The modern cycle of wage slavery and perpetual debt is an unseen force that keeps many stuck in financially precarious situations. Despite working long hours at unfulfilling jobs, getting ahead is challenging when wages no longer keep pace with the cost of living. This leads to seeking fulfillment through materialism and consumerism, which only leads to more debt. It’s an endless loop fueled by social conditioning and a society obsessed with possessions as status symbols.

Modern wage slavery refers to the concept that many people today feel trapped in unsatisfying jobs and financial situations due to factors like:

- Stagnant wages that have not kept up with the rising cost of living, making it harder to get ahead financially, leaving workers trapped in the paycheck-to-paycheck cycle

- The standard 40-hour work week was created in a different economic era and does not provide the same standard of living that it once did

- Feeling obligated to stay in an unfulfilling job due to financial constraints and lack of better options

- Having little autonomy or control over one’s time and schedule due to job demands

- Relying on consumerism and material possessions to fill the void left by job dissatisfaction, which leads to a cycle of debt

- Societal conditioning and social pressures that equate material wealth and possessions with status and value

- Being stuck chasing the promise of retirement for most of one’s adulthood rather than finding purpose and meaning through work

Overall, “modern wage slavery” evokes the idea that many people feel trapped financially, unable to leave jobs they dislike, and obligated to devote most of their lifetime to unfulfilling work – like a form of modern slavery, but tied to wages rather than literal servitude. It’s a systemic cycle driven by economic, social, and psychological factors.

The 40-hour work week it made sense in the industrial era when it drastically improved working conditions and hours. But in the modern age, sticking to an antiquated system no longer provides the means for financial stability for most families. Dissatisfaction with work bleeds into mental health issues and destructive coping outlets.

Breaking the cycle requires self-awareness, intentional goal-setting, and recognizing the power of our choices. We can regain control of our precious time by embracing minimalism, taking control of finances, and creating a career aligned with purpose. It will take time and effort, but we can build lives of greater meaning with small, consistent steps in the right direction.

The keys are understanding the psychological forces at play, forming strategies to counteract them, and remaining focused on values, not materialism. Fulfillment comes from within, not from possessions. By recognizing that, we can work towards lives defined by freedom rather than modern wage slavery.

We Live in a Society Obsessed with Material Possessions

Our society today is focused on acquiring material goods and possessions. People define their selves and each other by the things they own – the clothes they wear, the cars they drive, the gadgets they have. Even if most people don’t want to admit it, they have an addiction to “things” that started from a young age. Psychologists note that this materialism stems from the need to display status and success to others. A large-scale study of over 1,500 adolescents found that those who valued materialism tended to have lower self-esteem (Chaplin and John, 2010). Material possessions have become a crutch to help us feel worthy.

The 40 Hour Work Week Was Created in a Different Era

The 40-hour work week was established in the early 20th century during the Industrial Revolution. It was seen as a significant improvement over working 12-16 hour days. But our world today is radically different – the wages from a standard 9-5 job are rarely enough to save and get ahead financially. Studies show that real wages have remained stagnant since the 1970s while living costs have dramatically increased (Economic Policy Institute, 2022). This means the 40-hour grind no longer provides the same standard of living it did generations ago.

Putting Over 25% of Your Time Into an Unfulfilling Job Has Consequences.

Spending over 25% of your waking hours at a job you dislike will take an emotional toll over time. Just like going to the gym builds muscle, going to an unenjoyable job degrades your spirit incrementally. Before you know it, you feel dissatisfied with life even though you can’t pinpoint what’s wrong. Research by Gallup shows only 34% of US workers are engaged at their jobs. This lack of fulfillment leads to poorer mental health and general well-being.

Our Brains Have Been Wired Since Childhood to Crave Rewards

From an early age, our brains learn to associate gifts and presents with happiness and love through experiences like birthday parties. This conditions us to crave that same feeling through buying things as adults. It’s an addiction that’s embedded in our psyche. Psychologists note that rewards like presents flood our brains with dopamine, creating pathways reinforcing our expectations for future tips. This makes materialism intrinsically rewarding.

Working a Job, You Dislike Leads to “Making Up For It” in Other Areas

To compensate for the time at an unfulfilling job, people try to “make up for it” during their free time by indulging in treating themself to things like fancy gadgets, new cars, home upgrades in size, and more. It provides short-term happiness but, more significantly, long-term debt. A 2021 study found that those dissatisfied with their jobs were significantly more likely to overspend as a coping mechanism (Klontz et al., 2021). This provides temporary relief but is ultimately financially destructive.

