William J. O’ Neil founder of Investor’s Business Daily says Nicolas Darvas’ book is recommended reading for anyone wanting to learn to trade stocks.

Darvas was a professional dancer who first became interested in the stock market in 1952 when he received some mining stock shares in exchange for performing in a Toronto nightclub. The stock took off, with Darvas selling near the top. He learned a valuable lesson when the stock subsequently crashed: the exit is crucial for profitability in the stock market.

Davas realized that knowledge and experience were the keys to success. He read more than 200 trading books about successful speculators and about the stock market. At one time early in his trading journey he studied for eight hours per day. Some of his favorites were Tape Reading and Market Tactics by Humphrey Neill, and the classic The Battle for Investment Survival by Gerald Loeb, almost every week.

After trial and error he eventually developed his own momentum and trend trading system for stocks. Between 1956 and 1958 Darvas turned $25,000 into $2.25 million. He would scan newspapers for a few minutes late at night or early in the morning and select the stocks that met his requirements.

As he travelled as part of a famous dance team he would obtain a copy of the Wall Street Journal and Barrons from the local United States Embassy. He ignored everything he read and focused only on the stock prices. He would place his trades through telegram with his broker not watching prices while the market was open and trading off end of day prices and setting market orders.

Darvas was a true market wizard, often stating that it was not so much his trading profits which pleased him, but rather the peace of mind he achieved by following the system he developed which best fit his personality.

Many cynics believe that Darvas was simply lucky, making his money in a very strong bull market. It’s true that the market was very strong, however Darvas’ method is a valid trend following system to capture huge trends in bull markets.

Darvas was one of the first successful trend followers/momentum traders to specifically quantify and share what he did to make his fortune.

Nicolas Darvas learned the hard way what not to do:

- He lost money following advisory services, they knew no more than he did about a stocks future direction.

- He learned not to brokers’ advice. They were wrong more times than right.

- He ignored many wall street sayings, no matter how old and revered. Example: “You can’t go broke taking a profit”. You can if your losses are bigger than your wins.

- He learned not to trade over the counter or penny stocks and only in exchange listed stocks where there were always buyers when he wanted to sell.

- He learned not to listen to rumors, no matter how founded they may appear.

- The technical approach worked better for him than guessing, predicting, and holding strong personal opinions. He studied price movements.

- He would rather hold on to one rising stock for a longer period than actively trade a dozen stocks for a short period at a time.

How do you use Darvas’ theory?

The Darvas System:

- Buy only the strongest stocks in the stock market.

- Buy them as they break out of consolidated price boxes.

- Sell at a small loss if they fall back into the previous price box.

- When he was right he made big profits by letting the winner run until it fell back into the previous price box.

- He liked buying at an all time high price with increasing volume in an overall up trending market.

- He believed stock prices bounced around in boxes with support and resistance, a buy signal or short signal was when one of these were broken.

- He put in automatic buy orders to purchase stocks that made new highs at the break out.

- He put in stop loss sell orders to sell a stock that fell back through the break out price level.

How do you plot Darvas Box?

