During wars are the build up of a military in preparation to a potential war money inside the stock market can rotate to companies in stocks that would profit from military spending.

Here are ten stocks to watch as the tensions between the United States and Iran escalate over the weekend after the U.S. took out a top Iranian general.

Boeing ($BA) builds and supplies military aircraft to several branches of the U.S. military like the navy and air force.

Lockheed Martin ($LMT) is even a bigger defense contractor than Boeing producing planes, helicopters, missiles, and fire control systems.

Northrop Grumman’s ($NOC) produces drones and the Orbital ATK for space defense, it also builds the B-21 stealth bomber.

Raytheon’s ($RTN) builds several missile defense systems along and air defense systems.

General Dynamics’ ($GD) builds many sizes of military ships, tanks, and light armored vehicles for the military.

L3Harris ($LHX) produces military communications systems, devices for night vision, satellite communications, and a computer processor for jets.

Honeywell International Inc. ($HON) manufactures for the military in the aerospace sector supplying planes.

Heico Corp. ($HEI) products are produced for military aircraft, as well as on a large variety of industrial turbines, targeting systems, missiles and electro-optical devices.

United States Oil Fund ($USO) is not a defense stock exactly but could be a defensive play for your stock portfolio as it could rise and trend higher with any threat to the production of oil in the middle east or the transport of oil to the rest of the world.

SPDR Gold Shares ($GLD) could also be a defensive play with a flight to safety if the stock market falls or inflation heats up on currencies and a major war begins.

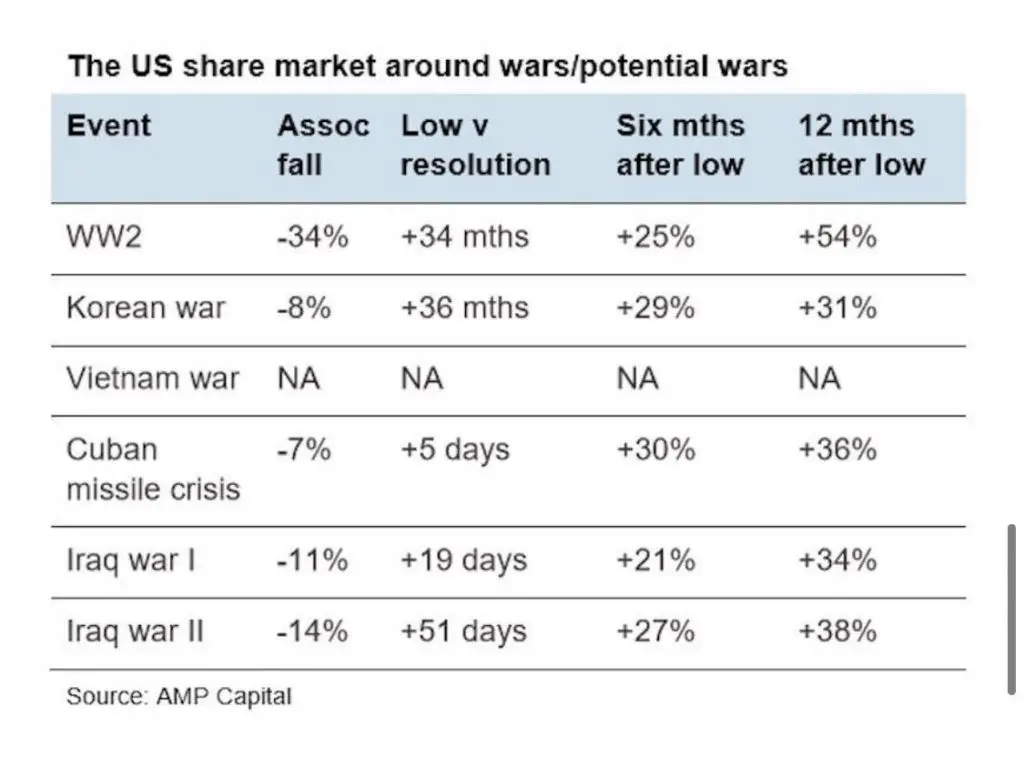

Here is a look at the stock market stats during other war times: