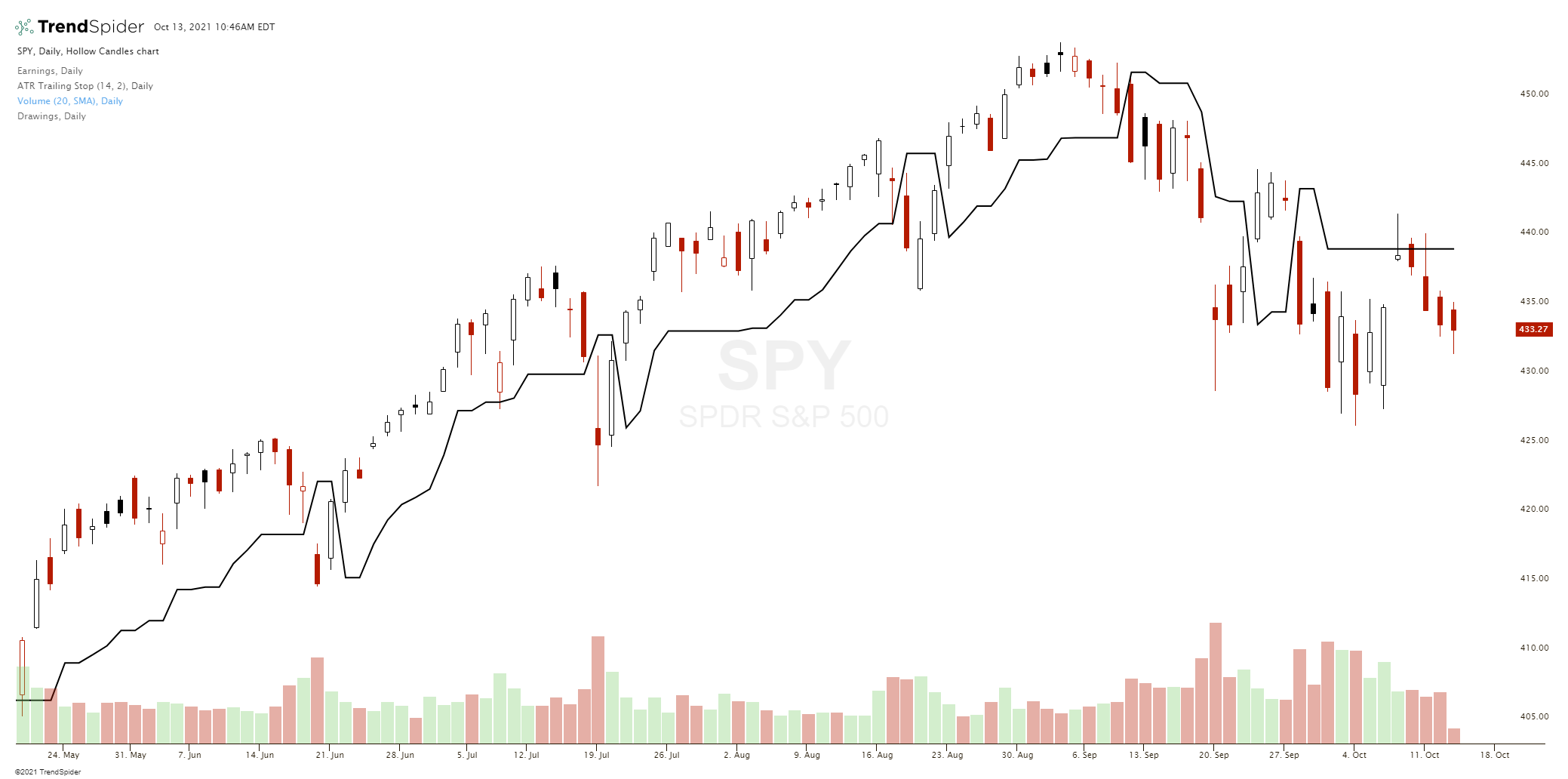

- Use an ATR multiple as trailing stop.

The below chart shows the 2-ATR multiple as a trailing stop line on the SPY ETF chart. Exits would happen as price falls below that line.