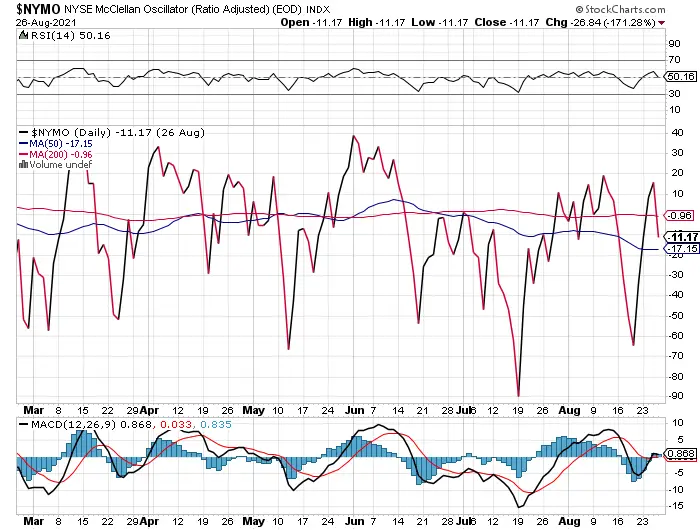

The $NYMO ticker is the McClellan Oscillator that is ratio adjusted for the end of the day.

The McClellan Oscillator ($NYMO) is a technical market breadth indicator that is calculated based on the variance between the number of advancing and declining stocks on the New York Stock Exchange.

This technical indicator is used to show the underlying sentiment in an index as the market breadth changes from bullish to bearish and back again. It helps show the strength of an overall index trend through divergence, confirmation, and extreme readings in either direction.

- The McClellan Oscillator formula can be used to see the market breadth for any stock exchange.

- An above zero reading signals a potential bullish rise in an index and readings that are below zero signals a potential bearish decline in an index.

- When the value of the index is going higher but the oscillator reading is going lower, it can signal a warning that the index could move lower as well. When the index is going lower in value and the oscillator is going higher, it can signal that the index could start going higher as well. This is a divergence between the indicator and the value that can predict a later convergence between the two.

- A significant movement from negative to positive is a breadth thrust. It may signal a reversal from a downtrend to an uptrend or the opposite if it goes from positive to negative it could signal a move from an uptrend to a downtrend.

The 3o RSI reading on the $NYMO can signal a great dip buying opportunity in the index. The MACD crossover can signal a bullish move higher for the index and the MACD cross under can signal a bearish move lower.

This is a tool for quantifying market breadth on an index.