With buying and holding stock index ETFs becoming thought of as the holy grail of investing by everyone from Warren Buffett to young financial planners in this post we will look at alternatives. Too many young investors now believe that an index virtually guarantees a +8% annual return over most 10 and 20 year periods. The problem with this is that it still depends on the timing of the buying and holding period as well as how the investments are entered. All in at one time is a lot different than dollar cost averaging. Also if you reached your peak investment years ready to retire in 1982, 2000, or 2009 you had a very stressful event to hold through. The path to these returns are ignored believing that the markets will always bounce back quickly as they have since the bottom in 2009.

The lessons of the history of the stock market are ignored, even the recent history of the 2008-2009 meltdown than at the March 2009 lows had wiped out all the S&P 500 index returns from 1997. Or the pandemic lows in early 2020 that had wiped out all the Trump era gains in a few weeks. Another example is the flat returns in the stock market from 1929- 1954. The point is that there are lost decades and even 25 year periods that don’t return steady gains. Most of the stock market gains of the last 25 years are a direct result of central bank and government intervention. The U.S. is also unique with the performance of its stock indexes and markets as new innovative companies list and new winners emerge consistently, this is not true in every stock market around the world. Ten or fifteen years of stock market gains can be taken from a buy and hold investor in a manner of months and may or may not return. When the stock market is fundamentally over-priced for future earnings it can underperform for many years below investor’s expectations.

There is an alternative to the buy and hold portfolio and the 60/40 equities/bond portfolio that focuses on defense and preserving capital through all market environments from bear markets, bull markets, volatility, crashes, and high inflation. Chris Cole, a hedge fund manager and financial historian designed the Dragon portfolio that is constructed to be capable of going through any type of economic cycle and preserving wealth and buying power through diversification. The Dragon portfolio looks at the financial markets from the view of a one hundred year history and considers the performance of all asset classes not just the modern portfolio theory.

Currently retail investors are advised to have little to no exposure to defensive asset classes, and Cole disagrees and believes that defensive assets should be at the core of portfolio holdings.

Offensive assets have steady gains during long periods of economic stability and grow but eventually have large and quick losses when there is a major change in the market environment. These are stocks, bonds, and real estate.

Defensive assets have small losses or little performance during periods of market and economic stability. But they have exponential gains in value during high market volatility, high inflation trends and market crashes. These are gold, long volatility positions, cryptocurrencies and commodities.

