What is a trailing stop loss?

A trailing stop loss is a risk management tool for locking in profits on a winning trade. A trailing stop is a strategy that moves the exit point for a trade as price moves in the right direction to increase profits. A trailing stop loss is a quantified strategy to keep a trader in a trend until the end when it starts to bend.

Stop loss versus trailing stop

While a trade may start out with a stop loss after the initial entry to exit if the trade moves too far against the entry level to cap losses, a trailing stop is used for winning trades.

A stop loss is used on losing trades that fail to move in the right direction for a profit but instead goes low enough to show that a trade is not going to work. In contrast, a trailing stop is used for winning trades to let a winner run until it stops moving in the trader’s favor and begins to reverse.

While a stop loss is a way to manage a losing trade a trailing stop is way to manage a winning trade. The purpose of a stop loss is to keep a loss small while a trailing stop is a way to make a winning trade as big as possible. A trailing stop loss is a moving target following a trade. Trailing stops ascend higher in uptrends with long positions and descend lower in downtrends with short positions following the trades movement.

Trailing Stop Loss vs Trailing Stop Limit

A regular trailing stop is manually taken when price reverses through the price level or technical indicator used to signal the exit. A trailing stop limit order allows you to set a specific trigger price, this quantifies how much the price should move against the trade before an exit signal. A trailing stop limit order can set a specific percentage, dollar amount, price level, or indicator reading to exit the trade. When your trailing stop limit order is triggered, the execution order for the trade will be a limit order. It will only execute if the price can be filled at the set price. A trailing stop limit can prevent bad fills on the exit and optimize for the best fill but it can also miss the exit altogether and cause bigger than expected losses by being stuck in a losing trade.

Managing a winning trade

An initial profit target on entry is one way to measure the risk/reward ratio on a trade when compared to the stop loss placement but a trailing stop can maximize a gain allowing a trend to run as far as it will go.

While a stop loss is set to cap a loss a trailing stop is moving to maximize a gain. A trailing stop is an exit strategy that triggers an exit when a price reverses back enough to signal the possibility that a trend is possibly coming to an end.

A trailing stop is a quantified strategy to keep a trader in a trend until the end when it starts to bend.

How to set a trailing stop loss

Here are some key strategies for trailing stops with long positions.

