The Head and Shoulders Chart Pattern is one of the most popular and bearish patterns in technical analysis. It defines three attempts to make highs and then trend but fail, it precedes many major corrections and bear markets.

Chart Facts:

- The Head and Shoulders chart pattern is a reversal pattern of an uptrend. The pattern is formed during a bull market and the completion of this pattern is bearish and is usually a set up for a pullback, correction, or bear market. A previous uptrend must be in place before this pattern can be considered valid.

- This pattern consists of three peaks with the middle higher peak creating the ‘head’ and each smaller peak is a ‘shoulder’. The low of support that creates the valleys between the peaks is used to create the horizontal support which is the ‘neckline’.

- The break of the neckline support to the downside is the signal line to sell or sell short.

- The left shoulder is created during the first swing up in the uptrend. Price then pulls back to support on the down swing.

- The next up swing in price goes higher than the left shoulder and breaks out to a new higher high but eventually swings back down to near the previous support low price.

- The third swing up in price is lower than the middle peak that is the head and similar in size to the first high in price that is the left shoulder. Price then swings back lower for the third time near the previous two areas of support.

- The three swing backs to low price support should be similar to create a horizontal support line that is the neckline in this pattern. This line can be very flat or trend up or down. A neckline that is trending down is another indicator of the end of the uptrend.

- This pattern should see declining volume to the upside of the head and shoulders and increasing volume as it swings lower after each peak to give additional signs of distribution.

- The Head and Shoulders pattern is not confirmed until the neckline of the pattern is broken. Many times the old support at the neckline becomes the new resistance as price tries to rally back up after the break down. Increasing volume on the break below the neckline is more confirmation of the potential for a down trend.

- The magnitude of the move down can many times be the same magnitude as the distance from the neckline to the top of the head in the Head and Shoulders pattern.

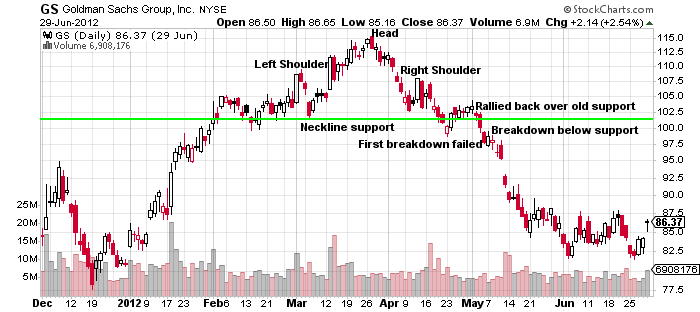

The below $GS chart shows a Head and Shoulders pattern that was very fast to play out. The left and right shoulders are smaller than the head and similar in size. The neckline support is measured from left to right at the first low after the left shoulder. Additional signs of a reversal were in the volume with down volume being greater than the upside volume and large bearish candlesticks after each peak in price. Price did not initially breakdown near the $105 neckline but rallied back above before finally breaking down. A close below the neckline was the sell short signal in this pattern with a stop loss back over this line. Notice that the move from the neckline of $105 to the peak of the head at $119 move was $14 and the move from the neckline at $105 to the bottom of the downtrend at $84 was $21 and similar in magnitude. Sometimes it takes multiple entries before catching the down move, patience pays.

Chart Summary: This pattern is created at the end of a bull market when the market exhausts buyers and each of three highs in price is met with selling pressure through profit taking. The head of the pattern generally creates a market top. The support line of the neck is where buyers step with volume to rally price up on sellers two times but not the third. The pattern can be irregular in sizes and shapes; the key is seeing the three peaks with the middle higher than the other two that are similar in size and the middle line of support close to each pullback.

Chart patterns are tools to define high probability entries and exits by going in the path of least resistance and managing risk.