With the globalization of world trade, national economies have never been more interrelated which means that when one country slows down it can have a ripple effect across the entire world.

Below are the world’s top export countries that shipped the highest dollar value in exports during 2021 and the growth over 2020.

1. China $3,026,233,691,000 +16.8% (trillions)

2. United States $1,753,941,406,000 +23.1% (trillion)

3. Germany $1,626,387,793,000 +17.9% (trillion)

4. Japan $757,460,945,000 +18.2% (billions)

5. Netherlands $691,826,642,000 +25.5% (billions)

6. Hong Kong $672,153,980,000 +21.9% (billions)

7. South Korea $644,438,622,000 +25.7% (billions)

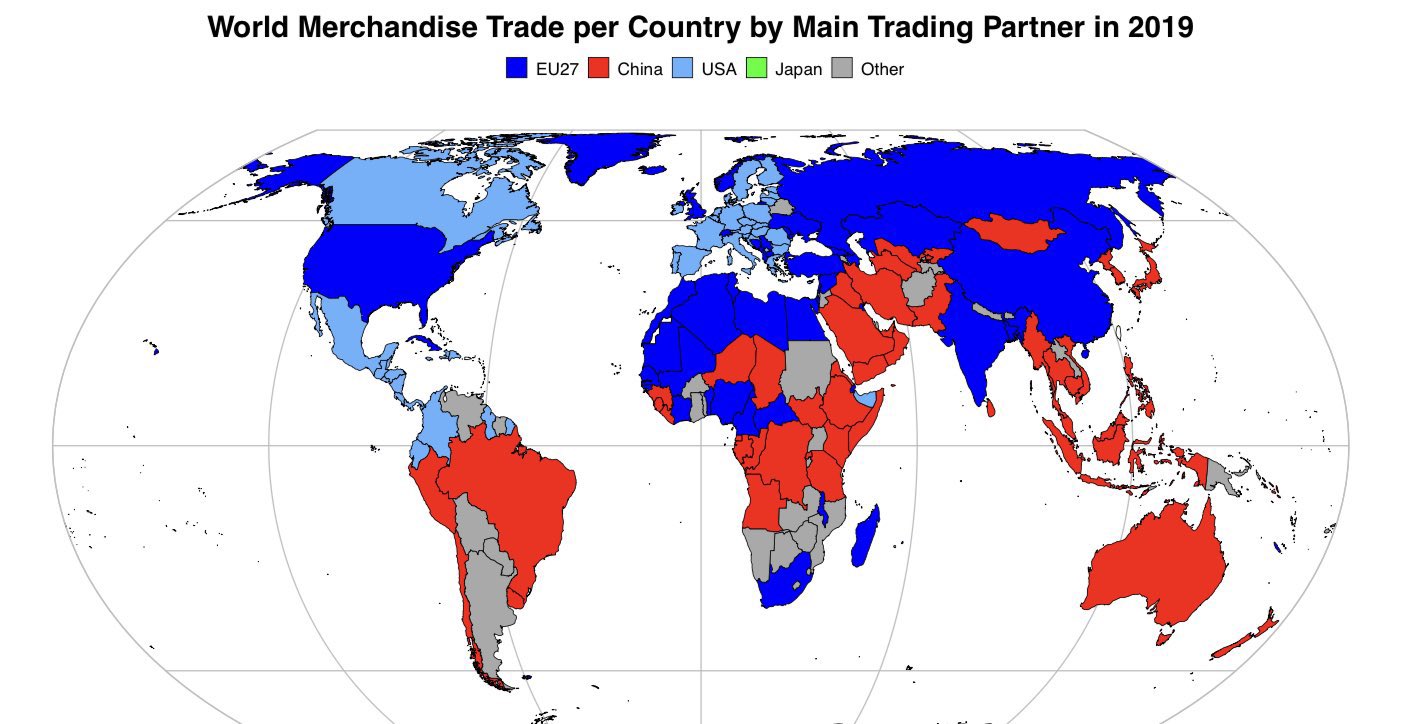

Here is a map of the primary world trade partners for each country before the pandemic and the Ukraine invasion.

China is the primary world exporter of goods creating almost the amount of exports of the U.S and Germany combined. Their weak currency, cheap labor, and cheap shipping costs has held down the world’s inflation for decades. Their economy has grown into one of the biggest in the world with the U.S. now as their only individual country in competition for top economic power and GDP.

Here is a list of top countries by gross domestic product.

- United States $25.35 trillion.

- People’s Republic of China $19.91 trillion.

- Japan $4.91 trillion.

- Germany $4.26 trillion.

- India $3.53 trillion.

- United Kingdom $3.38 trillion.

