Many aspire to financial freedom, but few achieve it. It’s not just about having a high income; it’s about understanding how money works and making it work for you.

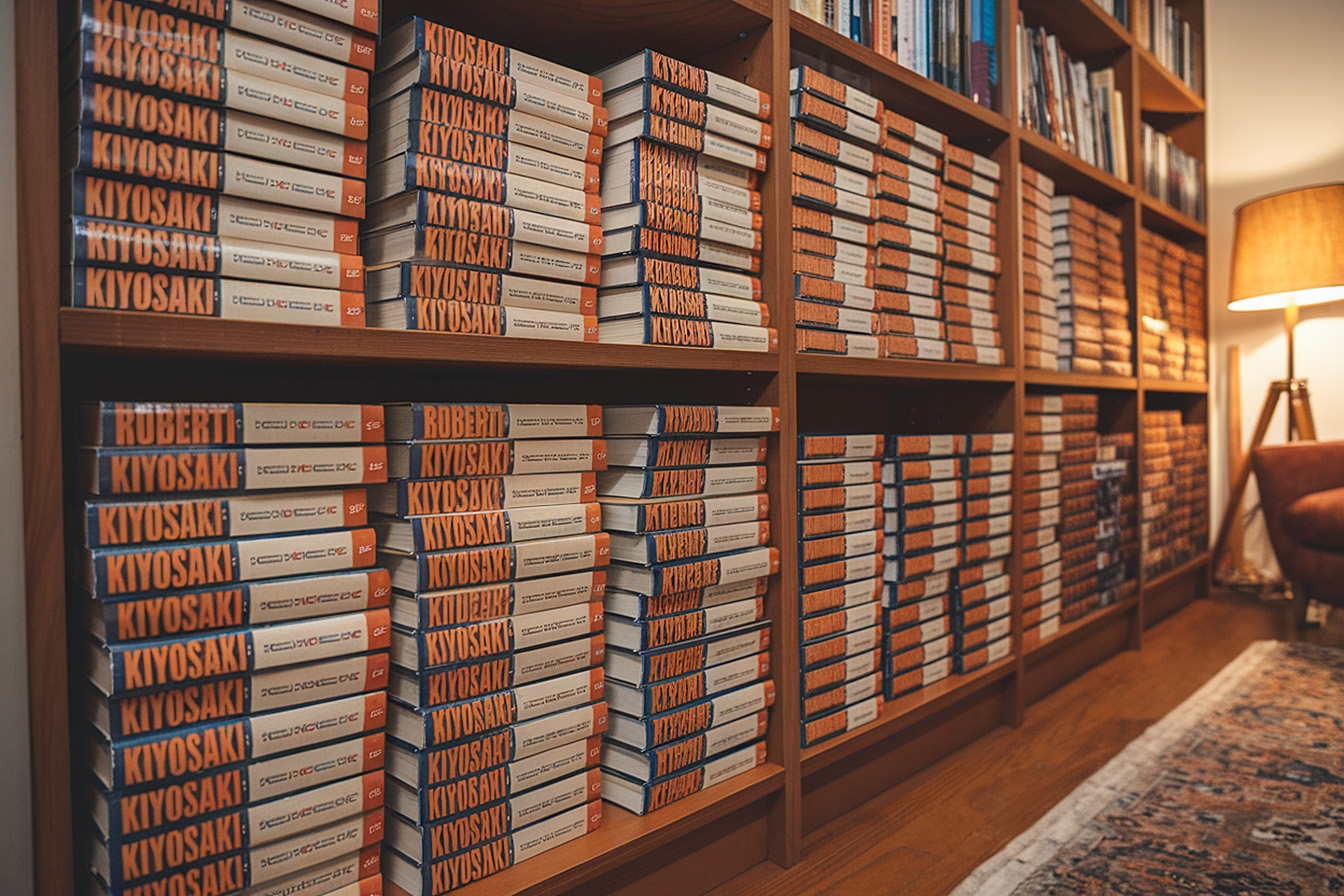

Through his series of books, Robert Kiyosaki has revolutionized how people think about money and wealth creation. His teachings challenge conventional wisdom and provide practical strategies for achieving financial independence.

Kiyosaki’s books are based on the lessons he learned from his “rich dad” (his best friend’s father) and his “poor dad” (his biological father). These contrasting perspectives on money and success form the foundation of his financial philosophy.

Diving into Kiyosaki’s works can be a transformative experience for those seeking financial freedom. Here are five essential Robert Kiyosaki books that anyone with financial freedom goals should read.

1. Rich Dad Poor Dad: The Foundation of Financial Education

Rich Dad Poor Dad” is the cornerstone of Kiyosaki’s financial education empire. Published in 1997, this book has become a classic in personal finance literature. It introduces readers to the fundamental concepts that differentiate the wealthy from the poor and middle class.

The book’s central premise is that the rich don’t work for money; they make money work for them. Kiyosaki illustrates this through the contrasting advice he received from his two “dads.” His poor dad, a highly educated government employee, advocated for job security and savings. His rich dad, an entrepreneur, taught him about building assets and financial intelligence.

