According to a working paper from the National Bureau of Economic Research, 15.7% of NFL players have filed for bankruptcy within twelve years of retiring.[1]

The National Football League (NFL) is known for its high-energy games and the astronomical salaries of its players. However, despite these lucrative incomes, many NFL athletes struggle financially after their careers end.

In the high-stakes world of professional football, NFL athletes often grapple with financial challenges that seem at odds with their substantial earnings and public image. This paradox, where famous football stars face monetary struggles, is a complex issue rooted in various factors. These athletes, celebrated for their on-field prowess, frequently encounter a harsh reality off the field, marked by financial instability and the risk of going broke.

This article delves into the myriad reasons behind this phenomenon, exploring everything from the fleeting nature of an NFL career to the pitfalls of inadequate financial planning and education.

The financial struggles of many NFL athletes after their careers can be attributed to several key factors:

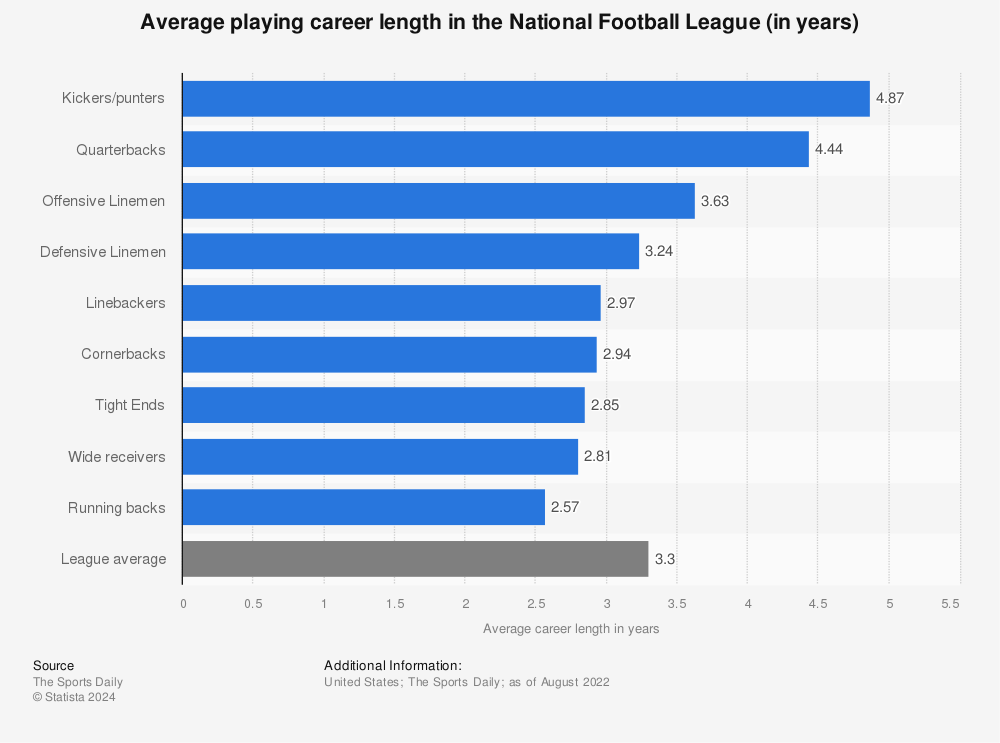

- Short Career Span and Earnings Window: NFL careers are typically short, often around three years. Players have a limited time to earn a significant income, making it challenging to sustain their lifestyle post-retirement without long-term financial planning.

- Lack of Financial Literacy and Education: Many players enter the league young and inexperienced in managing large sums of money. This lack of financial literacy can lead to poor investment decisions and economic mismanagement.

- High Lifestyle Expenses and Peer Pressure: Player’s spending on luxury cars, expensive jewelry, and custom items reflects a culture of high expenditure among athletes. This includes maintaining an extravagant lifestyle and succumbing to peer pressure, leading to significant cash outflows.

- Tax Implications and Mismanagement: Athletes often don’t fully account for the high taxes on their income. A significant portion of their earnings goes to taxes, reducing their wealth.

- Poor Investment Choices and Asset Management: They can make bad purchases in depreciating assets like custom luxury cars and custom jewelry that don’t hold their value. Athletes often make high-risk investments without proper guidance, leading to financial losses.

- Family and Social Obligations: Many athletes from humble backgrounds feel obligated to support family and friends, leading to additional financial burdens.

- Continued Spending Post-Career: Athletes often continue their high spending habits even after their income has decreased or stopped. This includes maintaining expensive properties, cars, and lifestyles they can’t afford.

- Lack of Trustworthy Financial Advisors: Some athletes fall victim to unscrupulous financial advisors, leading to mismanagement of funds or fraud.

- Inadequate Post-Career Planning: Many athletes don’t plan for a career post-retirement, leaving them without alternative income sources when their sports career ends.

Keep reading for a deeper dive into these factors that can lead to financial troubles for retired NFL players.

