A reverse conversion option play is a type of arbitrage trade used to make money from selling the option premium of a put option that is priced too high but is structured in a way that profits regardless of the following price action of the underlying stock.

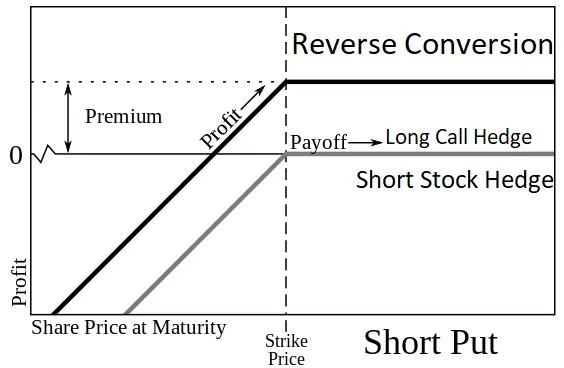

This option play is created by opening three legs. Selling to open the put option that is overpriced and also purchasing a call option on the same stock to make a synthetic long stock position, then shorting the same underlying stock as a hedge.

The put option and call option used to build the synthetic stock side must have the same strike price and expiration date on the underlying. The synthetic long position should control the same amount of shares as the short stock, if 200 shares were shorted then 2 call and put options should be used to build the synthetic stock position.

The synthetic stock option play will mimic closely the same risk and return of the short stock and create a Delta hedge shifting the option play structure to primarily capture profits in declining Theta and Vega on the short put contract until expiration. This option play profits from perceived put option mispricings in relation to the same call in time and strike price in the option chain.

The short put option contracts are hedged by the short stock and the long call option hedges the short stock leading to profiting from the declining value of the overpriced short put option.

A reverse conversion is a pure put option arbitrage play that only works when a put option that is overpriced or a call option is underpriced in relation to that put allowing an option trader to make money regardless of the next market direction as long as the option premium is locked in by a hedge making it Delta neutral.

Historically a put option contract is usually less expensive not higher priced in relation to a call option of the same strike price and expiration. A reverse conversion is one of closest things an option trader will find to a sure profit when they open the trade. However, the efficiency of pricing in the option market makes overpriced put options a very rare find. Even when they are found the option must provide enough liquidity for the option trade to be executed with minimal slippage and the stock must have shares available to short.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.

Gxti / CC BY (https://creativecommons.org/licenses/by/3.0)

Short Put edited from original source to add hedges to create a Reverse Conversion.