Melvin Capital Management is a hedge fund with seven clients and over $24.56 billion dollars in assets under management.

Melvin Capital became famous in the trading world in early January 2021 as their GameStop short position combined with other short sellers resulted in more than 139% of Gamestop (GME) shares to be short at one time. This made GameStop stock the most shorted equity in the world.[1]

This high short interest in GME stock lead to a short squeeze made popular by the Wall Streets Bets Reddit group and covered in major media that ran the GME stock chart up to $483 a share at its peak and forced Melvin Capital to cover for a huge loss.

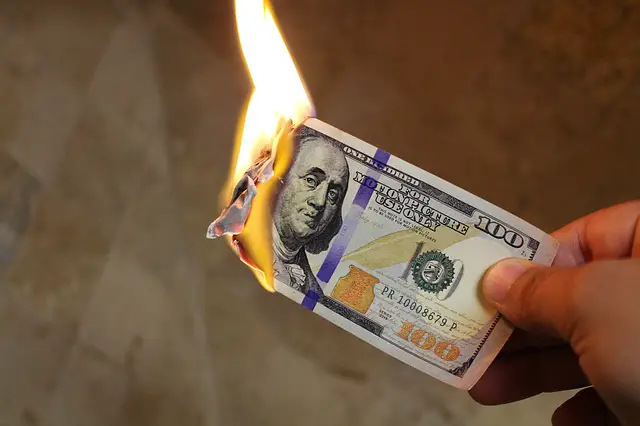

Melvin Capital Lost 53% in January 2021 due to its short selling of GameStop stock and other trades that didn’t work out at the beginning of 2021 the Wall Street journal reported.

Below are the current top positions totaling over $17.4 billon that Melvin Capital was holding going into the 3rd quarter of 2021 based on the most current 13F filing as of 06/30/21. The top ten holdings total 32.11% of the total portfolio.

Top 25 holdings by percentage of portfolio .

Stock ticker/ Total % of portfolio[2]

EXPE 5.83%

AMZN 4.23%

V 4.01%

PAGS 3.87%

LH 3.08%

FICO 2.83%

GOOGL 2.79%

SNOW 2.66%

ALGN 2.21%

JD 2.17%

TXRH 2.16%

EXPE(CALL) 2.15%

IAA 2.02%

DASH 1.89%

BKNG 1.69%

PYPL 1.67%

TEAM 1.65%

LVS 1.63%

H 1.62%

ADSK 1.56%

ATVI 1.47%

MA 1.46%

DPZ 1.40%

MSFT 1.39%

BILL 1.39%