Understanding average income across different states is more than just a curiosity—it’s a crucial factor influencing your career choices, lifestyle, and even where you put down roots. Whether you’re eyeing a job relocation or simply understanding economic trends, this article offers valuable insights into how salaries vary from state to state, what contributes to these differences, and how to make this information work for you.

Average Salary by State in 2023

Source: Forbes Advisor

| State | Annual Average Wage | Average Hourly Wage |

|---|---|---|

| Mississippi | $45,180 | $21.72 |

| Arkansas | $48,570 | $23.35 |

| West Virginia | $49,170 | $23.64 |

| South Dakota | $49,890 | $23.99 |

| Alabama | $50,620 | $24.32 |

| South Carolina | $50,650 | $24.35 |

| Louisiana | $50,940 | $24.49 |

| Oklahoma | $50,940 | $24.49 |

| Idaho | $51,350 | $24.69 |

| Kentucky | $51,490 | $24.76 |

| Montana | $52,200 | $25.11 |

| Tennessee | $52,820 | $25.39 |

| Kansas | $52,850 | $25.41 |

| Indiana | $53,500 | $20.24 |

| Iowa | $53,520 | $25.73 |

| New Mexico | $54,400 | $26.15 |

| Wyoming | $54,440 | $26.17 |

| Missouri | $54,520 | $26.21 |

| Nebraska | $55,070 | $26.48 |

| Nevada | $55,490 | $26.68 |

| North Dakota | $55,800 | $26.83 |

| Maine | $55,960 | $26.90 |

| Florida | $55,980 | $26.91 |

| Wisconsin | $56,120 | $26.98 |

| North Carolina | $56,220 | $27.03 |

| Ohio | $56,530 | $27.18 |

| Texas | $57,300 | $27.55 |

| Utah | $57,360 | $27.58 |

| Georgia | $58,000 | $27.88 |

| Michigan | $58,000 | $27.88 |

| Pennsylvania | $58,470 | $28.11 |

| Arizona | $58,620 | $28.18 |

| Vermont | $59,190 | $28.46 |

| Hawaii | $61,420 | $23.35 |

| Delaware | $62,260 | $29.93 |

| New Hampshire | $62,550 | $30.07 |

| Oregon | $62,680 | $30.14 |

| Minnesota | $63,640 | $30.60 |

| Illinois | $63,930 | $30.73 |

| Rhode Island | $64,530 | $31.03 |

| Virginia | $65,590 | $31.54 |

| Alaska | $66,130 | $31.79 |

| Colorado | $67,870 | $32.63 |

| Connecticut | $69,310 | $33.32 |

| Maryland | $69,750 | $33.53 |

| New Jersey | $70,890 | $34.08 |

| Washington | $72,350 | $34.79 |

| California | $73,220 | $35.20 |

| New York | $74,870 | $36.00</td |

The Importance of Understanding Average Income by State

Understanding the average income by state is crucial for various reasons. Whether you’re considering relocating for a job, comparing salaries in your industry, or simply curious about economic trends, this information can offer valuable insights. It can help you make informed career, lifestyle, and retirement planning decisions.

Nationwide Averages: A Bird’s Eye View

According to Forbes Advisor, the nationwide average annual salary in the US for 2023 is $59,428, with an average hourly rate of $28.34. These figures serve as a baseline for comparing individual state averages and understanding how income varies across the country.

The High Rollers: States with the Highest Average Salaries

When it comes to high salaries, some states outperform others. Massachusetts leads the pack with an average annual salary of $76,600, followed closely by New York at $74,870 and California at $73,220. These states often have thriving industries like technology, finance, and healthcare, contributing to higher average incomes.

The Underdogs: States with the Lowest Average Salaries

Conversely, states like Mississippi, Arkansas, and West Virginia have the lowest average salaries, ranging from $45,180 to $49,170. While these states may offer a lower cost of living, the income potential is also generally lower, often due to fewer high-paying job opportunities.

