As a trader you need rules to quantity the best decisions to make at any given time. As a new trader starting out you must start with a strong foundation of principles to both give you the ability to make profits and also avoid the risk of ruin. You need rules on how to execute your trading strategy while also managing risk as well as managing your own emotions and ego.

Trading rules can involve three core areas for a trader: method, risk management, and trader psychology.

Here are twenty seven of the best rules for a new trader to start out with for a strong foundation that they can expand on in more detail as they learn and grow through successes and failure.

Trading Method and Strategy

- The first rule before you even begin trading is that you must first learn how to create a trading system with an edge.

- If you don’t have a full trading plan with rules on entries, exits and risk management stop trading until you create one.

- Trade your plan, your system, your signals, the chart, and price action, not your own opinions, bias, or predictions.

- Never trade anything you don’t understand 100%. Don’t trade futures, forex, cryptocurrencies, or options until you understand the risk and how they work.

- Trade in the direction of the trend in your trading time frame.

- Trade what is happening not what you think should be happening.

- Create signals that optimize entries and exits for profitability.

- Manage your trade based on its evolving risk/reward ratio as it plays out.

- In uptrends, look for long signals stay out of downtrends or look to go short.

- Only trade when you have an edge.

Risk Management

11. Never lose more than 1% of your total trading capital on a single trade.

‘The very first rule we live by is: Never risk more than 1% of total equity on any trade.” -Larry Hite

“I try very hard not to risk more than 1% of my portfolio on a single trade.”–Bruce Kovnar

One of the most important lessons that a trader must follow to ensure his long term success, is to never risk more than 1% of his trading account on any one trade. This does not mean trading with 1% of your account capital, that is position sizing not risk per trade. Never losing more than 1% on a trade means adjusting your stop losses and position sizes based on the volatility of your stock, currency, commodity, option, or futures contract, so that when you are wrong the consequences are the loss of 1% of your trading capital. This almost eliminates your risk of ruin for a string of losing trades.

12. Position size right.

I base my position sizing in my trades on the fact that I never want to lose more than 1% on any one trade. If I am trading with a $100,000 account, I don’t want to lose more than $1,000 in a losing trade. A stop loss level has to start at the price level that you know you are wrong, and work back to position sizing. If the support level on your trade is $105 for your entry and you set your stop at $100, then you can trade 200 shares with a stop at the $100 price level. 200 X $105 = $21,000 position size for 200 shares. This is about 20% of your total trading capital with about a 5% stop loss on your position that equals a 1% loss of your total trading capital.

- A 20% position of your total trading capital gives you a potential 5% stop loss on your position to equal 1% of total trading capital.

- A 10% position of your total trading capital gives you a potential 10% stop loss on your position to equal 1% of total trading capital.

- A 5% position of your total trading capital gives you a potential 20% stop loss on your position to equal 1% of total trading capital.

The average true range (ATR) can give you the daily range of price movement and help you position size based on your time frame and your stocks volatility. If your entry is $105, your stop is $100, and the ATR is $1, then you have a five days worth of movement against you as a stop.

Start with your stop loss level and volatility to give yourself your position size. The more room you want on your stop determines how big of a position size you can take.

13. Never risk your lifestyle on a single trade.

“Speculate with less than 10% of your liquid net worth. Risk less than 1% of your speculative account on a trade. This tends to keep the fluctuations in the trading account small, relative to net worth. This is essential as large fluctuations can engage {emotions} and lead to feeling-justifying drama.”- Ed Seykota

14. Avoid the risk of ruin.

Your risk of ruin is the probability that you’ll lose so much money you can no longer continue trading due to financial or emotional reasons. It doesn’t always mean losing all of your trading capital, your personal breaking point is determined by your own personal risk tolerance pain threshold, one person could be ruined after a 50% drawdown from an equity peak while others may quit the first time their capital drops 20% from their starting point. Others will recapitalize and never quit until they are successful.

15. A diversified trading system can limit risk of over exposure to just one asset class.

16. Risk / Reward Ratios

Your expectation of reward on a trade entry should always be a multiple of the risk on your stop loss placement. Risking one dollar to make three or more is a better strategy of risk management than risking a lot to make a little. The reward has to be worth the risk taken.

17. Avoid big losses, they are the number one cause of unprofitable trading.

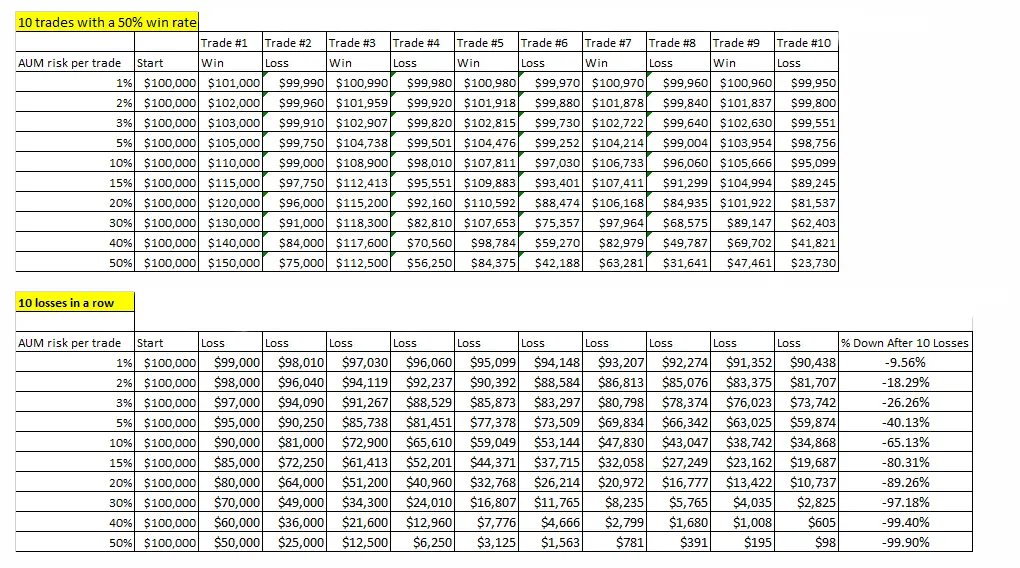

Here is an example of the different equity curves with the same winning percentage but based on different sizes of wins and losses. Also what happens with ten losses in a row based on higher risk% to capital.

Trading Psychology

18. Never trade so big that you end up watching every price tick even though you are not a day trader.

19. Don’t trade so big you dramatically increase your heart rate or sweat.

20. Each trade should only be one of your next one hundred trades and not impact your emotions or ego.

21. Don’t spend time obsessing over market hindsight. All you can focus on is following your trading plan in real-time.

22. Forget about your last trade and focus on your next trade.

23. Losses should be lessons that you paid to learn. Look at drawdowns in capital as tuition and not failure.

24. If you followed your trading plan, your loss is just part of the process to get to profitability. Think long term.

25. Position sizes can’t be so large that they compromise your emotions and distract you from your trading plan.

26. Don’t revenge trade to attempt to recover your losses. Stick to your trading plan regardless of your equity curve.

27. Your signals have to be based on price action and not greed, fear, or your ego.