The Challenge of a Short NFL Career

The average NFL career is surprisingly short, lasting about 3.3 years on average. This limited timeframe to earn significant income poses a considerable challenge. The league is considered one of the world’s most physically demanding sports leagues, with players regularly exposed to hard hits and collisions. Players often enter the league in their early 20s and retire before they hit 30. This short career span means they have less time to accumulate wealth than other professions, making it crucial to manage their finances wisely during their active years.

Find more statistics at Statista

Navigating Financial Literacy as a Young Athlete

Many young NFL athletes are suddenly thrust into wealth without the financial education to manage it. Coming straight from college, or sometimes even high school, they often lack experience in handling large sums of money. This gap in financial literacy can lead to mismanagement, as players may not understand how to invest wisely or appreciate the value of savings.

The High Cost of Maintaining an NFL Lifestyle

The lifestyle of an NFL player is often characterized by luxury. Expensive cars, lavish homes, and designer clothing become symbols of success. However, maintaining such a lifestyle is costly. Peer pressure and a desire to fit into the sports celebrity culture can drive athletes to spend beyond their means, leading to a significant financial drain.

Tax Implications: A Substantial Drain on Earnings

Taxes can take a massive bite out of NFL salaries. Athletes are often in the highest tax brackets and have additional considerations like state and federal taxes, agent fees, and other deductions. These can significantly reduce their take-home pay, a factor often overlooked by players unaccustomed to such complex financial matters.

The Pitfalls of Poor Investment Choices

Investment is critical to financial stability, but poor investment choices can be disastrous. Due to their high earnings, NFL athletes are often targeted for investment schemes or misguided ventures. They can fall prey to high-risk investments or scams without proper financial advice, leading to substantial monetary losses.

Family and Social Obligations: A Financial Burden

NFL athletes often feel a sense of responsibility to support friends and family. This can lead to financial strain as they fund businesses, buy homes, or cover expenses for relatives and friends. While generosity is commendable, it can lead to a significant financial burden without boundaries and budgeting.

The Dangers of Continued Spending Post-Career

After retirement, the income stream for NFL players dries up, but the spending habits often remain. This disconnect between income and expenditure can lead to rapid depletion of savings. Athletes must adjust their lifestyle post-career to align with their reduced income, a transition that many find challenging.

The Risks of Untrustworthy Financial Advisors

Trusting the wrong people with their finances can be a critical mistake for NFL players—there are numerous cases of athletes being misled or defrauded by unscrupulous financial advisors. Players must deal with reputable, knowledgeable financial professionals who have their best interests at heart.

The Need for Effective Post-Career Planning

A lack of post-career planning can leave athletes vulnerable. Many do not consider life after the NFL, failing to develop career skills or educational qualifications that could provide income post-retirement. Financial and professional planning for life after football is crucial for long-term stability.

Key Takeaways

- Brief Career Lifespan: NFL players often experience a fleeting professional tenure, emphasizing the necessity for prudent financial management.

- Financial Acumen Deficit: Young athletes frequently lack essential skills in wealth management, leading to potential financial missteps.

- Exorbitant Lifestyle Expenditures: The tendency to indulge in luxurious living can rapidly deplete financial resources.

- Taxation Impact: Hefty tax obligations can substantially erode NFL earnings, a factor often underestimated by players.

- Investment Misjudgments: Inexperienced or reckless investment ventures can result in significant capital losses.

- Obligations to Family and Community: Generosity towards relatives and acquaintances can be a considerable financial load.

- Persistent High Spending Risks: Continuing lavish spending habits post-career can lead to swift financial decline.

- Advisory Misguidance: Dependence on disreputable financial consultants can lead to exploitation and financial ruin.

- Lack of Long-Term Career Planning: Inadequate preparation for post-NFL life can leave athletes financially vulnerable.

Conclusion

The plight of financial instability among NFL athletes is multifaceted, encompassing many factors, from transient career durations and inadequate fiscal wisdom to the pressures of sustaining an opulent lifestyle.

The journey from abundant wealth to potential monetary hardship underscores how critical astute financial stewardship is for young athletes, prudent investment strategies, and the foresight to plan beyond the glitz of the gridiron.

Ingraining these disciplines is paramount for NFL stars and anyone navigating the unpredictable tides of high earnings and public scrutiny. As these athletes grapple with the unique challenges posed by their profession, the lessons drawn from their experiences resonate far beyond the football field, offering valuable insights into the universal principles of financial prudence and resilience.

The financial troubles faced by many NFL athletes stem from short career spans, a lack of financial literacy, extravagant lifestyles, heavy tax burdens, poor investment decisions, family pressures, uncontrolled post-career spending, untrustworthy advisors, and insufficient post-career planning. Addressing these issues is critical to ensure that the wealth earned during their short time in the spotlight can sustain them long after they leave the field.

These factors, combined, contribute to the financial difficulties many NFL athletes face after their playing days. Proper financial education, planning, and trustworthy advice are crucial to avoiding these pitfalls.