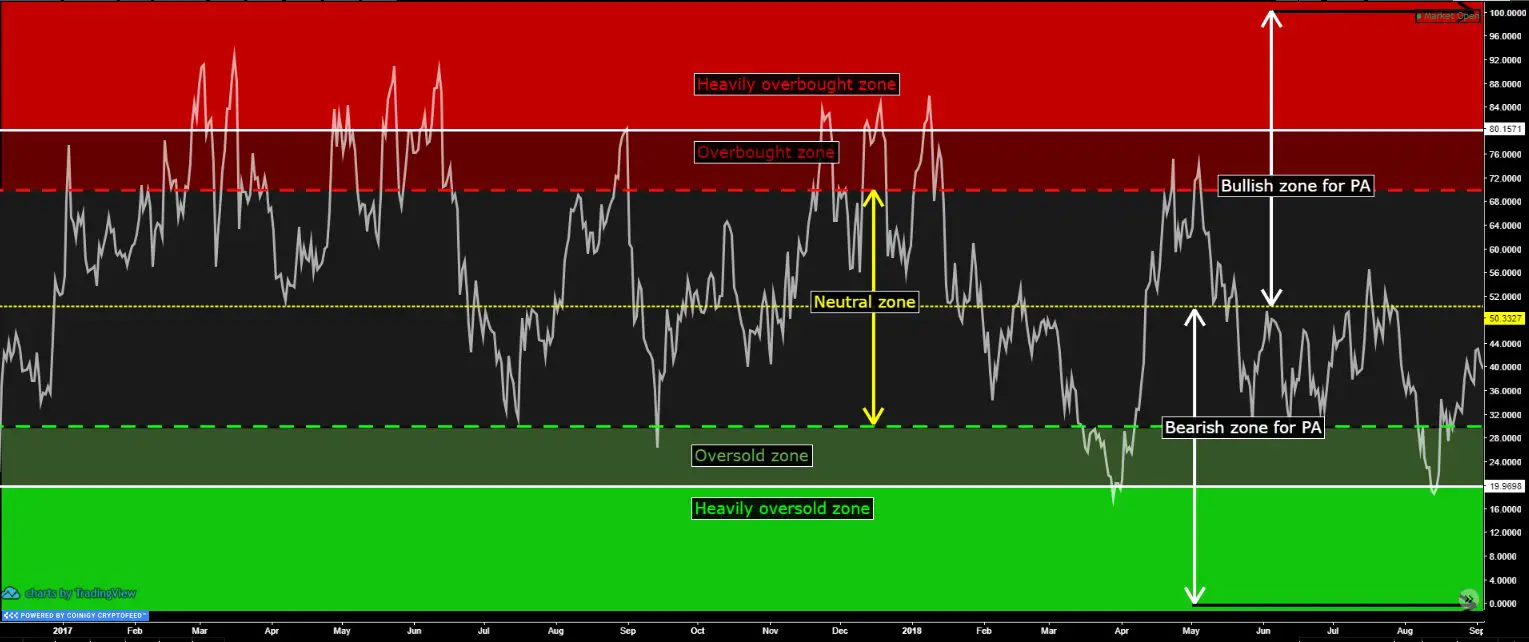

The RSI technical indicator buy and sell signals are based on oversold and overbought conditions on a price chart. The RSI is a measurement of price moving too far and too fast in one direction, and as the RSI gets extended farther from the 50 RSI middle line, the probability of a reversion to that mean increases.

The Relative Strength Indicator (RSI) is a momentum oscillator that measures the speed and magnitude of the change in price over a period of time. The RSI moves in a bounded range between zero and 100. I use the RSI on the (14) setting on the daily chart. The RSI is generally overbought when its reading is above 70 and oversold when it reads below 30. Signals can also be generated by looking for divergences between RSI and price action, as one makes a higher high or lower low and the other doesn’t. A divergence shows the relation between the RSI and current price action is becoming uncorrelated, and the price may be about to change direction from the primary trend. RSI divergence signals show traders when price action and RSI no longer show the same momentum.

The RSI is one of the most popular oscillators used in technical analysis.

The RSI works best in range-bound markets to identify potential support and resistance boundaries. In a strongly trending market, a break above the 70 RSI can be a short-term momentum signal to the upside, and a breakdown below the 30 RSI can signal the start of a deeper downtrend in the short term. As a trend continuation indicator, breaking the 30 or 70 RSI boundaries can signal a potential parabolic move beginning that can’t be contained in the near term. Approximately 95% of price action on a chart tends to happen inside the bounds of the 70/30 RSI resistance and support levels.

Parabolic breakouts below 30 or above 70 on a closing basis and centerline price crossovers can signal momentum trades in the breakout direction. RSI can also be used to identify the current market trend, as the price is generally above 50 RSI in an uptrend and below 50 RSI during a downtrend. If RSI leaves the bounds of the 30/70 RSI reading range, it can signal a parabolic move outside the normal historical range. Once RSI returns under 70 or over 30 then that creates a reversal signal with the potential to reach back to the 50 RSI middle line.

Think of the RSI as a risk/reward quantifier, and the reward diminishes for long positions as a stock chart reaches the 70 RSI zone, and the short sellers can see less potential reward as the RSI moves near the 30 RSI zone. The odds of a successful dip buy increase as a chart reaches near the 30 RSI, and short selling has a greater chance of success near the 70 RSI inside the normal bounds of the RSI.

In downtrends, a chart can see a key price bounce zone near the 30 RSI zone, but a resistance area comes into play at the 50 RSI. In uptrends, a chart can see dip buyers come in at pullbacks to the 50 RSI and see resistance at the 70 RSI.

