A moving average crossover signal is when you use both a short term moving average and a long term moving average on the same chart. A crossover signal is generated when the moving averages break above or break below each other. A trader buys when the shorter term moving average crosses over the longer term moving average and sells when the shorter term moving average crosses back under the longer term one Instead of price crossing over or under a single moving average as a signal the shorter term moving average itself becomes the signal line as it crosses over the longer moving average. The best things about moving average crossover signals is that they can capture trends while filtering out much of the volatility. Unlike the discretionary nature of trend lines and chart patterns a moving average crossover is not an opinion, either it happens or it doesn’t, it is a mathematical fact. Since moving averages are quantifiable, crossovers can be backtested to see how they performed in the past and used to create signals with an edge.

Moving average crosses are trend trading tools and under perform during sideways or choppy markets. However they can capture big winning trades during trends and also keep you safe in cash during bear markets and crashes. They do not capture the top or bottom price as it takes time for the crossover to happen to confirm a trend is underway but they are great at catching the main piece of a trend.

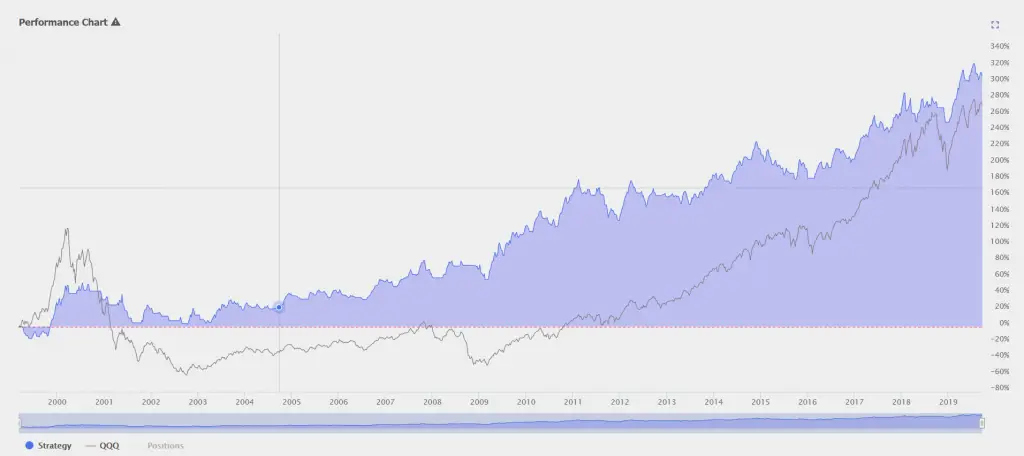

Below is the chart and backtesting data for a 5 day / 20 day exponential moving average crossover signal on the QQQ ETF. It is based on buying at the end of the day when the 5 day exponential moving average closes above the 20 day exponential moving average and selling at the end of the day when the 5 day exponential moving average closes back under the 20 day exponential moving average. This repeating pattern is a good momentum strategy historically for catching swings and trends to the up side using two key short term moving average as a crossover smoothing out the volatility of using just one as a standalone signal. Individual short term moving averages are good tools for discretionary traders to stay on the right direction of the trend. However as mechanical signals with no other filters very short term moving averages can create a lot of false signals and the noise from price action cutting through one of these lines.

If you would like more information about moving averages I’ve created short cuts to learning with my books Moving Averages 101 and 50 Moving Average Signals That Beat Buy and Hold and my Moving Averages 101, Backtesting 101, or Real Trade Example eCourses.

Charts and backtesting data courtesy of TrendSpider.com.