W Pattern in Trading

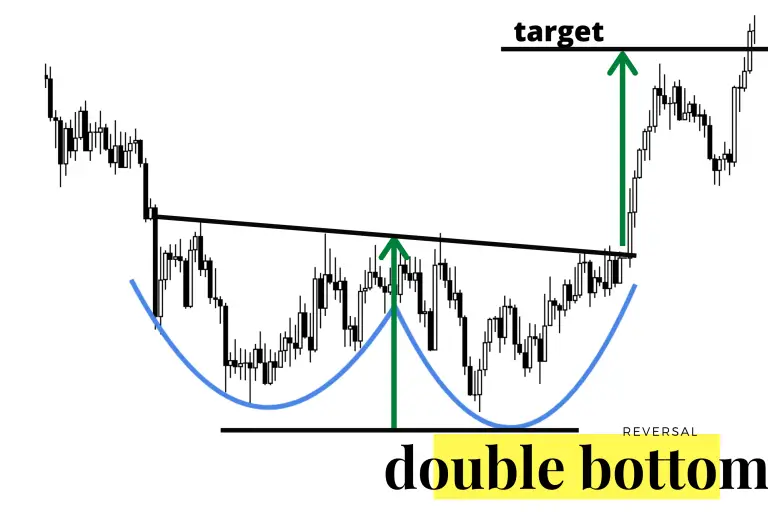

A W pattern is a double-bottom chart pattern that has multiple swings both up and down in price that create the shape of the letter “W” on a chart of price action. This pattern usually has a strong downtrend before creating the W and then a strong uptrend on the chart after the W is fully […]

W Pattern in Trading Read More »