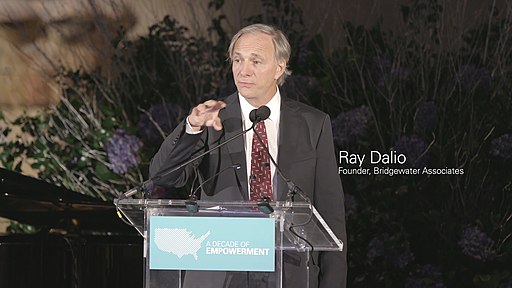

Ray Dalio founded Bridgewater Associates in 1975 and grew it into one of the world’s largest hedge funds by 2005. As of 2021 his hedge fund has 105 clients with over $223 billion in total assets under management. Ray Dalio is ranked 36th richest person in the world according to Forbes with a net worth of approximately $20 billion.

Bridgewater’s Pure Alpha strategy has generated approximately 12% annualized returns since its founding in December 1991.

Below is the current Ray Dalio portfolio in 2021. This is a breakdown of his Bridgewater Associates Holdings portfolio top positions of over 1% of capital from his fund’s 13F filings as of the 3rd quarter after his 2021 update on September 30, 2021. (Positions under 0.99% of capital in his portfolio are no listed here).

Top 10 holdings are a concentration of 38.39% of assets under management.

Below are the top 19 Bridgewater Associates holdings in this primary portfolio with $18,264,176,000 in invested securities under management as of the beginning of the 3rd quarter in 2021:

Position ranked by size/Ticker Symbol/Portfolio Percentage[1]

- VWO 6.42%

- EEM 5.56%

- IEMG 4.65%

- SPY 4.62%

- WMT 3.84%

- PG 3.59%

- BABA 2.67%

- JNJ 2.44%

- KO 2.40%

- PEP 2.21%

- GLD 2.15%

- COST 2.09%

- IVV 1.95%

- MCD 1.93%

- SBUX 1.38%

- ABT 1.21%

- TGT 1.20%

- DHR 1.17%

- EL 1.16%