Entering a trade is just the first step and exiting for a profit is the last step. Your profit target creates the reward in your risk/reward ratio at entry so you know if the risk is worth the time, stress, and potential profits.

The risk/reward ratio for a trade is always evolving and the same trade may shift to being more risk to continue to hold and the remaining profit may be limited if it has already moved in your favor for a long period of time.

Here are five of the best places on a chart to set your profit target on entry so you know when it could be time to lock in your profits while they are still there when you get the chance. These are all examples of using technical analysis to project potential maximum profit targets on a chart with indicators and price action.

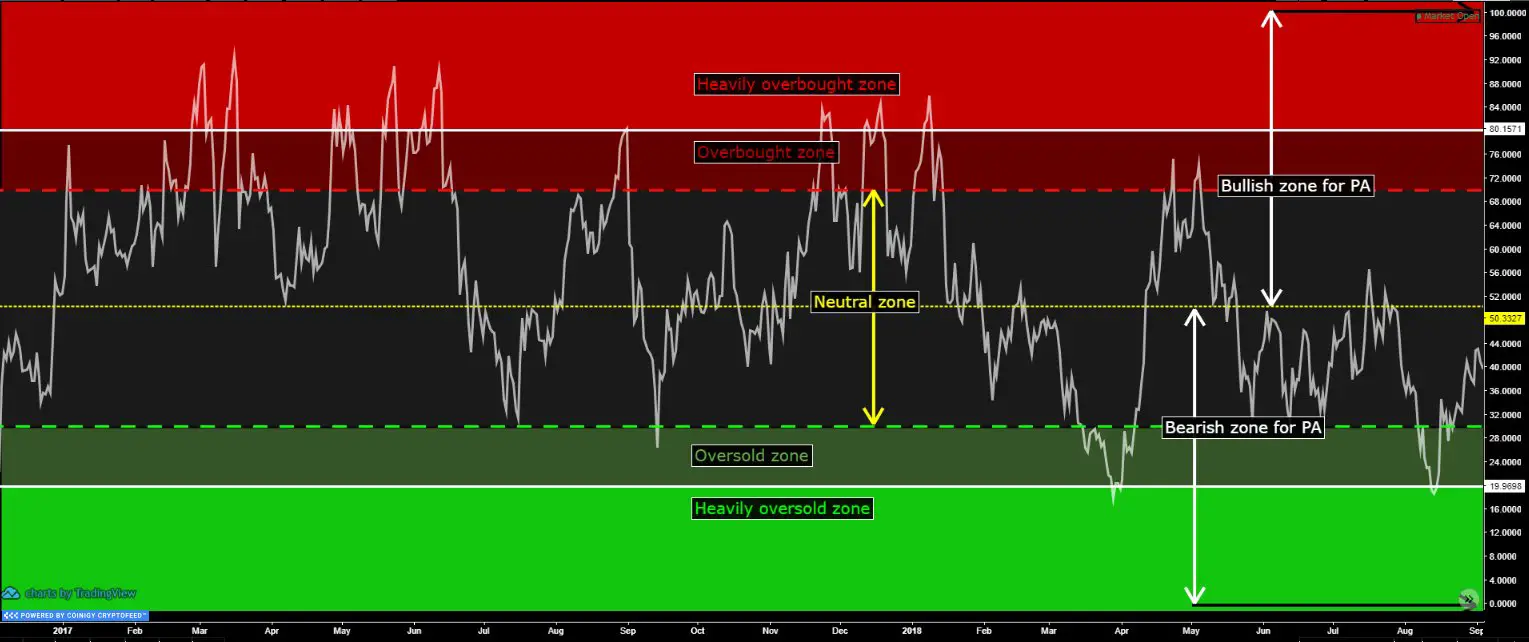

1). The 70-RSI reading on a chart may be the time to consider taking profits on a long side trade and the 30-RSI may be the time to lock in profits on a short trade.

