Michael Burry has been very vocal on Twitter voicing his opinions and predictions over the past year. However he deletes them after tweeting and also deactivates his account at times. Let’s look at what he has said.

Stock Market Predictions for 2022

Dr. Michael J. Burry, who accurately predicted the 2008 subprime crisis and was the central figure in the book and film The Big Short, has been one of the biggest bears on the financial markets and the American economy over the past 18 months. He has forecasted another market crash in 2022 based on underlying economic fundamentals, debt, and monetary policy.

Based on his tweets he believes that the 2020 rebound was too fast and that the fundamental values of stocks are far too high based on fundamental P/E ratios. It appears he believes the stock market could drop 50% from the highs to return to a normal historical valuation based on earnings.

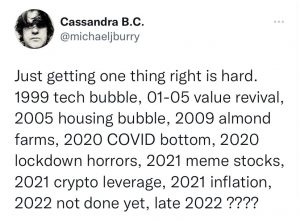

— Michael Burry Archive (@BurryArchive) May 3, 2022

He believes late 2022 will be a crash similar to the end of the dotcom bubble, housing bubble crises, and Covid year plunge.

Michael Burry Twitter Archive

Here is a link to a Twitter account that archives Burry’s tweets: Michael Burry Archive @BurryArchive.

Michael Burry twitter account: Cassandra B.C. @michaeljburry. He recently lost his blue checkmark verification after he deactivated his account repeatedly.

Current Michael Burry Portfolio 2022

Where does Burry have his capital? Here is the current portfolio of Michael Burry as of his 13F filing on 3-31-2022. The total current market value of his portfolio holdings is $201,379,000, with his top 10 holdings 94.14% of his portfolio. Michael Burry has a new Apple bet using 206,000 put options to short it.

Top 12 Holdings

Rank/Ticker/Company/Position Size/Market Value/% of Portfolio

- AAPL / APPLE INC (PUTS) 206,000 $35,970,000 (17.86%)

- BMY / BRISTOL-MYERS SQUIBB CO 300,000 $21,909,000 (10.88%)

- BKNG / BOOKING HOLDINGS INC 8,000 $18,788,000 (9.33%)

- DISCK / DISCOVERY INC-C 750,000 $18,728,000 (9.3%)

- GOOGL / ALPHABET INC-CL A 6,500 $18,079,000 (8.98%)

- CI / CIGNA CORP 75,000 $17,971,000 (8.92%)

- FB / FACEBOOK INC-CLASS A 80,000 $17,789,000 (8.83%)

- OVV / OVINTIV INC 300,000 $16,221,000 (8.06%)

- NXST / NEXSTAR MEDIA GROUP INC 76,200 $14,362,000 (7.13%)

- STLA / STELLANTIS NV 600,000 $9,762,000 (4.85%)

- GPN / GLOBAL PAYMENTS INC 66,700 $9,127,000 (4.53%)

- SPWH / SPORTSMAN’S WAREHOUSE HOLDINGS 250,000 $2,673,000 (1.33%)