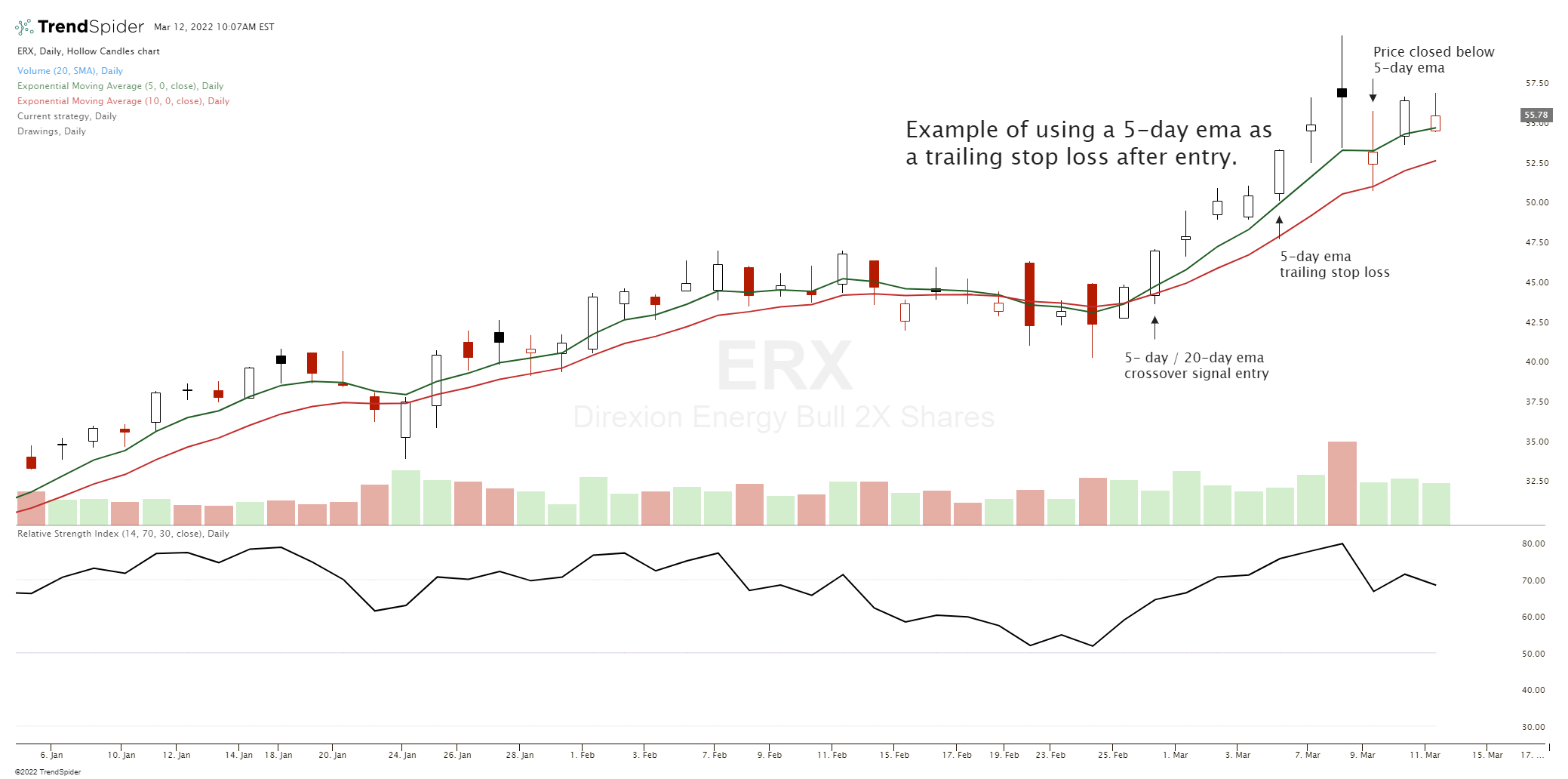

- Use a short term moving average as a trailing stop in a swing trade. Exit when the price closes below the chosen moving average.

- Use a long term moving average as a trailing stop in a trend trade. Exit when the price closes below the chosen moving average.

- Exit a winning trade when price closes below the previous day’s lowest price.

- Exit a trade when price closes under a specific RSI reading like 30 or 50.

- Exit after a bearish candle like a bearish engulfing.

- Use a close below a price support level of a current trading range.

- Exit on a close below the last gap up day low.

- Use a lowest price in a set number of days as a trailing stop. For example enter on the highest price in 10 days and exit if it returns to the lowest price in 5 days.

- Exit if price retraces a percentage from its highest price.

- Exit on a retracement of a percentage of a move in price.

- Use an ATR multiple as trailing stop.

- Use volume drying up as a trailing stop trigger.

Here are some key strategies for trailing stops with short positions.

- Use a short term moving average as a trailing stop in a swing trade. Exit when the price closes above the chosen moving average.

- Use a long term moving average as a trailing stop in a trend trade. Exit when the price closes above the chosen moving average.

- Exit a winning short trade when price closes above the previous day’s lowest price.

- Exit a trade when price closes over a specific RSI reading like 50 or 70.

- Exit after a bullish candle like a bullish engulfing.

- Use a close above a price resistance level of a current trading range.

- Exit on a close above the last gap down day high.

- Use a highest price in a set number of days as a trailing stop. For example enter on the lowest price in 10 days and exit if it returns to the highest price in 5 days.

- Exit if price retraces a percentage from its lowest price.

- Exit on a retracement of a percentage of a move in price.

- Use an ATR multiple as trailing stop.

- Use volume drying up as a trailing stop trigger.

These are different trailing stop loss strategies that can be used in different situations or in exiting tiers to manage the timing of locking in profits during a winning trade. Money is only made on the exit not the entry and managing a trade exit strategy for maximum profits is one of the most important skills a trader can use to be profitable. Creating large winning trades is one of the most important factors for profitable trading and trailing stops are the primary tool to achieve this with the opportunity is available.