Life and business are inherently risky. Every day, whether you’re an individual or an institution, you risk suffering damage or financial loss. Nevertheless, not all hazards are the same. Prioritizing the risks you want to concentrate on is crucial since certain risks are more serious than others. You can achieve that with the use of a risk matrix. We’ll go through what a risk matrix is, how it functions, and how to utilize one efficiently in this blog post.

Using a risk matrix

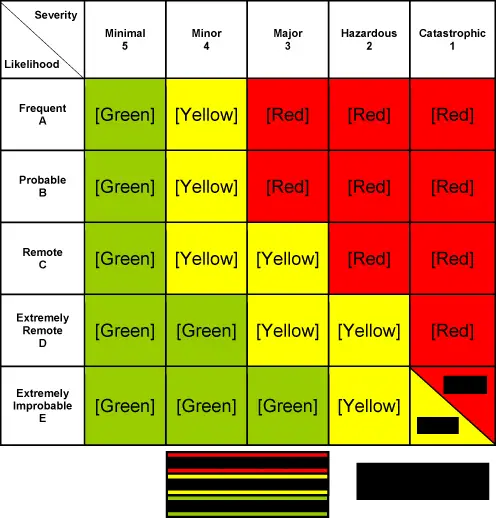

- A risk matrix is a chart used to evaluate the likelihood and consequences of potential risks.

- It helps identify and prioritize risks so they can be managed effectively.

- The matrix plots each risk according to its likelihood and impact, assigning it a color or symbol representing its severity.

- Accurate data should be used when determining the probability and consequence of each risk, as well as involving multiple stakeholders with diverse perspectives.

- A plan should then be created to manage those risks with high severity requiring procedures to be put in place. At the same time, medium-severity threats may need monitoring with response strategies in place if needed.

- The matrix must also form part of an ongoing risk management strategy which needs regular updating based on changing conditions or new threats arising over time

A chart used to evaluate the likelihood and consequences of prospective dangers is a risk matrix. It normally has two axes: one that gauges a risk’s likelihood of happening and another that gauges its potential effects. Typically, these axes are separated into predetermined categories, including low, middle, and high. The likelihood and impact of each risk are then shown on the matrix, and each risk is given a color or symbol to represent its severity.

A risk matrix’s objective is to assist in identifying and prioritizing risks so they may be properly managed for likelihood and how they are handled during occurrences. You may determine the most serious hazards by plotting them on the matrix according to likelihood and impact. This enables you to deploy resources in a way that focuses on the risks that are most likely to result in harm or loss.

When determining the possibility and impact of risks, it’s crucial to use a risk matrix successfully to be as exact and impartial as possible. This calls for using data and evidence whenever possible and the involvement of numerous stakeholders or professionals in a specific industry to obtain a diverse viewpoint.

The next stage is to create a plan to manage the risks after you have identified and plotted them on the matrix. Procedures may need to be implemented to prevent or reduce risks within the high-severity category. For instance, you might add smoke alarms and fire extinguishers if the risk is a possible fire hazard. If you are an investor, you may have an exit strategy for businesses that have a change in fundamentals. Traders use stop losses and position sizing to manage their total risk exposure and the risk of an adverse move against them.

The risk matrix can apply to all industries, investments, and businesses to quantify and understand the probabilities of risk events. It may be sufficient to monitor medium-severity threats and have a response strategy in place if they materialize.

It’s crucial to realize that a risk matrix should be used as a part of an ongoing risk management strategy and is not a one-time tool. The matrix should be updated to reflect changes as conditions change and new threats arise.

A risk matrix is a useful tool for identifying and prioritizing dangers so that risks may be properly managed. You may determine which hazards have the greatest likelihood and impact by placing them on a matrix and allocating resources accordingly. When determining the possibility and impact of risks, it’s critical to be as accurate and objective as possible. A risk matrix should also be part of an ongoing risk management strategy.

Steps for creating a risk matrix

- Define the scope of the project, trade, or investment.

- Identify the stakeholders, contractors, or employees involved in the project.

- Identify the risks associated with the project.

- Assess the likelihood of each risk occurring.

- Assess the impact of each risk if it were to occur.

- Determine the level of risk for each risk by multiplying the likelihood by the impact.

- Classify each risk as high, medium, or low based on its level of risk.

- Develop strategies for managing each of the risks.

- Monitor and review the risks throughout the project.

- Update the risk matrix table as needed throughout the project.

The risk matrix gives you a visual way to see both the likelihood and the magnitude of risks as they crossover in a confluence from the two columns on the chart. The higher the likelihood of an event, the more resources and effort must be made to minimize the occurrence’s damage. The higher the risk of an event, the more strategies must be put in place to prevent it from happening and safeguards to ensure that it’s not ruinous even if it occurs.

Risk management is the defense strategy for businesses, governments, investors, and traders. Understanding the probabilities and possibilities of negative events can determine success more than the right actions and systems. The risk of ruin can cause failure anytime if the worst-case scenarios are not anticipated and planned for.

Insurance, hedges, and exit strategies are some of the most popular tools for managing dangerous events inside the risk matrix. Systems, processes, and plans are the strategies most used for minimizing the impact of the most likely events in the risk matrix. Risk managers and risk management departments are some of the most underappreciated in the business world, as most people don’t understand their job is to ensure the survival of an institution by understanding the odds and impact of negative events.

The risk management matrix is a tool for customizing your risk so you can manage it properly. This can be the most important thing you to for your success.