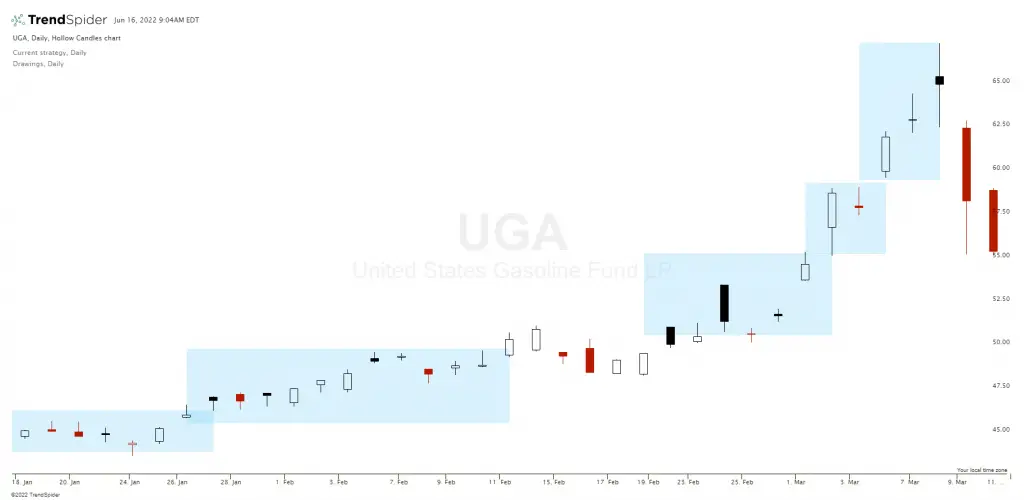

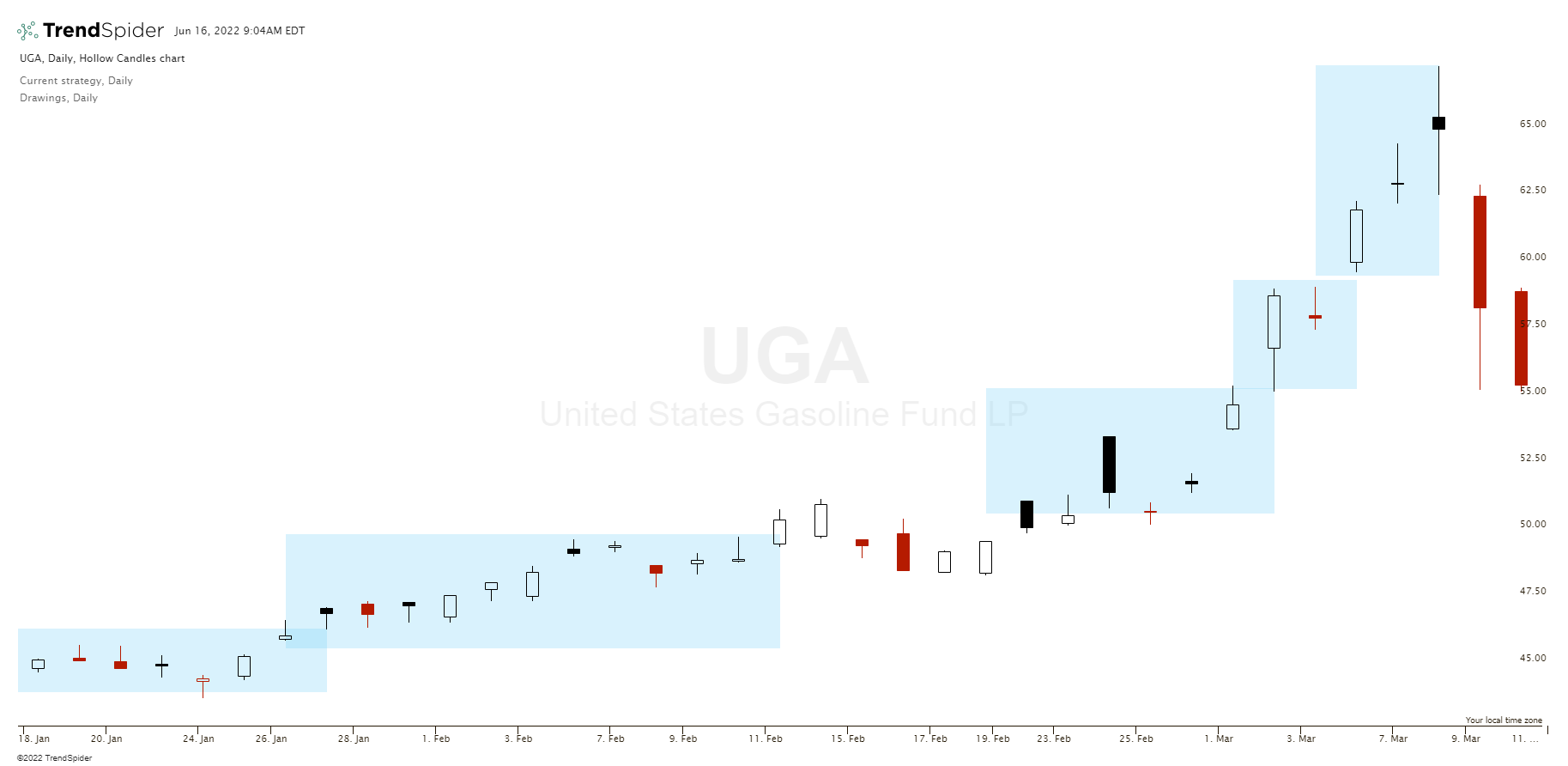

He would quantify trading ranges of price support and resistance highs to draw a box around. A break above the highs would signal a new buy entry point and a break below the low in the Darvas box price would trigger a stop loss and exit. A Darvas Box is considered in place as long as it doesn’t fall back and stays in the previous box. A breakout signals a new possible support level for the next box in the stair step.

Darvas traded his box theory through telegrams with his full service brokerage firm who was located in the United States as he travelled the world dancing. He had to pay very high commission costs to trade in the 1950s which lead to more stable price action in the markets due to transaction costs. Today’s zero commissions have led to more volatility and it’s more difficult for stocks to hold their Darvas Boxes as prices can move to extremes above and below the box before breaking out into a new trend.

Nicolas Darvas was one of the first trend followers in history to focus on systematically trading price action versus fundamentals, predictions, or opinions. He also was one of the very first mechanical system traders that used buy stops and trailing stops to make his decisions for him as he slept through the trading days and didn’t look at the market intraday only at the end of the day.

Below is an example of using the Darvas Box Theory to trade the $UGA ETF as it made trading ranges then broke out or broke down after each box.

Nicolas Darvas Quotes

Here are my favorite Nicolas Darvas quotes:

“My only sound reason for buying a stock is that it is rising in price. If that is happening, no other reason is required. If that is not happening, no other reason is worth considering.” – Nicolas Darvas

“I knew… that I had to keep rigidly to the system I had carved out for myself.” – Nicolas Darvas

“I was successful in taking larger profits than losses in proportion to the amounts invested.” – Nicolas Darvas

“I decided to let my stop-loss decide.” – Nicolas Darvas (Speaking on when to exit an up trending stock).

“I also learned to stay out of bear markets unless my individual stocks remain in their boxes or advance.” – Nicolas Darvas

“I believe in analysis and not forecasting.” – Nicolas Darvas

“I became over-confident, and that is the most dangerous state of mind anyone can develop in the stock market.” – Nicolas Darvas

“I decided never again to risk more money than I could afford to lose without ruining myself.” – Nicolas Darvas

“All a company report and balance sheet can tell you is the past and the present. They cannot tell the future.” – Nicolas Darvas

“I made up my mind to buy high and sell higher.” – Nicolas Darvas

“I accepted everything for what it was-not what I wanted it to be.” – Nicolas Darvas

“I keep out in a bear market and leave such exceptional stocks to those who don’t mind risking their money against the market trend.” – Nicolas Darvas

Darvas said he never sold short. “I have never done it myself because psychologically I am not cut out for short selling. But I think markets have now changed their character so much that all experienced investors should seriously consider it. It is not for the proverbial widows and orphans, though.”

Nicolas Darvas is one of the true legends in trading history by both making millions of dollars in the stock market and keeping it and also sharing his story and strategy with readers through his books. Here is a list of all the books published by Nicolas Darvas, there are several that many traders don’t know exist: The Full List.