- France $2.94 trillion.

China Economic System

China has one of the world’s largest economies and is the world’s biggest exporter, but its income per capita is below the world average of all nations. In 2021, the median per capita disposable income of residents in China was 29,975 yuan ($4,310 dollars), an increase of 8.8%, and the median was 85.3% of the average.[1]

China’s high growth based on resource-intensive manufacturing, exports, and low-paid labor has largely reached its limits and has led to economic, social, and environmental imbalances. Reducing these imbalances requires shifts in the structure of the economy from manufacturing to high value services, and from investment to consumption.[2]

The Chinese economy is a mixture of state capitalism and publicly traded corporations with the government and communist party acting as the most powerful player in the markets and deciding what they will allow companies to do. However, China does have a stock market where shareholders can own stock and corporations can operate with executives separate from the government that create profits for their investors. China operates on the world stage as a capitalist competing with other countries industries and businesses.

The CCP (Chinese Communist Party) wields expanding power over almost all areas of political and economic activity in China. It’s this feature of China’s state capitalist system—the expansive and expanding role of the CCP—that poses the most significant challenges not only in how the workings and structure of China’s economy are understood, but also in how market economies can and should respond to this competition on the world economic stage as China has won in exports.[3]

China currently holds just under $1 trillion in U.S. treasuries and is the nation that holds the most U.S. debt. If they ever sold the debt to raise currency it would send the treasuries price down and yields up as the debt markets tried to absorb that level of selling. The U.S. pays China interest on that debt.

China Economic Crises

China’s Zero-Covid approach during the pandemic rested on a 76-day mass lockdown, mass testing, intense surveillance, isolation, quarantines, and border closures. This broke their supply chains and hurt their national GDP in an all out attempt to stop the spread of the virus.

Since August 20, 2022 at least 74 cities with a combined population of 313 million have imposed lockdowns that cover entire cities, districts or multiple neighborhoods, according to CNN’s calculations.

“No part of China’s economy is untouched by the tightening of zero-covid policies,” Craig Botham, chief China economist at Pantheon has said.

China’s consumer and factory data missed expectations in July.

Chinese retail sales grew by 2.7% in July from a year ago, the National Bureau of Statistics said Monday. That’s well below the 5% growth forecast by a Reuters poll, and down from growth of 3.1% in June.

Industrial production rose by 3.8%, also missing expectations for 4.6% growth and a drop from the prior month’s 3.9% increase.

Investment into real estate fell at a faster pace in July than June, while investment into manufacturing slowed its pace of growth.[4]

Both supply chains breaking and the cost of shipping has dramatically increased the costs of Chinese imports around he world. The bigger the item and the higher the shipping costs based on weight and space the larger the impact on the item’s price.

The increase in goods takes money directly out of the world economy, so this has had a huge impact on consumers across the globe leading to increases in people turning to credit cards for daily purchases.

The Chinese economy has slowed its pace of growth and has begun to see a negative trend in economic production and expansion.

China Economic Collapse

The Chinese real estate sector is currently going through what looks like what happened during the 2008 financial crises in the U.S. with extreme speculation in real estate as it looks like an investment that always goes up.

The real estate risk has evolved into companies going bankrupt in the sector and investors not getting the properties delivered that they paid for.

Modern Land China Co. filed for Chapter 15 bankruptcy in New York last week, a move that allows the company to protect its U.S. assets while implementing a restructuring elsewhere.

Evergrande was once China’s top-selling property developer but has for months been struggling under the weight of more than $300 billion of debts, of which around $20 billion is held by investors from outside China. Crisis-hit Chinese property giant Evergrande says that one of its subsidiaries has been ordered to pay out 7.3 billion yuan (£888.7 million; $1.08 billion) for failing to honor its debt obligations. This is technically the first sign of a debt default.

A top arranger for Chinese junk dollar bonds says that a type of filing under the US bankruptcy code will play an important role for China’s distressed developers to restructure debt, buying them time to pay back creditors until markets recover. They predict more Chapter 15 bankruptcies.[5]

China’s property crisis is estimated to have wiped more than a trillion dollars off the value of the sector last year. [6]

As property developers run out of funding to finish properties, a growing number of buyers in China have stopped making mortgage payments on incomplete homes. Here’s what a 590-word letter penned by angry purchasers of the half-built Dynasty Mansion project for China Evergrande Group to complete homes they’d long been paying for said after they were not listened to: “All homebuyers with outstanding mortgage loans will stop paying,” unless construction resumes before Oct. 20, they threatened. [7]

The old economic phrase “When America sneezes, the world catches a cold” could now apply to China. This is much more serious than a cold.