Source2). A previous resistance zone on a chart is a good target for a long position and an old support zone on a chart is a good target for short positions.

3). After an A-B-C breakout and pullback pattern, Fibonacci extensions from the bottom to the top of the breakout move could be used as profit targets. After identifying a C retracement level, a trader can choose from a Fibonacci extension level as a profit target.

The 138 and 161 Fibonacci extension levels are the nearest ones and these are the most popular levels used as profit targets.

Image via Tradeciety.com

Image via Tradeciety.com

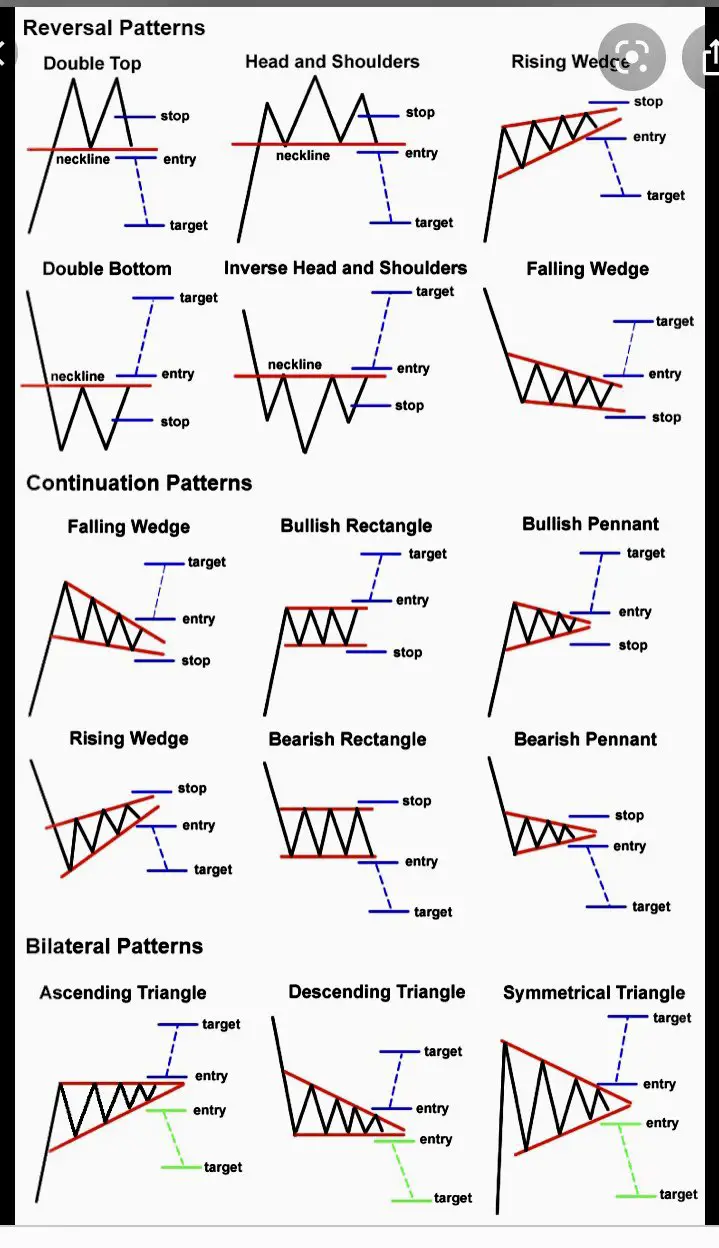

4). A chart pattern’s projected move based on the magnitude of the previous swing or trend before the pattern formed is another way to quantify the magnitude of the current move after a breakout of the pattern.

5). A key longer-term moving average above an entry can act as a profit target for long positions and a key longer-term moving average below the entry can act as a profit target for short positions to the downside.

These are all potential profit zones to consider when entering a trade and also managing your winning trades for maximum profits. Your stop loss on entry is your risk and your profit target is your potential reward.