An RSI divergence indicator signal shows traders when price action and the RSI are no longer showing the same momentum. The RSI shows the magnitude of a price move in a specific timeframe. The RSI is one of the most popular oscillators used in technical analysis. A divergence looks at it in relation to the current price action.

If a chart has a RSI divergence then the relative strength index (RSI) on the chart has lower highs when price is at a higher high or the RSI makes higher lows when price makes new lower lows. When RSI stops breaking out to higher highs during an uptrend in price or breaking down to lower lows when price is in a down trend then it is said to be an RSI divergence.

A divergence is a signal that the current trend in the time frame on the chart has lost momentum. This is a possible signal and set up to bet on a reversal in the direction of the market price action. An RSI divergence is saying that the indicator does not agree with the price action.

A bullish divergence is signaled when the RSI indicator has an oversold reading then a higher low that correlates to lower lows in the price action. This can show increasing bullish momentum, a break out back above an oversold reading is a common buy parameter used to signal a new long position.

A bearish divergence is signaled when the RSI indicator has an overbought reading then a lower high that correlates to higher highs in the price action. This can show decreasing momentum and a potential reversal in the uptrend. A break down back below an overbought reading is a common profit taking or short selling parameter used to signal a new short position.

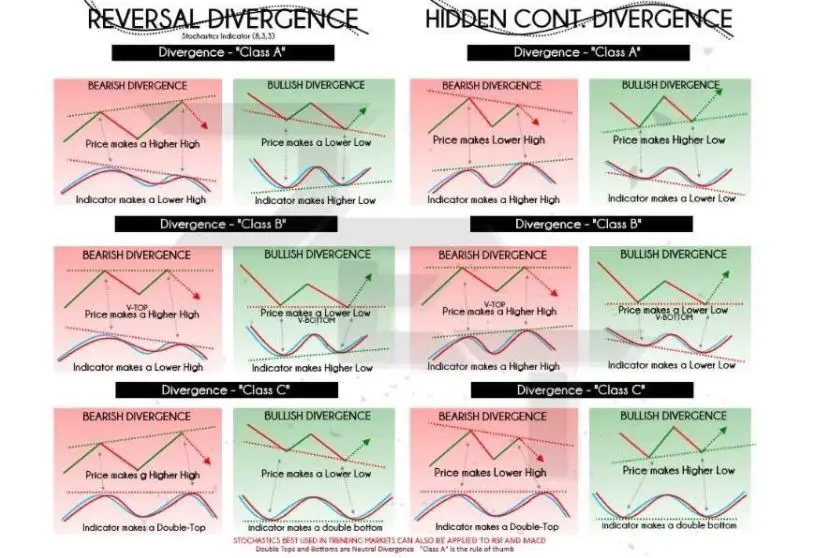

Divergence cheat sheet. Essential for any trader. #altseason pic.twitter.com/jKVUM1N45S

— Zen (@Zen_Trades1) May 10, 2018