One of the most important lessons from “Rich Dad Poor Dad” is the distinction between assets and liabilities. Kiyosaki defines an asset as putting money in your pocket, while a liability takes money out.

This simple yet profound concept challenges the common belief that a house is an asset; as Kiyosaki argues, it’s often a liability due to ongoing expenses.

The book also emphasizes the importance of financial education, something not typically taught in traditional schools. Kiyosaki argues that financial literacy is crucial for building wealth and achieving financial freedom.

He encourages readers to take control of their financial education and not rely solely on conventional advice about saving and investing.

2. Cashflow Quadrant: Understanding Income Streams

Building on the principles introduced in “Rich Dad Poor Dad,” “Cashflow Quadrant” delves deeper into how people earn income. Kiyosaki presents a simple yet powerful concept: the four quadrants of income – Employee (E), Self-employed (S), Business owner (B), and Investor (I).

The book explains how most people fall into the E and S quadrants, working for money and often struggling to achieve financial freedom. Kiyosaki argues that true financial independence comes from moving to the B and I quadrants, where you build systems that generate income without your direct involvement.

“Cashflow Quadrant” challenges readers to think about their quadrant and how they can transition to the right side (B and I) for tremendous financial success. It’s not just about changing jobs; it’s about changing your mindset and approach to income generation.

Kiyosaki provides insights into the characteristics and mindsets associated with each quadrant, helping readers understand why some people remain stuck in financial struggles while others thrive.

He emphasizes that moving to the right side of the quadrant requires developing new skills and overcoming fears associated with financial risk-taking.

3. Rich Dad’s Guide to Investing: Strategies for Wealth Building

Once readers grasp the basics of financial literacy and understand the different income quadrants, “Rich Dad’s Guide to Investing” takes them to the next level. This book focuses on how the rich make investment decisions and build wealth over time. Kiyosaki introduces the concept of “becoming the bank” rather than relying on banks.

He explains how wealthy individuals create opportunities rather than wait for them, often by starting businesses or investing in real estate. The book covers various investment vehicles and strategies, from paper assets like stocks and bonds to real estate and business investments.

A key lesson from this book is the importance of developing a high financial IQ. Kiyosaki argues that successful investing isn’t just about following trends or hot tips; it’s about understanding financial statements, market trends, and the law.

He encourages readers to think like sophisticated investors, considering factors like cash flow, risk management, and leverage. The book also challenges the conventional wisdom of diversification, suggesting that the ultra-wealthy often focus on becoming experts in specific investment areas.

Kiyosaki advocates for financial education to reduce risk rather than relying solely on diversification.

4. Retire Young Retire Rich: Achieving Early Financial Independence

“Retire Young Retire Rich” focuses on strategies for accelerating wealth creation and achieving financial independence at a younger age. Kiyosaki shares his personal story of retiring at 47 and provides insights into how others can do the same.

The book introduces the concept of “leverage” as a key to building wealth quickly. Kiyosaki discusses various forms of leverage, including financial leverage (using other people’s money), mental leverage (using other people’s knowledge), and time leverage (using systems to multiply your efforts).

A central theme of the book is changing one’s context and perspective about money and retirement. Kiyosaki challenges the traditional notion of retirement, suggesting that financial freedom should be the goal rather than simply stopping work at a certain age.

The book provides practical strategies for increasing income, reducing taxes, and building assets that generate passive income. Kiyosaki emphasizes the importance of having a clear financial goal and a plan to achieve it rather than simply hoping for the best or relying on conventional retirement planning.

5. Increase Your Financial IQ: Enhancing Financial Intelligence

In “Increase Your Financial IQ,” Kiyosaki focuses on the five critical areas of financial intelligence: making more money, protecting your money, budgeting your money, leveraging your money, and improving your financial information.

This book is a capstone to the financial education journey started in the previous books. It emphasizes the importance of continuous learning and adaptation in the ever-changing financial landscape.

Kiyosaki argues that financial intelligence is not just about knowing facts but also about how you process information to make financial decisions. The book provides practical exercises and real-world examples to help readers enhance their financial decision-making skills.

It covers topics like evaluating financial advice, understanding financial statements, and making informed investment decisions. Kiyosaki also discusses the importance of financial integrity and how it relates to building long-term wealth.

He challenges readers to take responsibility for their financial education and decisions rather than relying on others or blaming external circumstances for their financial situation.

Conclusion: Embracing a Wealth-Building Mindset

Robert Kiyosaki’s books offer a comprehensive financial education that goes beyond traditional advice about saving and investing. They challenge readers to think differently about money, work, and wealth creation.

By reading these five books, individuals with financial freedom goals can gain valuable insights into how the wealthy think and operate. The journey to financial freedom requires more than just knowledge; it demands action and a shift in mindset.

Kiyosaki’s books provide the theoretical framework and practical strategies for this shift. They encourage readers to take control of their financial education, build assets that generate income, and think like investors rather than employees.

While the path to financial freedom may not be easy, these books offer a roadmap for those willing to challenge conventional wisdom and take responsibility for their financial future.

By applying the principles and strategies outlined in Kiyosaki’s works, readers can work towards building wealth, achieving financial independence, and ultimately, living life on their terms.