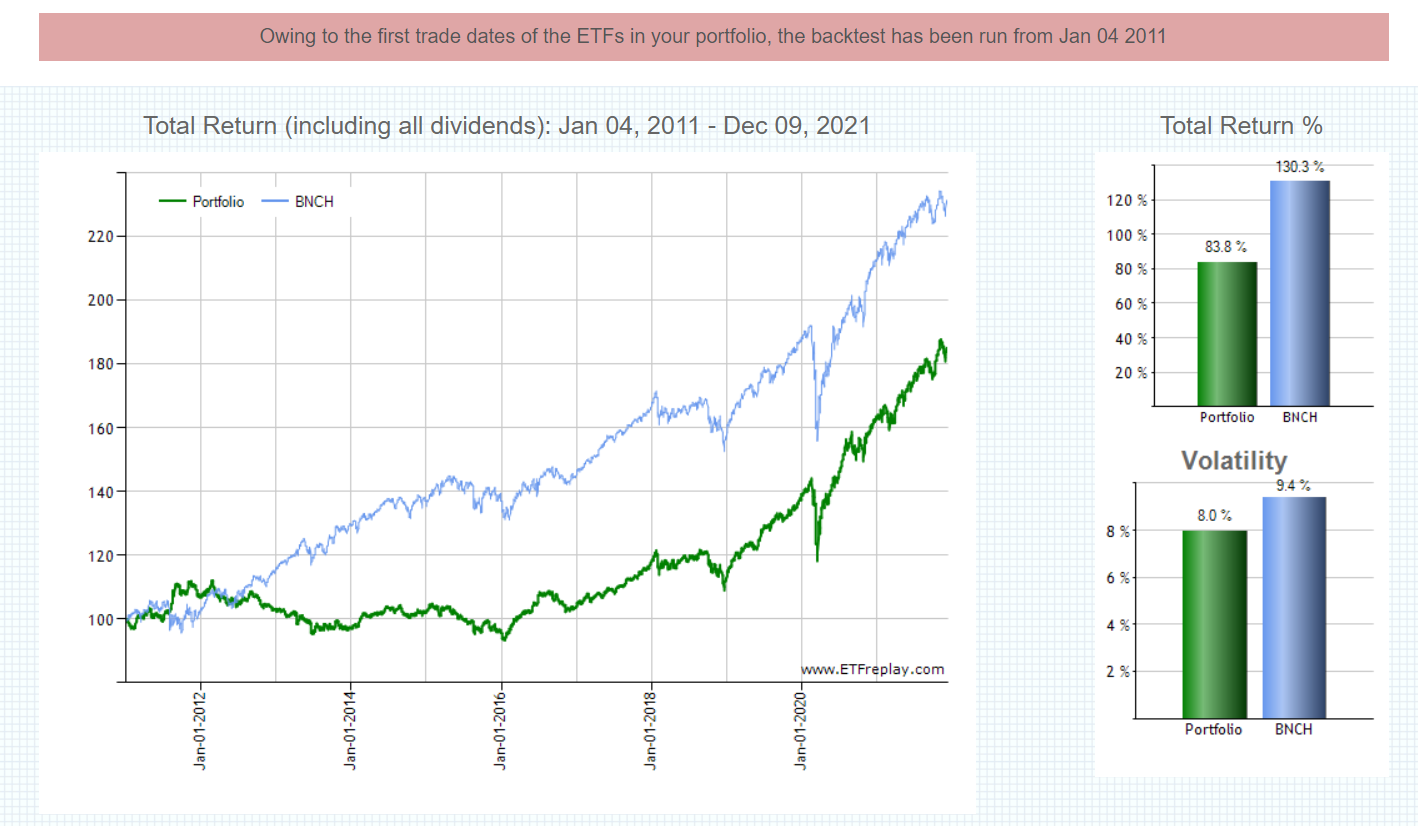

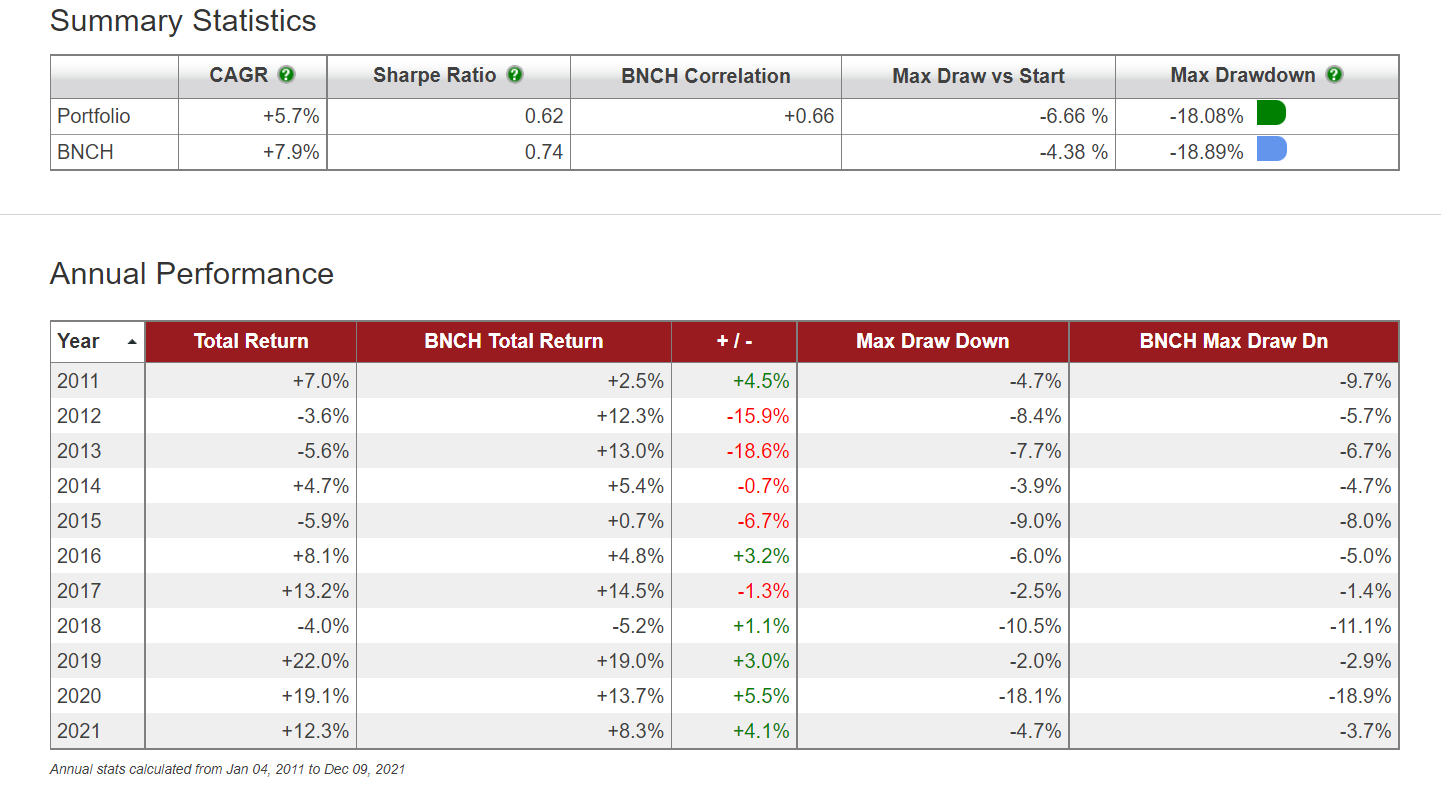

The Dragon portfolio creates diversification with uncorrelated assets to smooth returns on capital and hedge against out-sized risk in all market environments. This is the type of portfolio that would do very well during the 2008 crash but can’t be backtested that far back as long volatility ETFs didn’t exist then. This portfolio has had solid returns with minimal drawdowns the past five out of six years. You can see the full backtested results of the Dragon porfolio below in comparison with the 60/40 benchmark which is what it is designed to pace returns with at the same time having less risk during crashes. It