The most common chart context used for the RSI is a setting at a 14-day parameter and on a daily chart. An RSI can be used on all timeframes. Still, it should be looked at historically for a reference point on how it should work on a specific chart in a trading time period based on historical price action behavior. Some stock charts tend to go parabolic, some tend to trend to those boundaries, and others can go sideways for long periods.

I like to use the RSI as an entry signal looking to buy the best stocks or index ETFs when the price is near the 30 RSI reading. I prefer bounces at the 30 RSI to confirm support or breaks under and back over the 30 RSI to confirm it is near the bottom. The 50 RSI is usually a good reward target on a 30 RSI entry.

When I am long during uptrends, I look to exit and lock in profits when the 70 RSI starts to become resistance. If the price breaks above and closes higher than the 70 RSI, I will hold my long position as the potential of a parabolic uptrend increase.

I look at the RSI chart as an oscillator that measures the risk/reward ratio. As it nears 30, the reward favors the buyer as a stock or index has moved too far down too fast and could be due for a bounce. At the 70 RSI, the reward for long positions has started to diminish in most cases as a stock or index becomes overbought after going up too fast. It’s more probable that a stock can move from 50 to 70 RSI than from 70 RSI to 90 RSI. Not impossible, just less likely in the majority of cases.

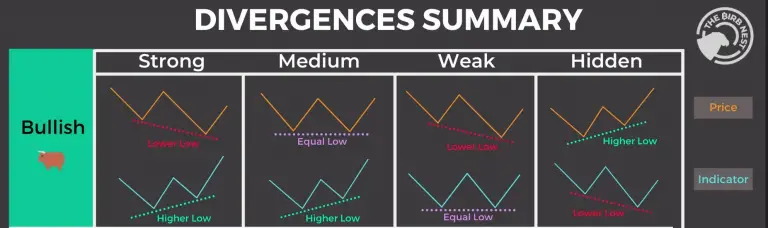

If a chart has an RSI divergence, then the chart’s relative strength index (RSI) has lower highs when the price is at a higher high, or the RSI makes higher lows when the price makes new lower lows. It’s an RSI divergence when RSI stops breaking out to higher highs during an uptrend in price or breaks down to lower lows during an uptrend.

A divergence signals that the current trend in the time frame on the chart has lost momentum. This is a possible signal and setup to bet on a reversal in the direction of the market price action. An RSI divergence indicates that the indicator does not agree with the price action.

Bullish Divergence RSI

A bullish RSI divergence pattern is defined on a chart when the price makes new lower lows, but the RSI technical indicator doesn’t make a new low simultaneously. This signals that bearish sentiment is losing momentum with the high probability that buyers are stepping in, and the market may be near the bottom of the chart’s time frame. In many instances, a bullish divergence can be the key indicator on a chart that signals the end of a downtrend and that the risk/reward ratio has shifted in the favor of the bulls.

Strong Bullish Divergence

Price makes a lower low, but the RSI indicator makes a higher low.

Medium Bullish Divergence

Price makes an equal low, but the RSI indicator makes a higher low.

Weak Bullish Divergence

Price makes a lower low, but the RSI indicator makes an equal low.

Hidden Bullish Divergence

Price makes a higher low, but the RSI indicator makes a lower low.

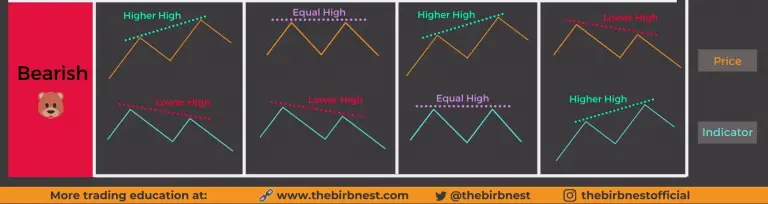

Bearish Divergence RSI

A bearish RSI divergence pattern is defined on a chart when prices make new higher highs, but the RSI technical indicator doesn’t make a new high simultaneously. This signals that bullish sentiment is losing momentum with the high probability that sellers are stepping in, and the market may be near the top of the chart’s time frame. In many instances, a bearish divergence can be the key indicator on a chart that signals the end of an uptrend and that the risk/reward ratio has shifted in the favor of the bears.

Strong Bearish Divergence

Price makes a higher high, but the RSI indicator makes a lower low.

Medium Bearish Divergence

Price makes an equal high, but the RSI indicator makes a lower high.

Weak Bearish Divergence

Price makes a higher high, but the RSI indicator makes an equal high.

Hidden Bearish Divergence

Price makes a lower high, but the RSI indicator makes a higher high.

RSI Divergence Strategy

The RSI divergence strategy is to buy the dip during a bullish RSI divergence or sell short near the end of an uptrend during a bearish RSI divergence. This can create one of the best risk/reward ratios when a long-term trend is losing momentum and about to reverse in the opposite direction. Of course, stop losses, and trailing stops must be used to manage the trade outcome to maximize the gain or minimize the loss.

Conclusion

A market will spend most of its time inside the 30/70 RSI boundaries and rarely leaves this range. Combining the best stocks in demand with 30 RSI dips increases the odds of success as buyers want in. Parabolic extended trends are what typically break the bounds of the RSI. The value zone is 50 RSI, and the price tends to return to that area over time.

The RSI doesn’t work perfectly every time, as nothing does, so you must still use proper position sizing to manage risk and stop out for a loss when price trends beyond its boundaries, but it’s an excellent tool for quantifying the oversold and overbought parameters for items on your watch list.