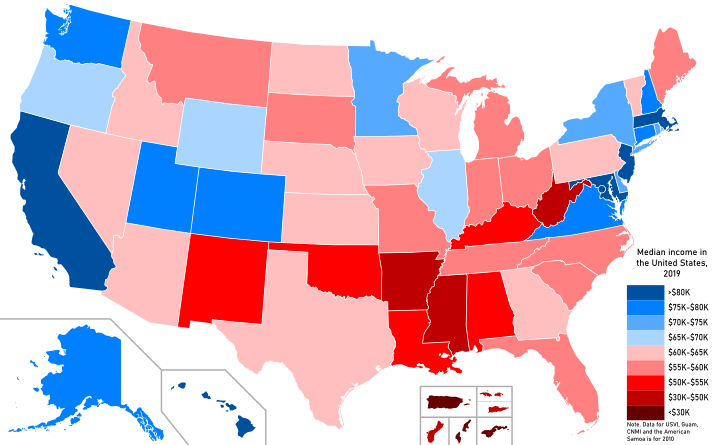

Regional Averages: How Geography Impacts Income

Geography plays a significant role in income disparity. For example, Northeast and West Coast states tend to have higher average salaries compared to the South and Midwest. This is often due to the concentration of high-paying industries and the cost of living in these regions.

Cost of Living: The Other Side of the Income Coin

While higher salaries may seem attractive, it’s essential to consider the cost of living. States with high average salaries often come with higher living expenses, negating the benefits of a larger paycheck. Therefore, weighing income against the cost of living is crucial to get a true sense of your financial well-being.

Future Trends: What to Expect in the Coming Years

As remote work becomes more prevalent, we can expect some shifts in average income by state. People may choose to live in states with a lower cost of living while working for companies based in high-salary states. Additionally, the push for minimum wage increases and equal pay could also impact state averages in the future.

If you’re not location-dependent and have the flexibility to work remotely, understanding income by state can be a game-changer for your lifestyle and financial well-being. Here’s how:

- Maximizing Earnings: You could reside in a state with a lower cost of living while working for a company based in a state with higher average salaries. You get the best of both worlds: a high salary and low living expenses.

- Tax Benefits: Different states have varying tax structures. Some states, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that have no state income tax. Note that Washington does levy a state capital gains tax on certain high earners. Living under this tax situation could result in significant savings over time. [1]

- Quality of Life: States with a lower cost of living often offer a more relaxed lifestyle, less congestion, and more affordable housing options. You can enjoy these benefits while still earning a salary that would be considered high for that area.

- Investment Opportunities: The money you save from lower living expenses can be invested in various ways, such as real estate, stock markets, or even starting your own business.

- Retirement Planning: Knowing the average income by state can help you plan your retirement better. You could choose to retire in a state where your savings and investments will last longer due to a lower cost of living.

- Family Planning: If you’re considering starting a family, some states offer better educational systems, healthcare, and overall quality of life. Your high remote salary could allow you to afford these benefits easily.

- Negotiation Leverage: Knowing the average income in various states can give you the upper hand if you’re job-hunting or negotiating a raise. You can argue for a salary that matches higher state averages, even if you live in a state where the cost of living is lower.

- Career Growth: Finally, if you switch to a job that requires you to be on-site, you’ll have a better idea of what salary to expect based on your chosen location.

You can optimize your income, savings, and overall quality of life by strategically choosing where to live. It’s not just about earning more; it’s about making your money work smarter for you.

Actionable Insights From This Information

- Consider Relocation: If you’re in a flexible career, consider moving to a state with a higher average salary and reasonable cost of living.

- Negotiate Your Salary: Use this data as a bargaining chip during salary negotiations.

- Career Planning: If you’re entering the job market or considering a career change, look at which states offer the best opportunities in your field.

- Investment and Retirement: Understanding income averages can aid investment and retirement planning.

Key Takeaways

- State-Specific Earnings: Salaries can vary widely depending on your geographic location.

- National Baselines: The US median income is a helpful benchmark for state-level comparisons.

- Top Earners: States like Massachusetts, New York, and California lead in income.

- Lower-Tier States: Mississippi, Arkansas, and West Virginia offer the least financial rewards for employment in their states.

- Geographic Influence: Your location can significantly affect your earning potential.

- Living Expenses: High salaries often come with elevated costs, affecting your net income.

- Future Outlook: Remote work and legislative changes will likely reshape income by state and geography.

- Practical Wisdom: Use this data for career moves, salary talks, and long-term financial planning.

Conclusion

Comprehending the variances in state-by-state income is pivotal for making enlightened career and lifestyle choices. Balancing your earnings against living expenditures provides a more nuanced understanding for financial planning. As the work environment evolves, so will the income metrics, offering fresh avenues for maximizing your financial gains. This knowledge is informative and actionable, serving as a roadmap for your future financial journey.