A technical indicator/price action divergence happens if a momentum indicator like the MACD (moving average convergence divergence), doesn’t show the same movement to higher highs or lower lows that price action does to confirm momentum. If the price on the chart makes a new high price but the MACD does not make a higher high from its previous reading that is a divergence between the price action and the MACD indicator showing the loss of confluence between the two.

The technical indicator filter is showing weakness in the direction of the price action and can be a signal of less momentum in the current swing or trend in price. A MACD divergence can be a signal for a reversal in price direction happening on the chart.

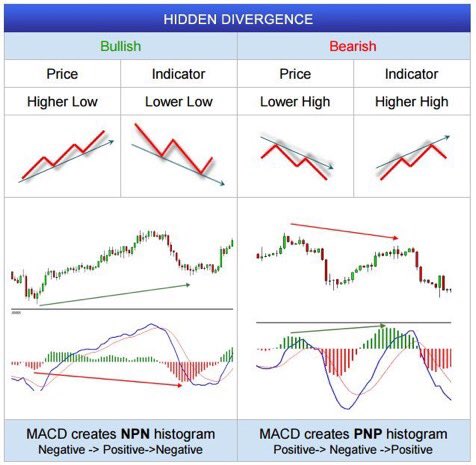

Here is a MACD divergence cheat sheet: