A Rising Wedge is a bearish chart pattern that forms during a downtrend in price action that has upward trend lines. A Falling Wedge is a bullish chart pattern that forms during an uptrend in price action with downward trend lines. Wedge patterns can be continuation or reversal patterns depending on which way they breakout. A wedge pattern generally forms and moves in the opposite direction of the longer term trend on a chart and shows a short term reversal that usually fails and the previous trend resumes.

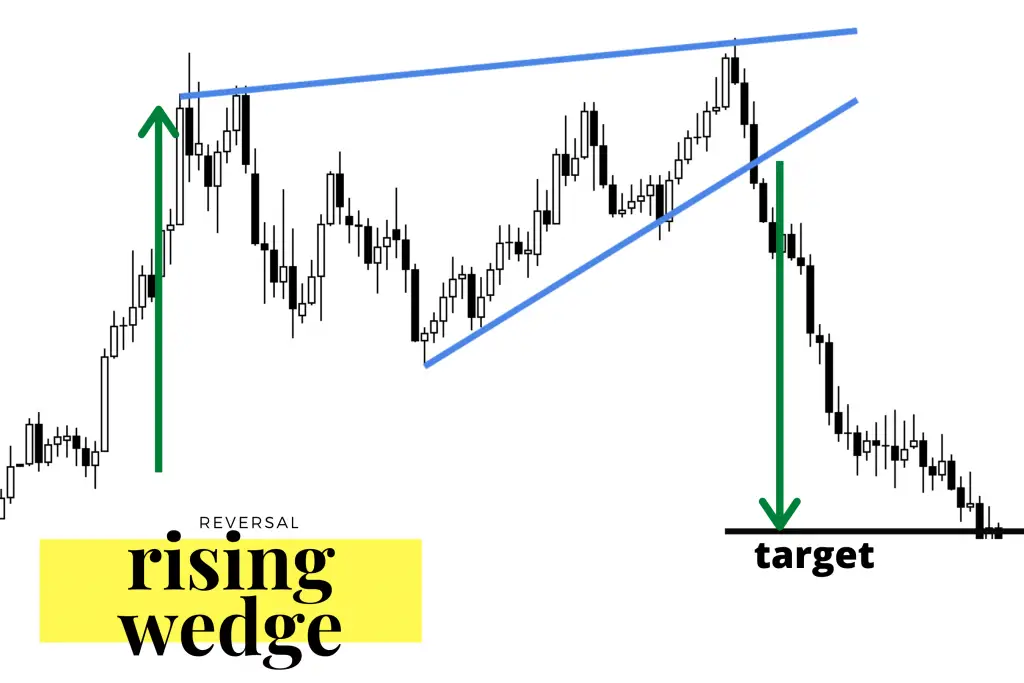

Rising Wedge Pattern

The rising wedge chart pattern can fit in the continuation or reversal category. When it’s a continuation pattern it will trend up, however the slope in the wedge will be against the overall market downtrend.

- The rising wedge is a bearish pattern regardless of what kind of market it appears in.

- The rising wedge is a bearish chart pattern that begins with a wide trading range at the bottom and contracts to a smaller trading range as prices trend up.

- This price action forms an ascending cone shape that trends higher as the vertical highs and vertical lows move together to converge.

- The bearish bias in this pattern can’t be signaled until a breakdown of the ascending support to show this is a reversal pattern from highs in price.

- This is a longer term pattern that generally forms over a one to six month timeframe.

- The new highs set in this pattern create higher highs, but the new highs should become less in magnitude. Less strength in highs indicate a decrease in the strength of buying pressure and should create an upper trend line of resistance with less ascending slope than the lower line of support.

When it’s a reversal pattern, the rising wedge trends up when the overall market is in a downtrend.

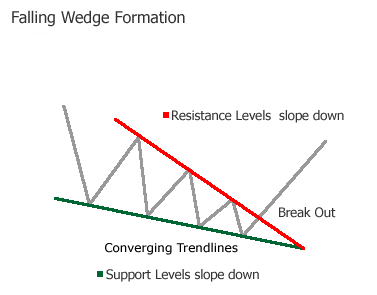

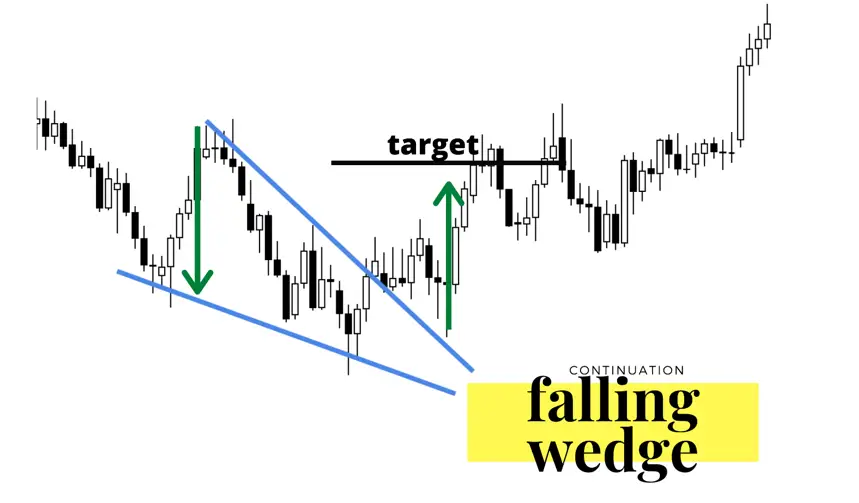

Falling Wedge Pattern

Images created by ColibriTrader.com

- The bullish wedge pattern shows price action falling in a downswing but breaks its descending upper resistance trend line to reverse higher into an uptrend.

- The falling wedge pattern can fit in the continuation or reversal category. When it is a continuation pattern it will trend down, however the slope in the wedge will be against the overall market uptrend. When it is a reversal pattern, the falling wedge trends down when the overall market is in a downtrend but breaks to the upside.

- The falling wedge has the potential to turn into a bullish pattern regardless of what kind of market it occurs in.

- The falling wedge is a bullish chart pattern that begins with a wide trading range at the top and contracts to a smaller trading range as prices trend down.

- This price action forms a descending cone shape that trends lower as the vertical highs and vertical lows move together to converge.

- The bullish bias in this pattern will not be signaled until a breakout back above the descending resistance to show this is a reversal pattern from lows in price.

- This is usually a longer-term pattern that generally forms over a three to six-month timeframe but can also appear on shorter time frames.

- This pattern creates lower lows, but the new lows should become less in magnitude. Less depth in lows indicate a decrease in the strength of selling pressure and should create a lower trend line of support with less declining slope than the upper line of resistance.

Bearish Wedge vs Bullish Wedge

The Rising Wedge should be traded as a bearish pattern by selling short to the downside as the previous downtrend resumes signaled by a breakdown of the lower trend line support.

The Falling Wedge should be traded as a bullish pattern by buying the breakout to the upside as the previous uptrend resumes signaled by a break of price above the upper trend line resistance.

As with any trade, proper position sizing and a stop loss should be used to minimize losing trades. Patterns are only probabilities of a chart moving in the path of least resistance not a perfect prediction, profits come from coming losses small and maximizing winning trades not winning every time.

You can learn more about all the different types of patterns in my book The Ultimate Guide to Chart Patterns available on Amazon here.