“Compound interest is the eighth wonder of the world. He who understands it earns it, he who doesn’t, pays it.” -Unknown

Why is compound interest considered the eighth wonder of the world?

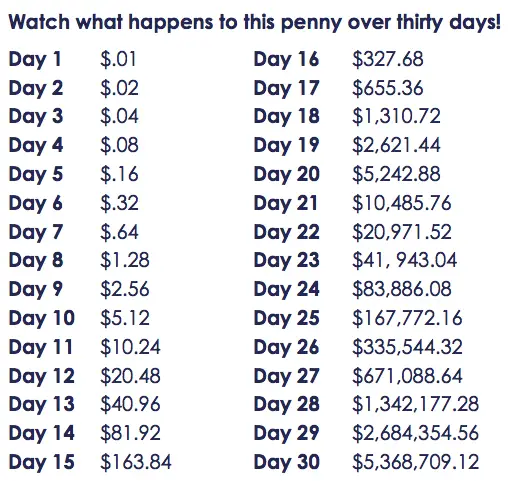

Here are three shocking examples of the exponential growth of compounding.

If you start with capital and grow it an additional 1% everyday for a year (1.01 to the 365th power) you would have grown one dollar to $37.78 by the end of 365 straight days. That is a 3,678% return on a compounding investment at +1% a day for one year.

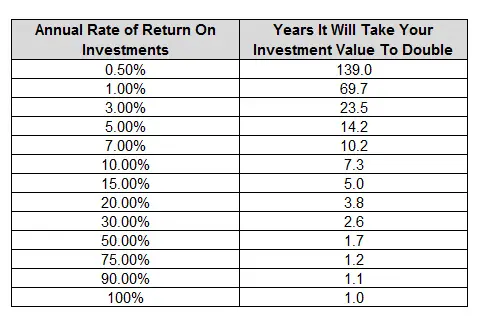

Annual compounding of capital can also double money over years at different rates based on returns.

If you have an investment account that returns +20% a year then in 3.8 years your money would double. A $100,000 account after 3.8 years of 20% annual returns would become $200,000.

Compounding is one of the reasons the rich get richer as their money grows when they make wise investments in stocks or businesses. This is one of Warren Buffett’s secrets to becoming the richest person in the world, he is a master of compounding the returns on capital and businesses his company acquires.

Compounding money through interest or capital gains puts your money to work for you. Your money makes more money, then that new money becomes a new capital base for making more as it grows exponentially. It’s like magic when it can be done with some level of consistency.

The examples above or to show the math and for the sake of simplicity. In the real world of trading and investing returns are not that even and there are ups and downs in investing and trading but the principles are sound. You have to aim for average returns and accept the drawdowns. Magic can happen over the long term if you are in the right stock index or growth stock but the ride can be bumpy.

Seeing a compound growth rate of capital when I was a teenager was one of my biggest inspirations for focusing on growing capital in the stock market and starting at a young age. I saw the opportunity and potential and that is why I became an investor first and then a trader and have been consistently growing and compounding capital for over 28 years.