3 best trailing stop loss strategy to ride any trend

This is a Guest Post by Abhi Raj of windows ground

In the journey to being a successful trader, one of the most important pieces of advice you’ll receive is “to start placing stop losses”, but do you wonder why you are not getting the desired profits after placing a stop-loss, even in a trending market? It’s because you are using a stop loss like the majority of traders and are not using a stop loss as a part of dynamic trade management.

So how can you use stop-loss smartly? Your initial stop loss must evolve into a dynamic trailing stop-loss as your trade turns profitable.

What is a trailing stop loss?

A trailing stop is a type of stop-loss order, where, as we start gaining profits in trading, we keep raising the stop loss level.

It is also known as a profit protecting stop because its job is to protect your profit from going back to zero.

The main difference between a regular stop loss and a trailing stop is that the trailing stop moves as the price moves.

For example:

For every five cents that the price moves, the trailing stop would also move five cents.

But when to trail a stop loss?

Before you even think about placing a trailing stop loss, you must know that a trailing stop loss can not be used everywhere.

A trailing stop loss strategy should be used only in a trending market. where the trend is clearly visible, either an uptrend or downtrend.

Example:

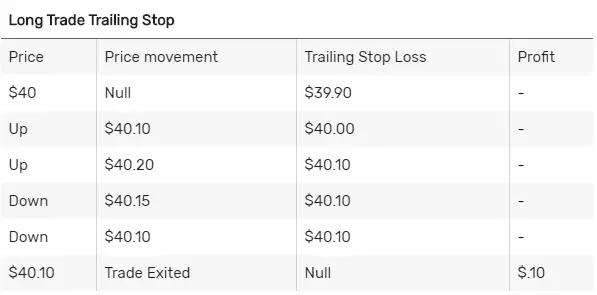

If a long day trade is entered at $40, a 10 cent trailing stop would be placed at $39.90. If the price then moved up to $40.10, the trailing stop would move to $40. At $40.20, the trailing stop would move to $40.10.

If the price then moved back down to $40.15, the trailing stop would stay at $40.10. If the price continued down and reached $40.10, the trailing stop would exit the trade at $40.10, having protected 10 cents of profit (per share).

Above example was taken from thebalance.com

So what are they? what are the…

3 best trailing stop loss strategy to ride any trend

These 3 trailing stop-loss strategies are ranked based on their risk level. The 20 moving average line trailing stop loss strategy is very risky compared to the first two as you risk more open profits for the chance of a bigger move.

You can try all three trailing stop loss strategies and see what suits you best.

- Two steps forward, one step backward trailing stop loss.

- The 8 moving average line trailing stop loss technique.

- The 20 moving average line trailing stop loss technique.

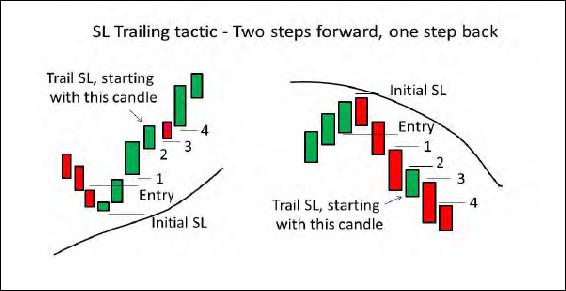

Two steps forward, one step backward trailing stop loss strategy

In this two steps forward, one step backward trailing stop loss strategy, we allow the price to move two candles forward in our favor from the entry-level and then we start trailing the stop loss, once we see two green candles in an uptrend or two red candles in a downtrend. including the entry candle.

“With every new candle that begins to form from the start of the third candle onward, we move the stop loss to below the low of the previous candle”

In short: there will always be a gap of one candle. If you use this stop loss technique then the market will keep you in as long as you’re in the trend, because your stop-loss is just one candle away from the current candle under formation.

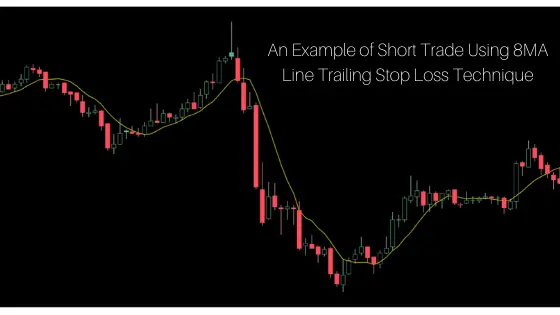

The 8 moving average line trailing stop loss technique

The next stop-loss strategy is the 8MA line trailing stop loss techniques, here 8MA means 8 days moving average

You probably know that in an uptrend a stock price almost always remains above their 20 moving average lines (20MA). But did you know that in a strong uptrend price is not only above their 20MA but also the 8MA as well? As we are going to use this 8MA line for our trailing stop loss.

This 8MA line will stay closer to the price action and will keep rising as the price moves higher.

When price action stays above the 8MA line, the momentum is said to be really strong since every pullback will immediately be absorbed by fresh buyers coming in.

Accordingly, all minor dips will be brought into in such cases and the up move will remain intact without any major correction.

In other words, you continue to hold your position so long as the candles keep closing above the 8MA line in an uptrend and below the 8MA line in a downtrend.

The 20MA line trailing stop loss technique

The last trailing stop loss strategy is the 20MA line trailing stop loss strategy.

This is the riskiest among all three because here we take the 20MA line as a trailing stop-loss instead of the 8MA. So the risk is in giving back more open profits but it gives the opportunity to catch a bigger trend in price for more profits.

This technique is suitable for those who are willing to take higher risks for the chance of higher rewards.

Last word:

All these techniques are good, it all depends upon the trader and their mentality. though I personally like the 8MA line trailing stop loss technique, because it’s easy to follow. and doesn’t require much risk.

Some of the key concepts of this article were taken from the book “How to Make Money in intraday trading”, which is a very nice book for new traders.

This was a guest post by Abhi Raj and you can follow him on LinkedIn and visit his website at WindowsGround.com.