The More You Try to Escape, the Further You Sink Into Debt

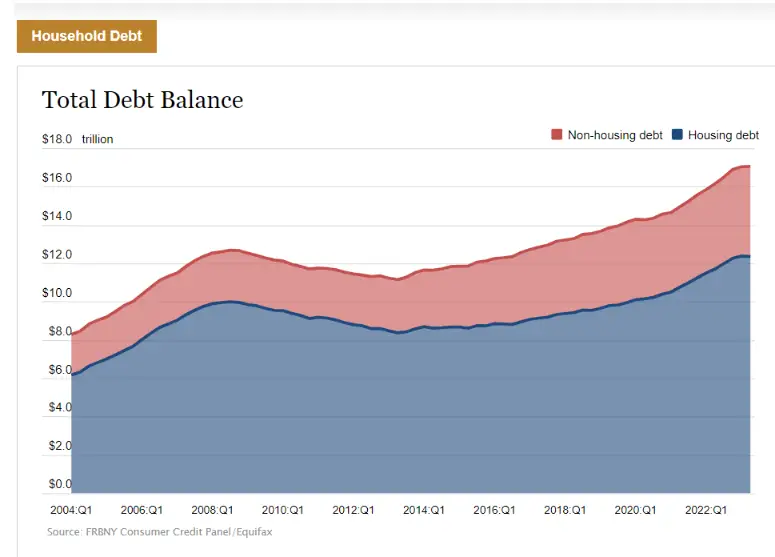

The more expensive items you buy to bring back meaning and joy to your life, the further in debt you slide. People get stuck in a vicious cycle of working to pay for things that they hoped would provide freedom and happiness in the first place. Reports show consumer debt has steadily risen as more Americans use it as a band-aid solution for stagnating wages and living costs. This debt trap leads to even longer being stuck in an unsatisfying job.

Household Debt and Credit Report – FEDERAL RESERVE BANK of NEW YORK –

Awareness Is the First Step to Breaking the Cycle

Like any habit, the first step is becoming aware of this cycle of debt and wage slavery. Understand how you’re trading your time for consumer goods that provide fleeting happiness yearly. Count the months and years at your job – what do you have to show for it? Experts agree the foundation of change is self-awareness and consciously observing your thoughts and behaviors. Only then can the cycle be broken.

Consider Embracing Minimalism to Control Spending

One solution is to embrace minimalism – reducing spending and possessions to focus on simpler joys in life. You don’t have to go overboard, but carefully consider each purchase and avoid impulse buys whenever possible. Minimalist lifestyles can significantly reduce anxiety, increase gratitude, and promote sustainable behaviors. Minimalism helps control the materialism urge.

Take Action to Escape the Cycle, Whether Through New Careers or Early Retirement

Build a long-term plan to get out of a soul-crushing job, whether shifting to a new career that provides meaning or aggressively saving to retire early. Join communities like FIRE to take control of your savings. Having an exit plan is critical to coping with an unfulfilling job. Taking purposeful steps provides hope.

Form a Long-Term Plan to Regain Control Over Your Time and Life

The only way out is to become aware of the cycles limiting you and plan to escape. It won’t happen overnight, but you can regain control over your precious time with focus. Intentional goal-setting and planning can help overcome consumer impulses and break free of dissatisfying work. You have the power to change your situation.[1]

Key Takeaways

The Essentials

- Our consumeristic society leads us to seek status and self-worth through material possessions

- Wages have not kept pace with living costs, making it harder to get ahead financially

- Spending 25%+ of time at an unfulfilling job degrades wellbeing over time

- Our brains have been conditioned since childhood to crave material rewards

Breaking Free

- Dissatisfaction with work leads to “retail therapy” and short-term mood fixes

- Trying to fill the void through spending causes increasing debt

- Becoming aware of the cycle is the first step to change

- Embracing minimalism can help control unnecessary spending

- Creating an exit plan provides hope and a way out

Moving Forward

- Set long-term goals to escape soul-crushing work

- Join communities to help take control of finances

- Regain command over your time and life through planning

Conclusion

This modern cycle of wage slavery and debt is driven by engrained materialism and unfulfilling work. Despite generations of societal conditioning, we can break free through self-awareness, minimalist living, and actively working towards a meaningful career, entrepreneurship, or early retirement. With focused effort, we can regain control over our time, finances, and ultimate purpose in life. The path will take much work, but remain grounded in your values and priorities. Fulfillment, not possessions, paves the road to prosperity. Keep your expenses at a level that keeps you free to change your career when you’re not happy. When you control your finances, you stay in control of your life.