performs the best in high volatility, high inflation, high interest rate environments and underperforms in stock market bubbles.

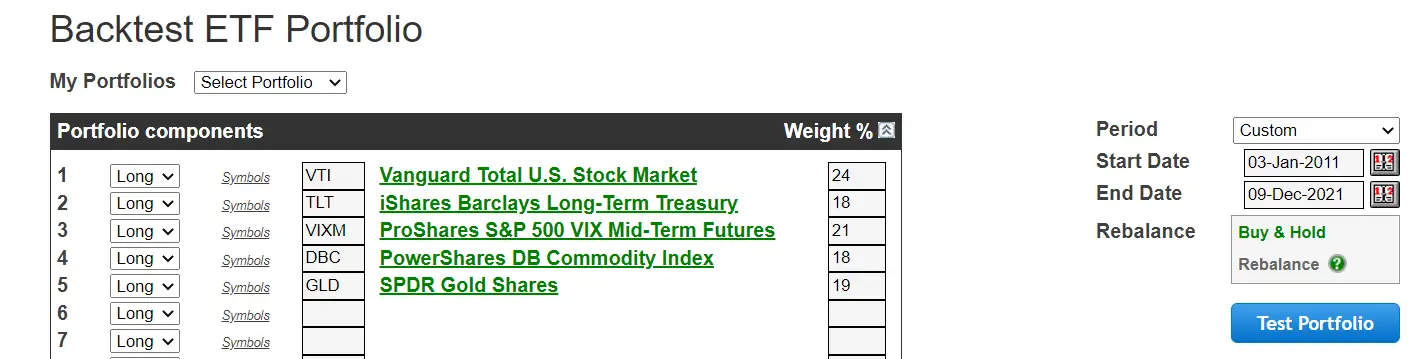

Here is the Dragon Portfolio construction using exchange traded funds:

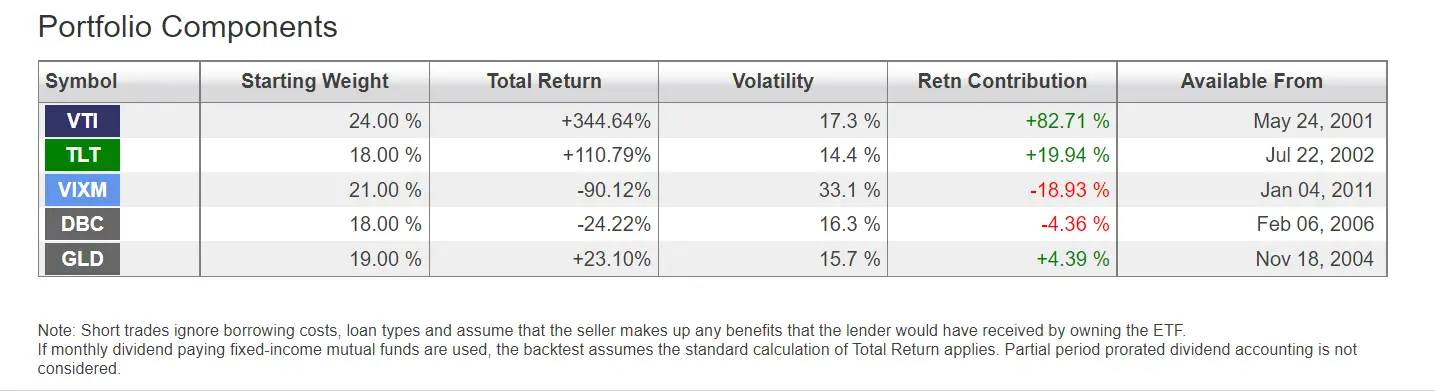

24% Equity exposure: Vanguard Total Stock Market ETF $VTI

21% Long Volatility: Profit from increases in the expected volatility of the S&P 500, measured by the prices of VIX futures contracts $VIXM

19% Gold: Central Gold-Trust, which holds gold bullion $GTU

18% Commodities: PowerShares DB Commodity Index Tracking Fund $DBC

18% Long-Term Government Bonds: iShares Barclays 20+ Year US Treasury Bond ETF $TLT