In options trading, a debit spread or net debit spread play is created when a trader both buys an option with a higher premium and sells an option with a premium that is lower in price at the same time.

The debit spread option play is when the value of options bought is greater than options sold so your options account pays money as the result of a net debit on that play. You pay to play with a debit spread.

It costs money to open a debit spread option trade as you are a net buyer of option premium. The greater the spread between the options being used to create the play, the more money is needed by the option trader to open the option play.

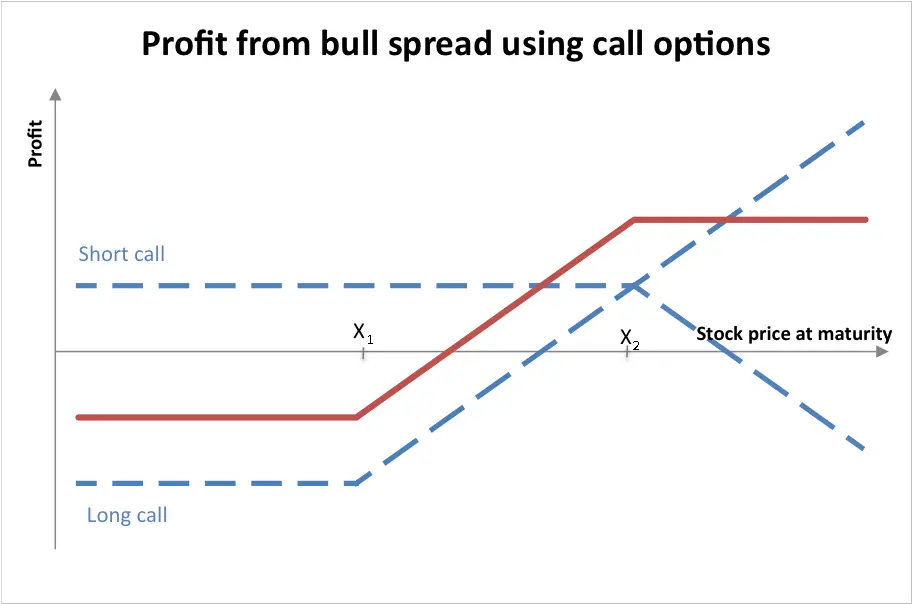

In this type of option play the trader is a net buyer with the expectation that the difference between the two options in the play will grow more in his favor and create a profit on the long side.

The inverse of a debit spread option play is a credit spread when the value of options sold is greater than options bought so your options account would receive money as the result of a net credit on that play. You are paid to put on a credit spread.

Debit spreads are one way to try to lower the cost of long options by selling short options in the opposite direction of the expected market price move. Debit spreads make money when the market trends in the direction of the long options in the play.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.

Suicup / CC BY-SA (https://creativecommons.org/licenses/by-sa/3.0)