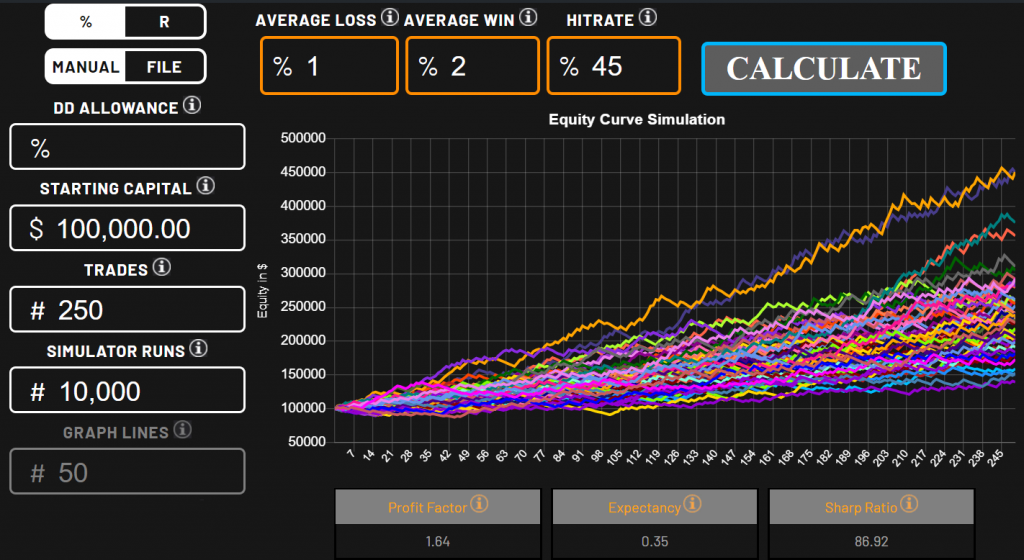

Calculated Risk

A calculated risk is taken when the probability and size of potential success is estimated along with the magnitude of a possible loss is considered before a decision is made involving the potential of failure. A calculated risk tries to determine if the risk is worth the reward based on the probabilities between success and […]